Cryptocurrency analyst Justin Bennett says he expects inflation to taper off but not before investors who own risk assets see their portfolios rise in value once more.

Bennett tells his 98,300 Twitter followers that cryptocurrencies, equities and commodities are likely to surge, but the rally won’t last forever.

“I continue to think we see one last leg higher for risk assets in 2022 as inflation numbers start to tick lower later this year.

It’s an unpopular opinion, but that makes it all the more likely.”

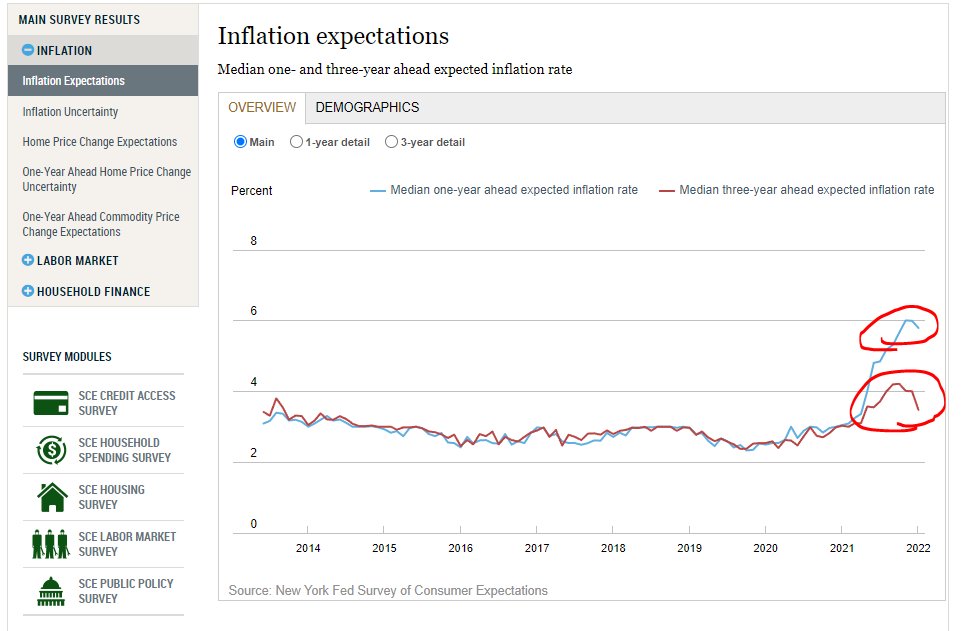

The analyst includes a graphic from the New York Fed Survey of Consumer expectations while observing,

“But transitory inflation is just a meme, right?”

Bennett next cites a recent Reuters article that says consumer inflation expectations have gone down for the first time in 16 months. He says,

“It’s already starting…”

The chart guru next looks at how Bitcoin (BTC) stacks up against the dollar index (DXY), which compares the USD to a basket of other fiat currencies.

He provides a graphic highlighting BTC peaks versus DXY valleys over the last 11 years and says,

“DXY matters for BTC.”

Moving on to the prospect of a “bearish engulfing pattern,” which usually signals that lower prices are on the horizon, Bennett says,

“If the DXY is going to make good on the bearish engulfing week from early February, this is where I’d expect it to start.

Above 97.30 is bullish. Below 95.13 is bearish.

We want the latter for cryptos to strengthen. Short-term target for BTC.”

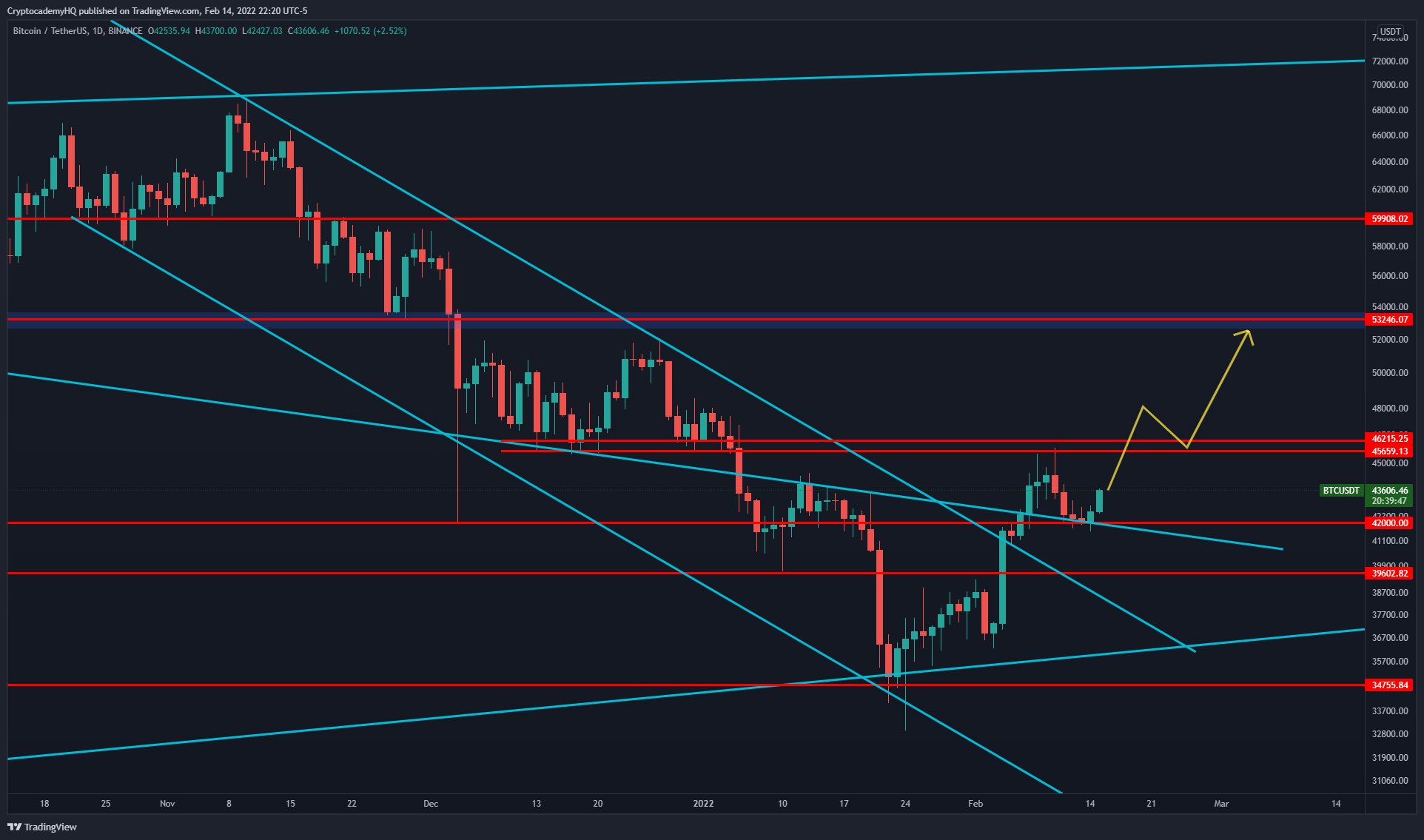

The crypto guru concludes his analysis by looking at the Bitcoin chart dating back to November of 2021. He thinks BTC is primed for a rally that will reclaim its New Year’s Day price of $46,200 before pushing past $50,000 once again.

“BTC time to take out the yearly open at $46,200.”

At time of writing, Bitcoin is up 3.45% to $44,352.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/prodigital art/Konstantin Faraktinov