A leading digital asset intelligence firm reveals that crypto whales are accumulating massive buying power to the tune of more than $1 billion worth of stablecoins.

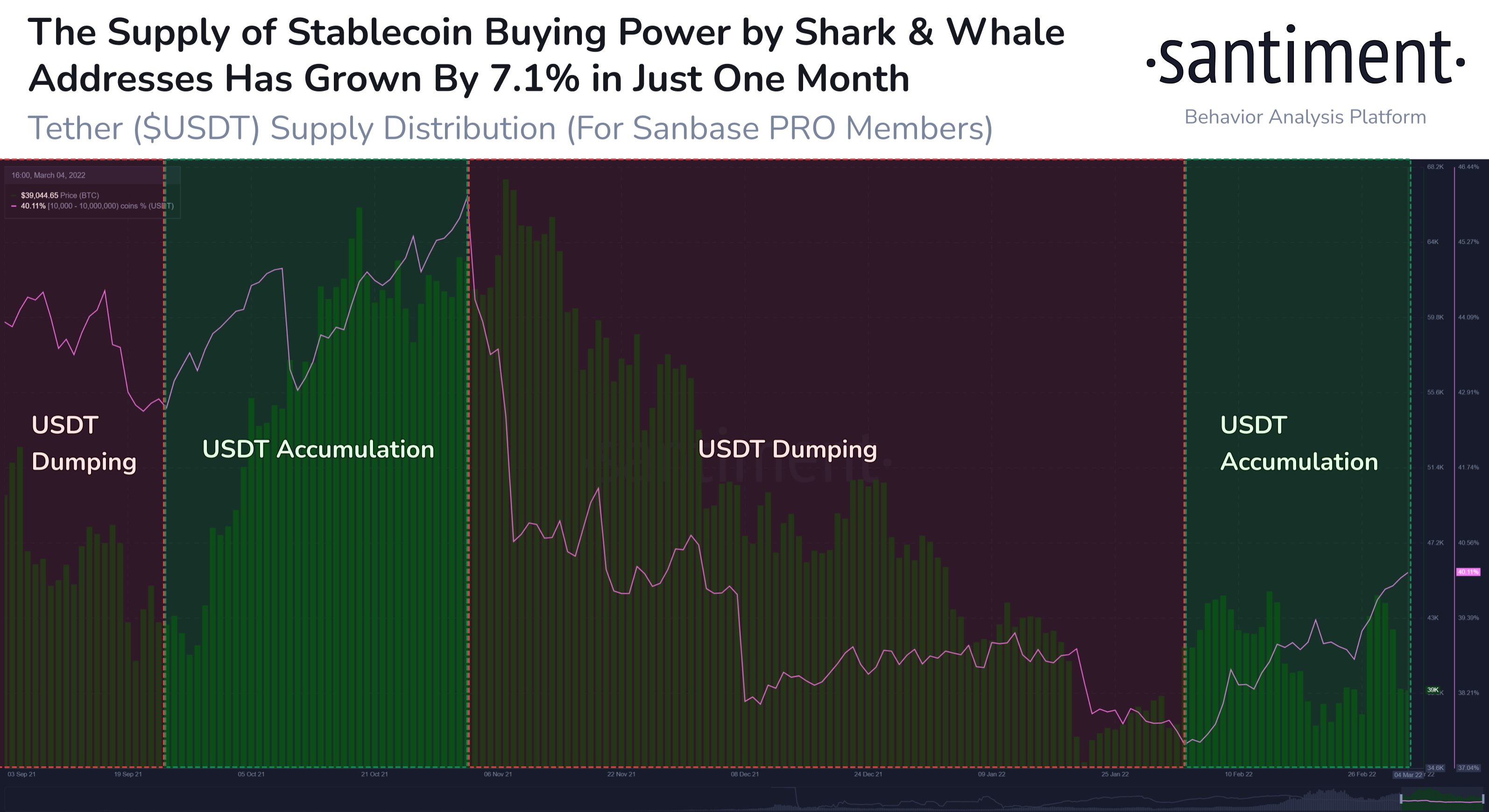

Santiment says that deep-pocketed crypto investors known as whales and sharks are snapping up stablecoin Tether (USDT) after months of unloading the crypto asset.

“Whales and sharks provide alpha through stablecoin behavior, just as they do with their [Bitcoin] and altcoin accumulation and dumping. In the last month, addresses with 10,000 to 10 million Tether have added $1.06 billion in buying power, 2.7% of the total supply.”

While crypto whales and sharks accumulate USDT, Santiment also reveals that Bitcoin (BTC) investors continue to load up on BTC.

