Crypto analytics firm Santiment is laying out its outlook for Terra (LUNA) after the Terra ecosystem supporting Luna Foundation Guard (LFG) raised $1 billion in a private token sale.

The Singapore-based non-profit says that the proceeds from one of the largest token sales in crypto history will be used to establish a Bitcoin (BTC)-denominated forex reserve for Terra’s dollar-pegged stablecoin TerraUSD (UST).

2/ The $1B private token sale by LFG is one of the cryptocurrency industry’s largest sales to-date.

The sale was led by Jump Crypto & Three Arrows Capital, with participation from DeFiance Capital, Republic Capital, GSR, Tribe Capital, & many others.

— Terra ? Powered by LUNA ? (@terra_money) February 22, 2022

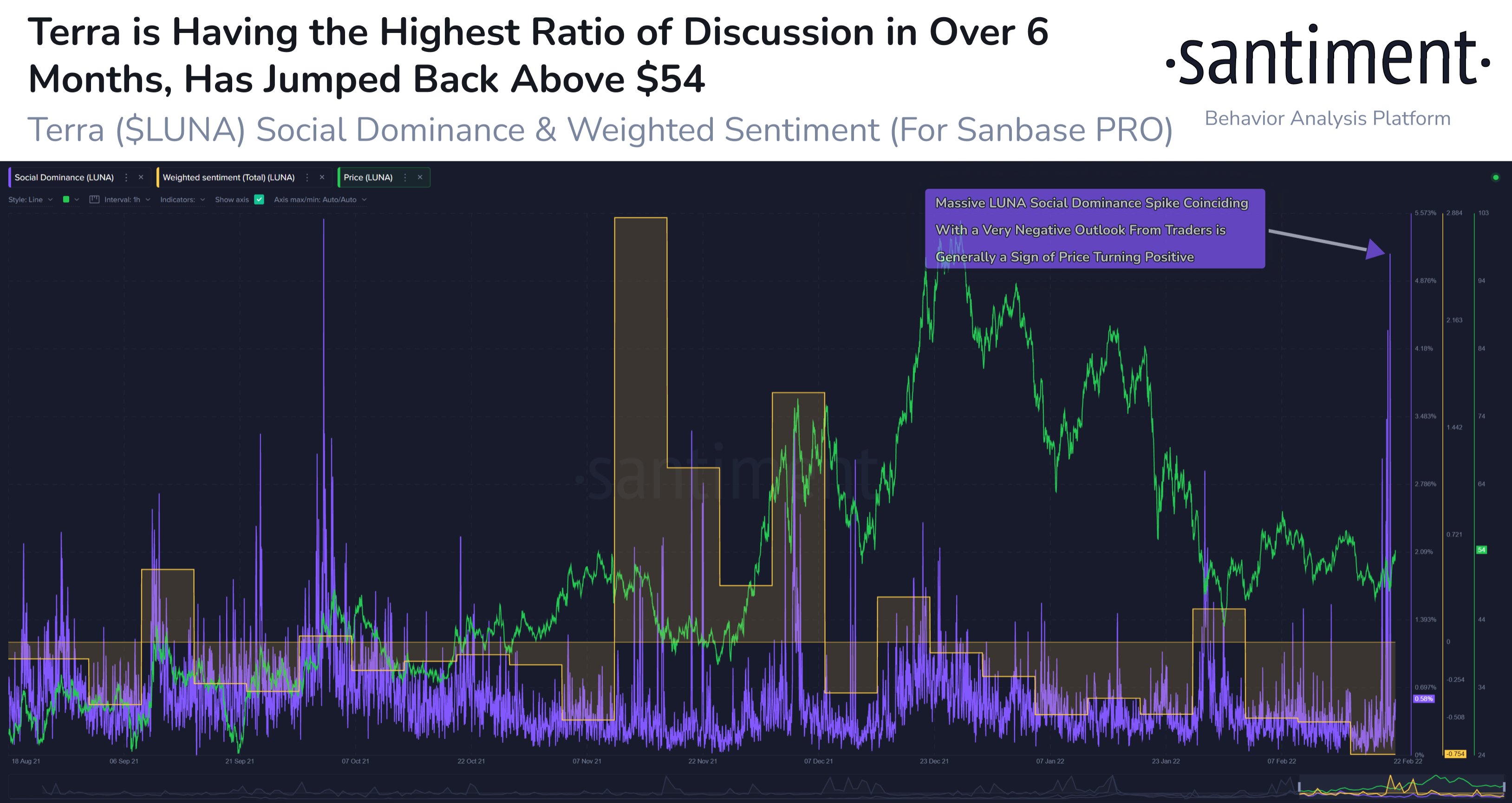

LUNA is currently trading at $58.96 from a high of nearly $100 in December, but Santiment says that the token will likely surge based on signals from its social dominance metric.

Social dominance measures how popular a particular crypto asset is against other crypto projects at a particular point in time. Usually, crypto assets that receive a higher percentage of media attention switch price directions more quickly.

According to Santiment, Luna’s social dominance is at its highest in more than six months despite the bearish sentiment of traders. The behavior analytics platform says that the spike in discussions suggests that LUNA is heading in a positive direction.

“LUNA sits as the 11th largest cryptocurrency. It gained major fanfare in 2021, and appears to be a hot topic despite its 3-month drop. It’s currently seeing the highest percentage of discussion since October, a good sign of an incoming turnaround.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Tithi Luadthong/Natalia Siiatovskaia