Blockchain analytics firm Santiment is pointing out some on-chain metrics developing behind the scenes for Bitcoin as BTC rallies above $42,000.

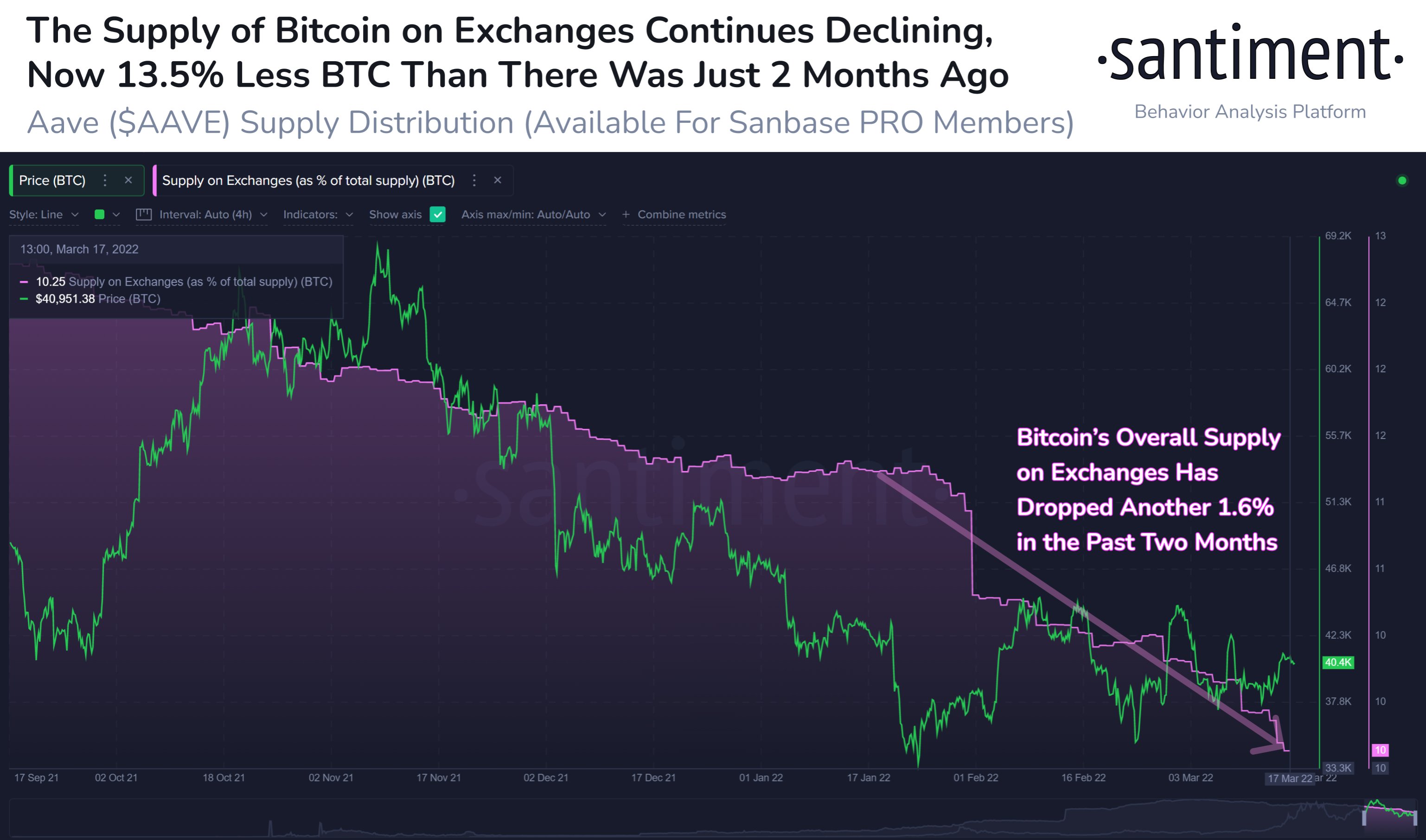

The intelligence firm says that the overall supply of Bitcoin on crypto exchanges has slipped down to its lowest level in over three years.

“Bitcoin’s ratio of supply sitting on exchanges continues dropping hard, down to its lowest level since December 2018. There is 13.5% less BTC on these exchange wallets compared to just two months ago, amounting to 1.6% less of the overall supply.”

