Crypto analytics firm Santiment is seeing bullish on-chain indicators for the top two digital assets by market cap.

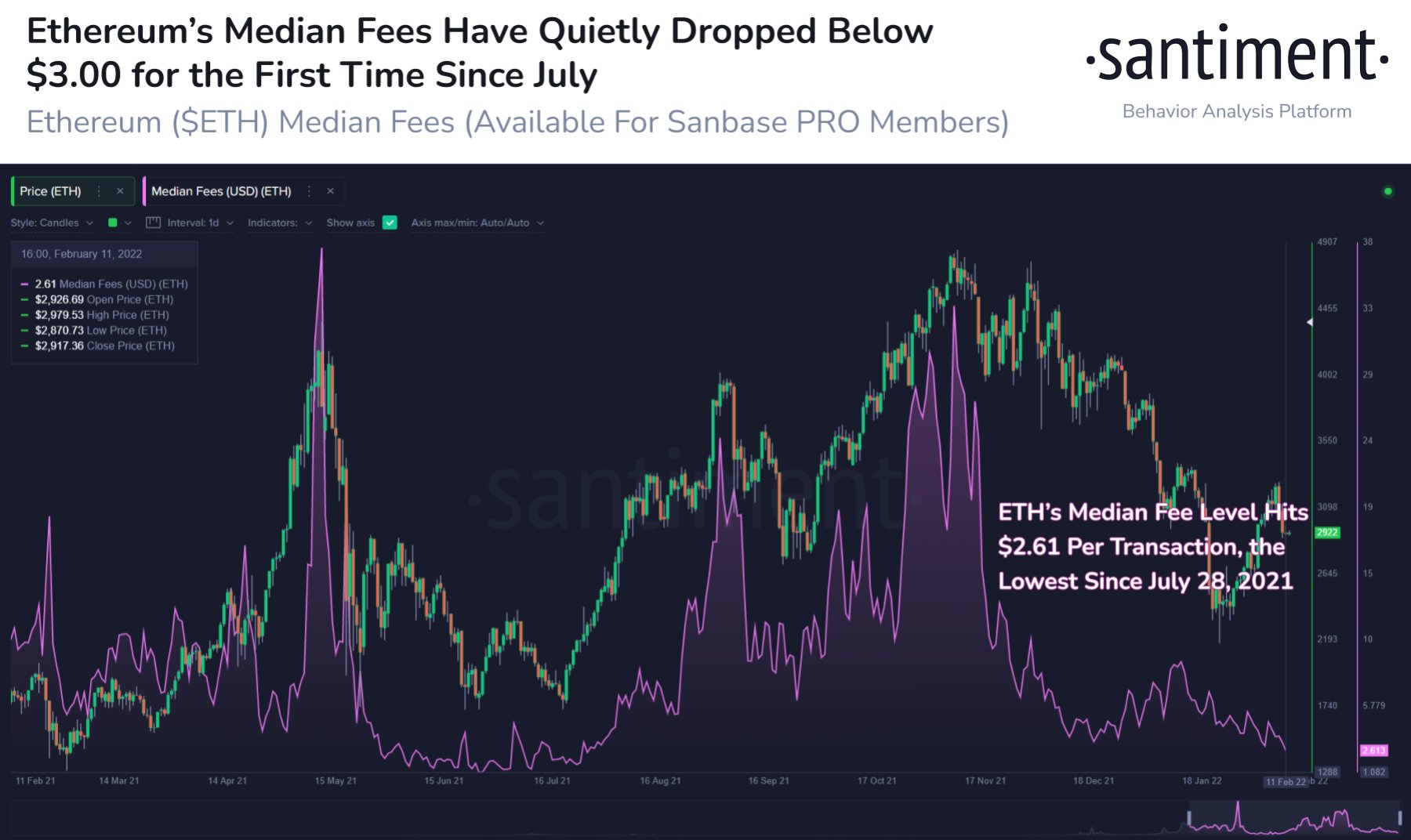

According to Santiment, Ethereum (ETH) transaction fees are dropping, a good sign for the leading smart contract platform.

“Transaction fees are now officially at their lowest level since July 28th, 2021. Low fees typically maximize the chances of a bounce.”

Ethereum is trading at $3,013.34 at time of writing, down nearly 4.6% in the past seven days.

