Digital asset manager CoinShares says last week’s crypto market recovery was accompanied by significant institutional investment inflows for several large digital assets.

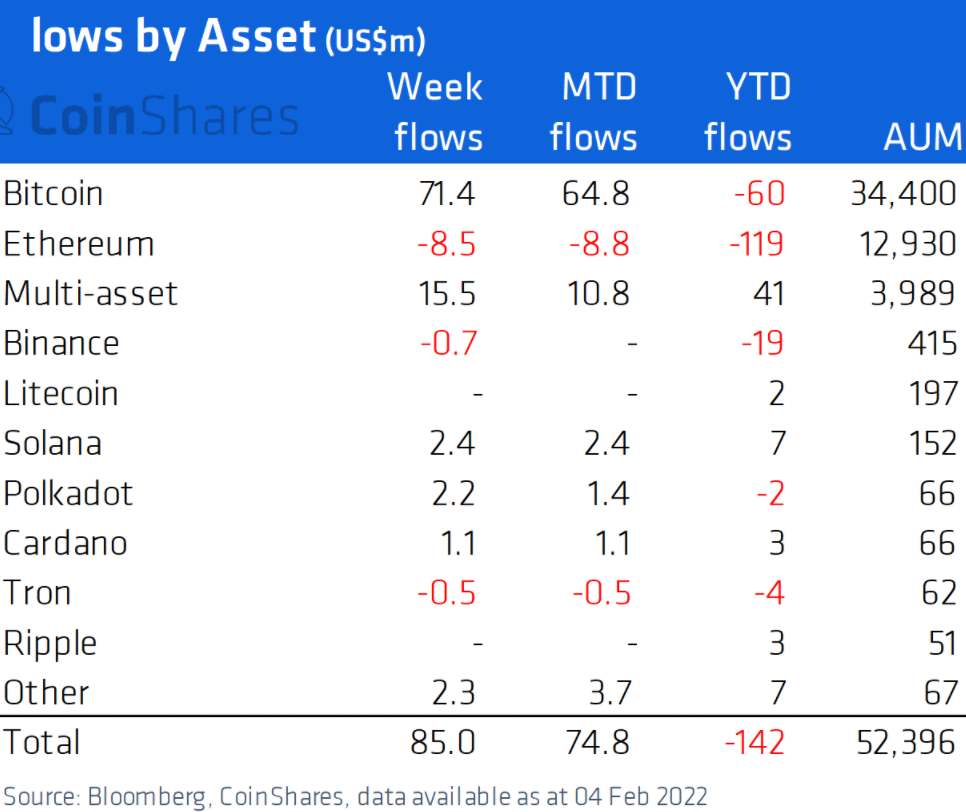

According to the latest Digital Asset Fund Flows Weekly report, the largest crypto by market cap, Bitcoin (BTC), enjoyed last week’s largest share of institutional investments.

“Bitcoin continues to lead the inflows with US$71m last week, the largest since early December with this 3-week run of inflows totaling US$108m. Volumes in Bitcoin investment products remained low last week at US$1.8bn versus US$3.4bn the previous week.”

Leading smart contract platform Ethereum (ETH) suffered its ninth consecutive week of outflows, losing $8.5 million in institutional investments last week.

“Investment products flows for Ethereum suggest investors remain bearish with outflows of US$8.5m, having entered the 9th week run of outflows totaling US$280m…”

Meanwhile, Ethereum challengers Solana (SOL), Polkadot (DOT), Terra (LUNA) and Cardano (ADA) all saw inflows totaling $2.4 million, $2.2 million, $1.4 million and $1.1 million, respectively. This was the first week of significant institutional investor inflows for LUNA.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/PHOTOCREO Michal Bednarek