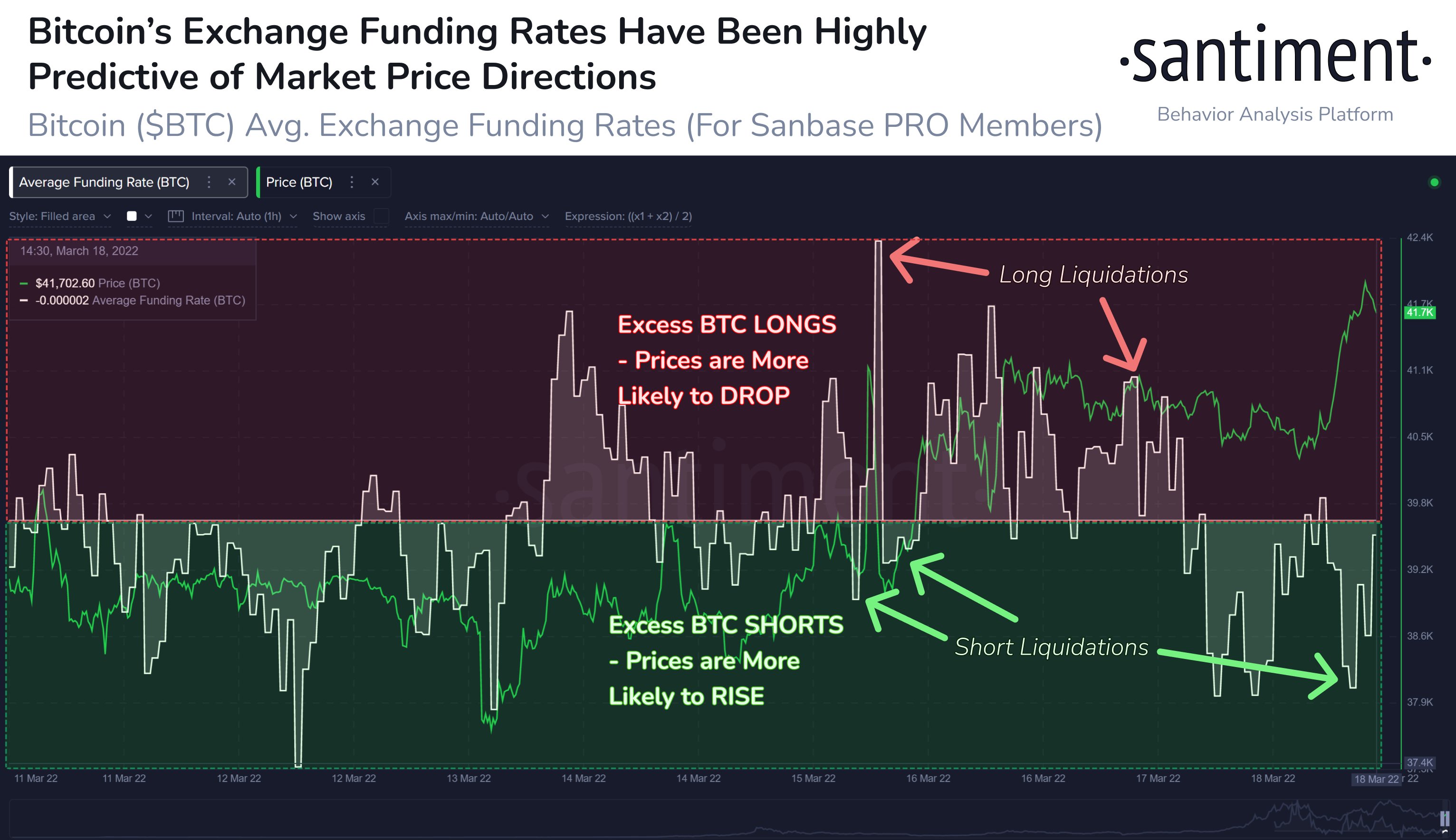

Santiment also says that the recent price spike in BTC was triggered by a cascade of short sellers being liquidated as the value of Bitcoin moved higher, triggering a short squeeze.

A short squeeze happens when traders who bet on BTC’s price to fall are forced to buy Bitcoin as the price moves against their bias.

“Bitcoin’s rise to $42,300 today was propelled thanks to plenty of short liquidations. Funding rates continue to be a great source for indicating how traders place their bets and peeking in to see if they’re putting their money where their mouth is.”