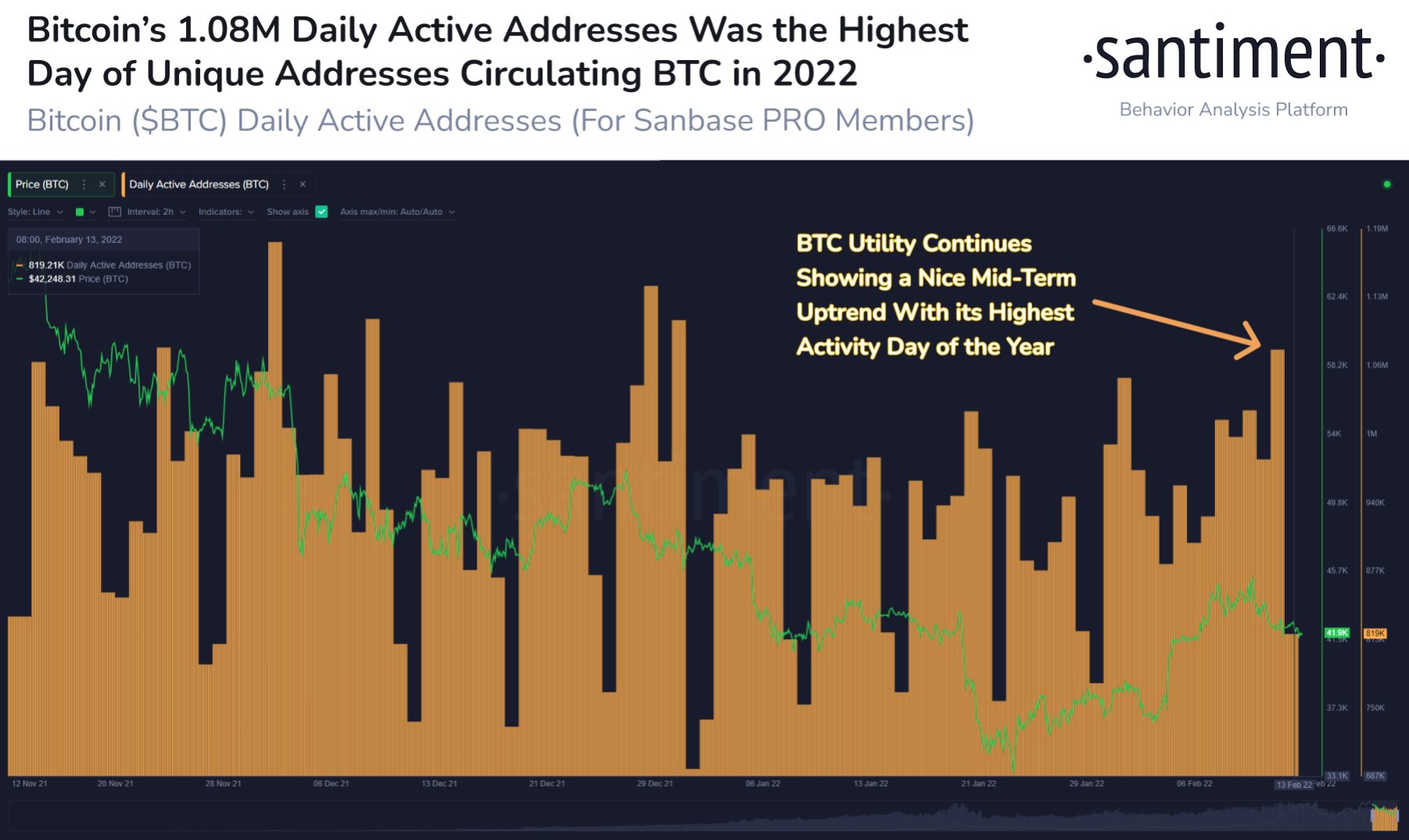

Santiment also notes that the number of daily active Bitcoin (BTC) addresses hit 1.08 million on Saturday, the highest of the year so far. It’s a potentially bullish indicator, according to the crypto intelligence firm.

“The uptick in participants transacting on the BTC network is a nice sign of increased utility, a predecessor to price rises.”

Bitcoin is trading at $43,463.32 at time of writing. The top-ranked crypto asset by market cap is down about 1.5% from where it was priced one week ago.