“Bitcoin continues to see coins moving off of exchanges while prices are near a six-month bottom. Interestingly, 21 of the past 26 weeks saw BTC moving more off of exchanges than on to exchanges. Look for major outflow spikes as price rise indicators.”

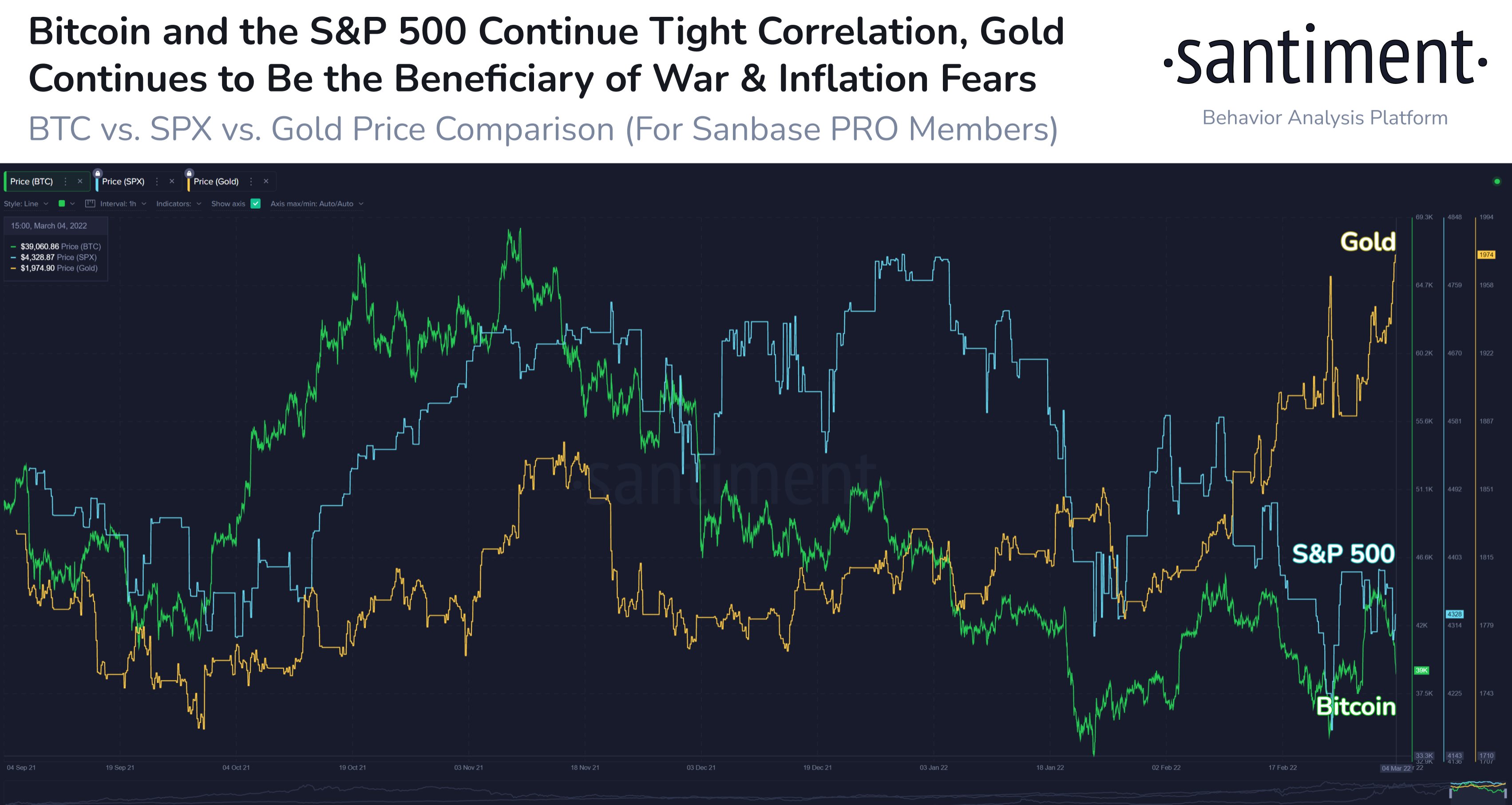

As for when Bitcoin might ignite another rally, the crypto intelligence firm says that market participants should look at BTC’s correlation with the stock market.

“As the week comes to a close, Bitcoin has fallen back to $38,900, while the SP500 followed suit. Their correlation remains relevant to when BTC will be able to break out again. Meanwhile, gold climbed back to the same level as when war news broke.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/FullRix/Andy Chipus