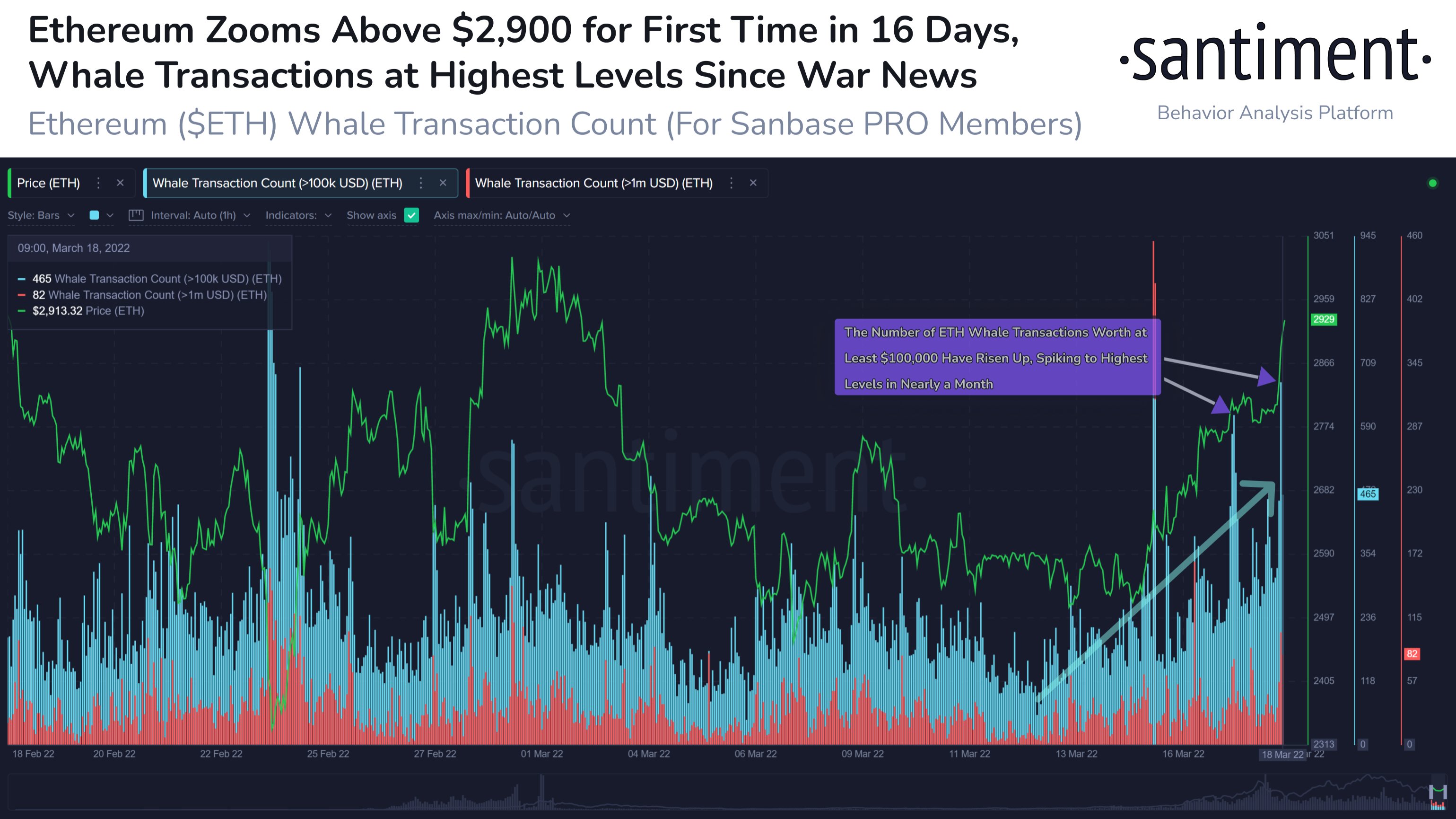

Looking at Ethereum (ETH), Santiment says the second-biggest crypto asset by market cap is also showing bullish fundamentals on-chain.

According to the firm’s data, Ethereum whales, or entities with at least 1,000 ETH in their wallets, have suddenly come to life.

“Ethereum has surged back above $2,900 for the first time since March 2nd, and whale transactions are on the rise big time. Yesterday was the first day with over 7,000 $100,000+ transactions on the ETH network since the war news broke.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Tithi Luadthong