A leading analytics firm says the utility of Ethereum (ETH) hasn’t dipped despite its price plummet over the past few months.

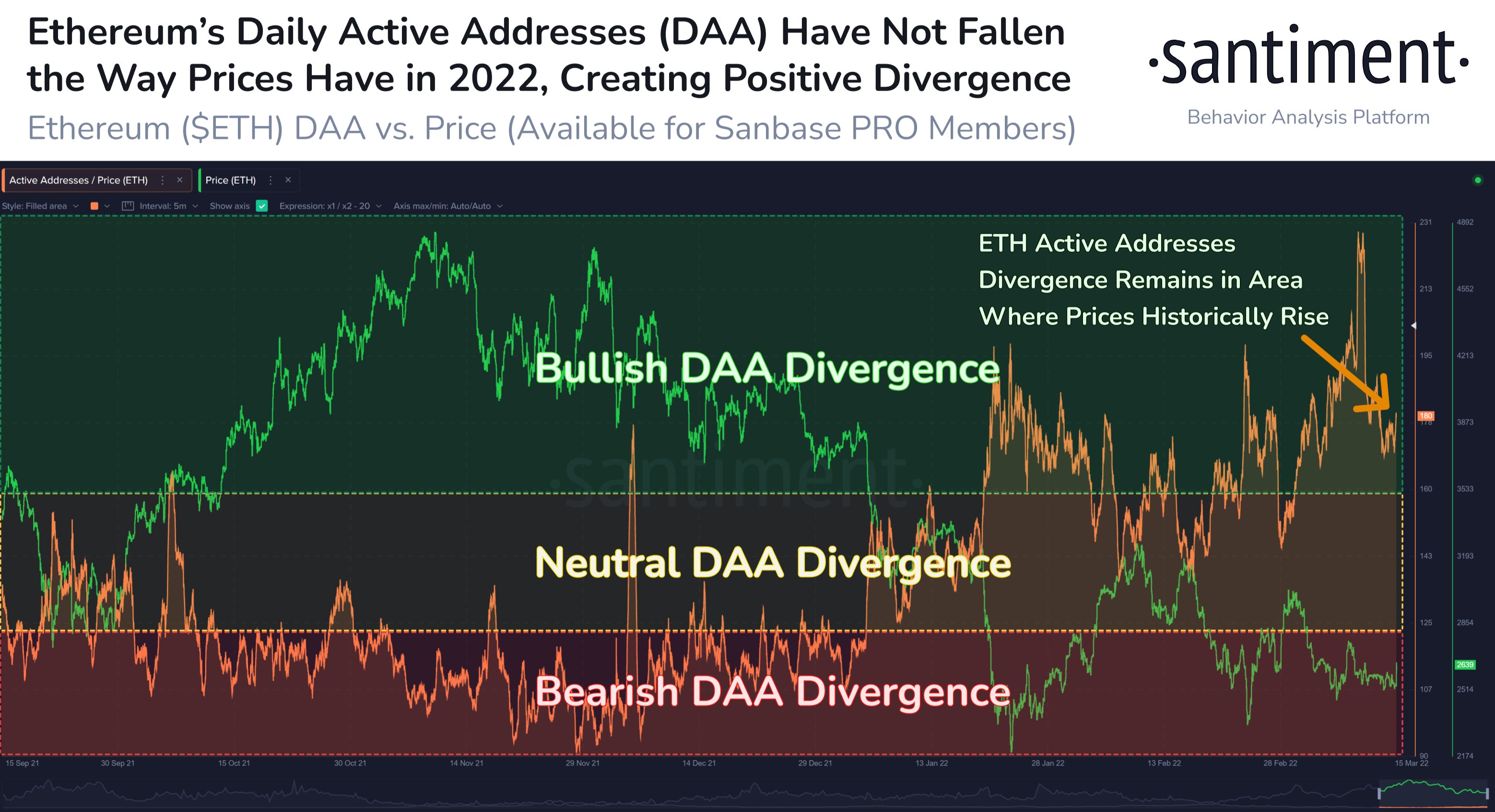

Santiment notes in a new tweet that ETH’s number of daily active addresses (DAA) has remained steady over the past four months despite losing approximately 35% in price over the same period.

According to the crypto analytics firm, the disparity between Ethereum’s DAA and price has created a bullish divergence for the leading smart contract platform.

Ethereum is trading at $2,769.18 at time of writing, up nearly 5% in the past 24 hours.

Ethereum isn’t the only crypto asset flashing potentially bullish metrics. Santiment says that the decentralized oracle network Chainlink (LINK) is in an interesting token circulation pattern.

As the analytics firm explains in a recent Santiment Insights blogpost,

“There were a few times when circulation increased, then dumped, and then price surged. There is a chance we are now in a similar pattern.”

Santiment also notes that since January, the majority of LINK tokens have been moved at a loss, a potential bottom indicator.

LINK is trading at $14.73 at time of writing. The 24th-ranked crypto asset by market cap is up more than 6% in the past 24 hours.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/local_doctor/Natalia Siiatovskaia