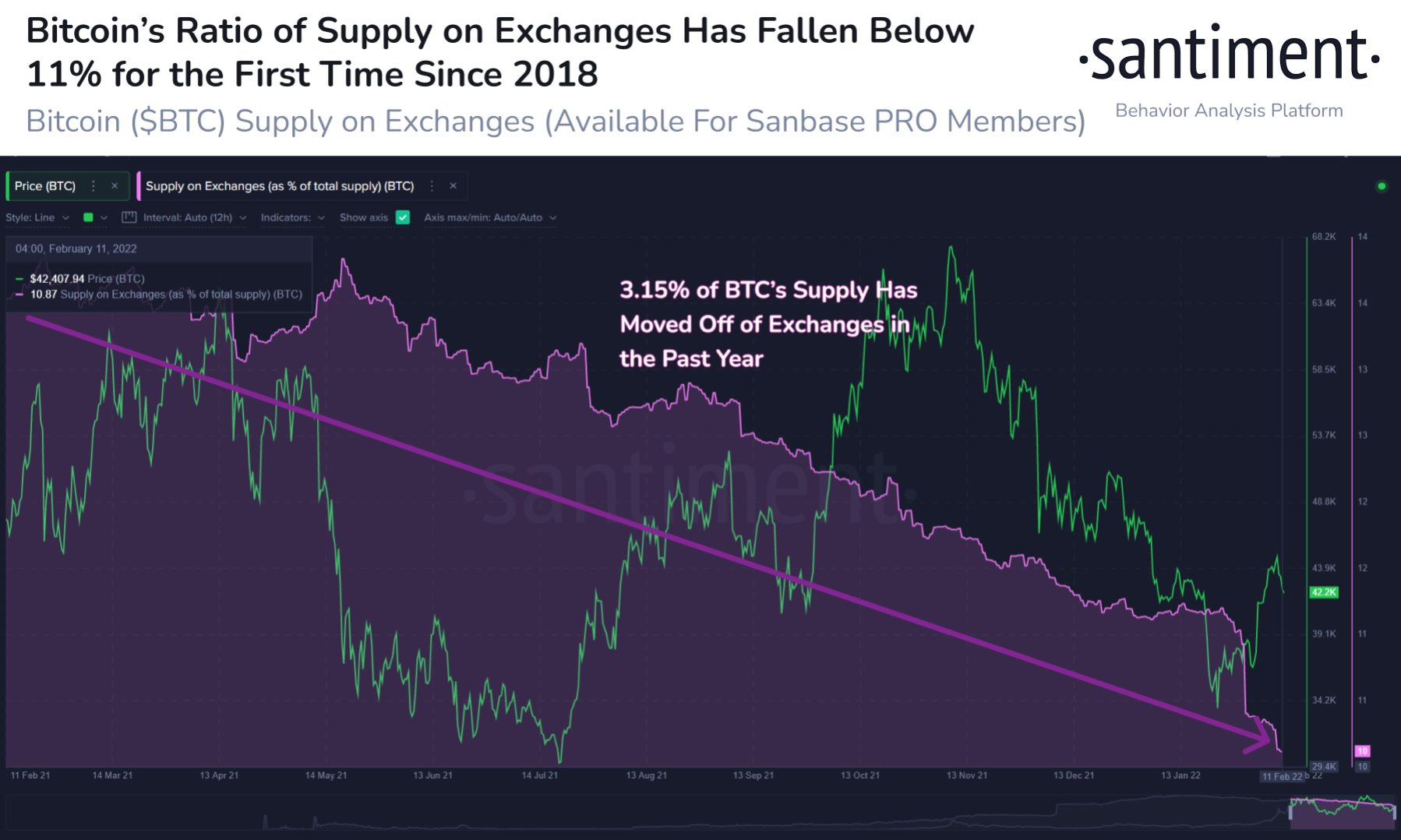

After a few price drops last Friday, BTC’s supply on exchanges plummeted to 10.87% of its total supply, its lowest point since December 2018, according to Santiment.

The analytics firm says the drop of existing supply on crypto exchanges is another potential positive development for BTC.

“Generally, this continued trend of coins moving off of exchanges limits the risk of major sell-offs.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/INelson