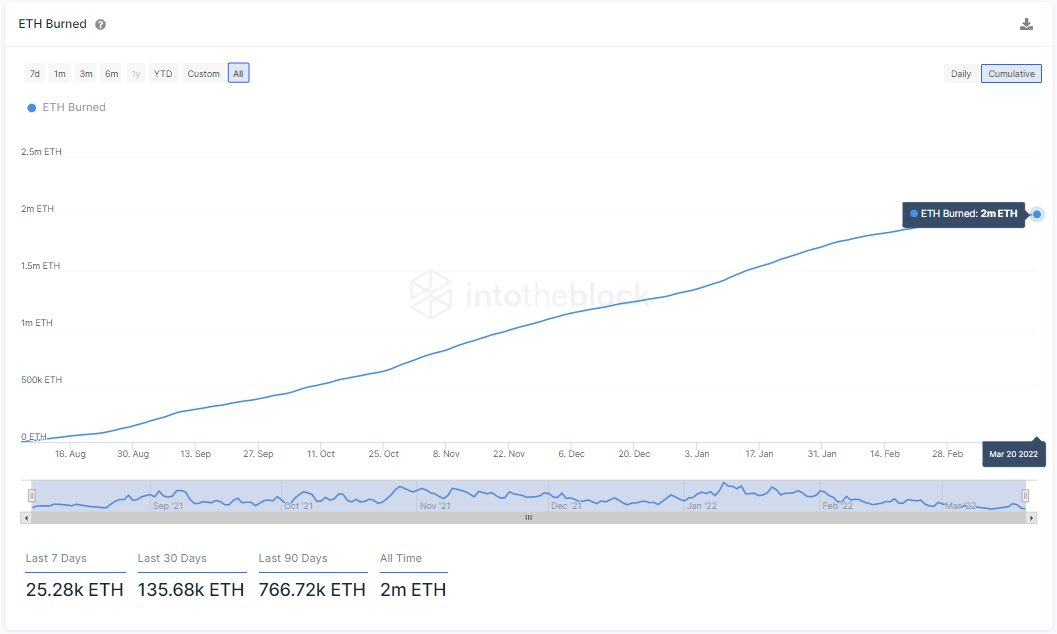

A leading crypto intelligence firm is revealing the amount of Ethereum (ETH) torched since the rollout of the London hard fork in August.

IntoTheBlock says that the leading smart contract platform has burned over two million Ethereum worth $5.86 billion since the upgrade, adding that 766,720 ETH ($2.27 billion) were destroyed in the last three months.

The London hard fork introduced the EIP-1559 protocol that permanently destroys certain amounts of ETH every time a user processes a transaction to create pressure on the supply of the leading smart contract platform.

IntoTheBlock says transactions involving non-fungible tokens (NFTs) are the largest fuel source of Ethereum’s fee-burning mechanism.

“NFT trading activity has been the largest burner of Ether since the introduction of EIP 1559:

- OpenSea activity alone has led to 230k ETH no longer being in circulation as per ultrasound.money

- As NFT volumes peaked in January, Ether’s net issuance dropped to historic lows of nearly -2%

- Following The Merge, the amount of ETH issued is projected to drop by 90%, which would lead to similar levels of fees to reduce Ether’s supply by as much as 5% a year.”

As the circulating supply of Ethereum continues to drop, widely followed pseudonymous analyst Smart Contracter predicts that ETH will outperform Bitcoin (ETH/BTC) in the coming months.

“ETH/BTC weekly looks like it’s putting in a nice high timeframe higher low. Not a bad spot to rotate some BTC into at these levels, in my opinion.”

Looking at Smart Contracter’s chart, the analyst predicts that ETH/BTC will rise to 0.09 BTC ($3,811) by June, suggesting an upside potential of nearly 30% from the pair’s current value of 0.07 BTC ($2,964).

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Zelenov Iurii