A leading crypto analytics firm is looking at what’s under the hood of Bitcoin to see what’s powering BTC’s latest rally.

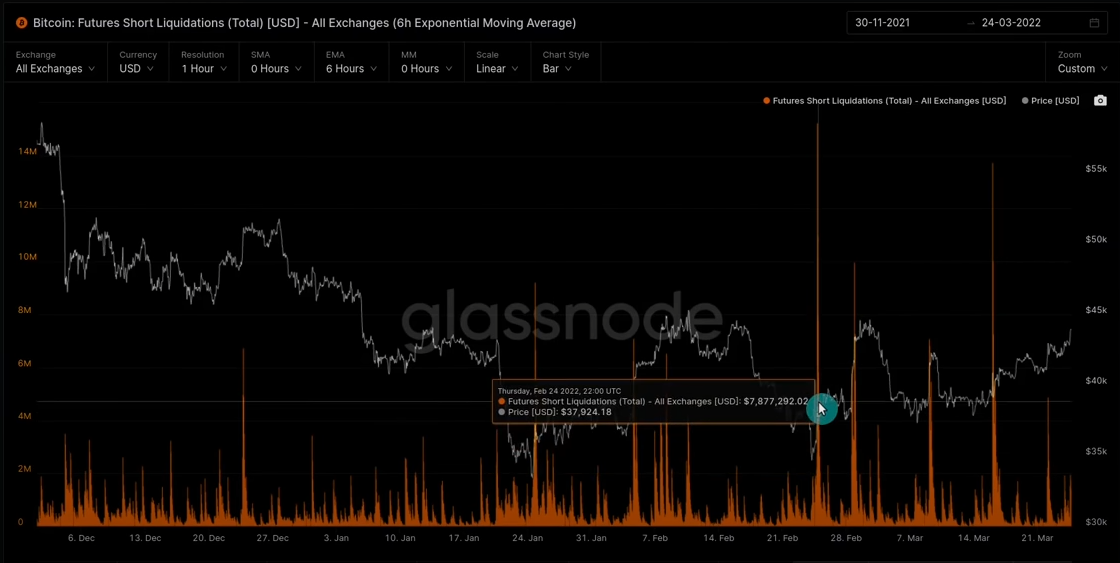

In a new video, Glassnode says that short sellers, or those who were betting on the sustained drop of Bitcoin’s price, were responsible for carving out a bottom for BTC.

“Short liquidations typically happen when we have very violent upswings. Essentially, people get very comfortable with it with a market trend. They see it going down, and down and down… Eventually, they feel confident enough and go, ‘You know what? I’m tired of being squeezed out of my long position. I’m going to go short.’ Impressively, they managed to do that at the exact bottom, and then they get squeezed out in the opposite direction, and the trend starts to change.”

Looking at Glassnode’s chart, the shift in trend appears to have started on February 24th when short liquidations skyrocketed as BTC traded around $37,000.

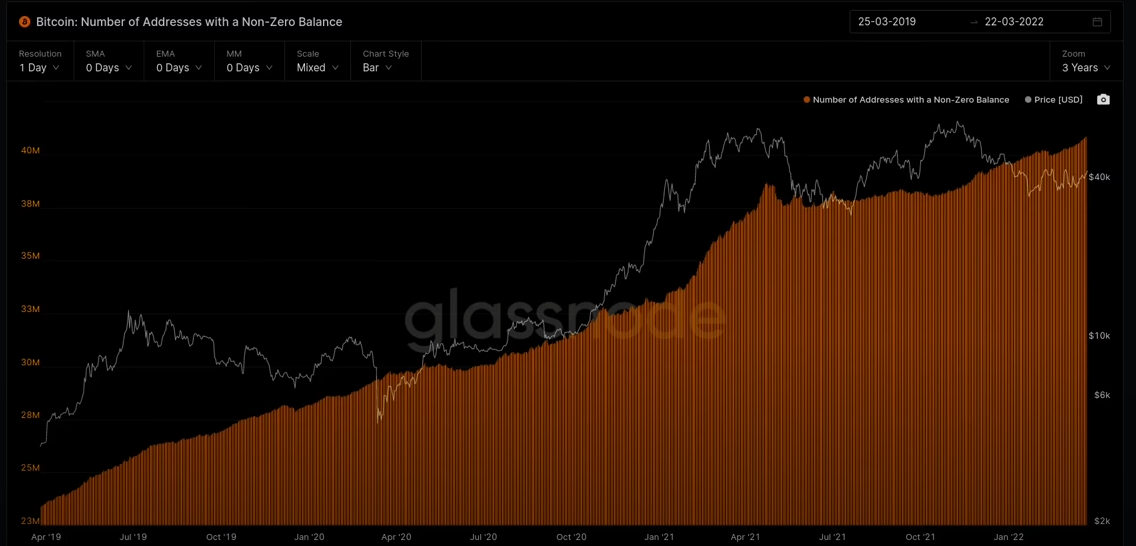

As short sellers fuel BTC’s initial leg up, Glassnode highlights that the rally wouldn’t be sustained without organic demand. The analytics firm says it is looking at Bitcoin’s number of addresses with a non-zero balance metric to show that investors continue to buy BTC in spite of the macroeconomic backdrop.

“What we can see is that over the last couple of weeks, notice how we’ve actually seen a bit of an acceleration. It’s really starting to curl to the upside. So we are seeing that people, even though we’re at depressed prices and even though we’ve been in what I would call a bear market… Despite all of that, all of the geopolitical uncertainties, the macro headwinds, the Fed hiking rates – all of the risks in the economy right now – people are still accumulating BTC.”

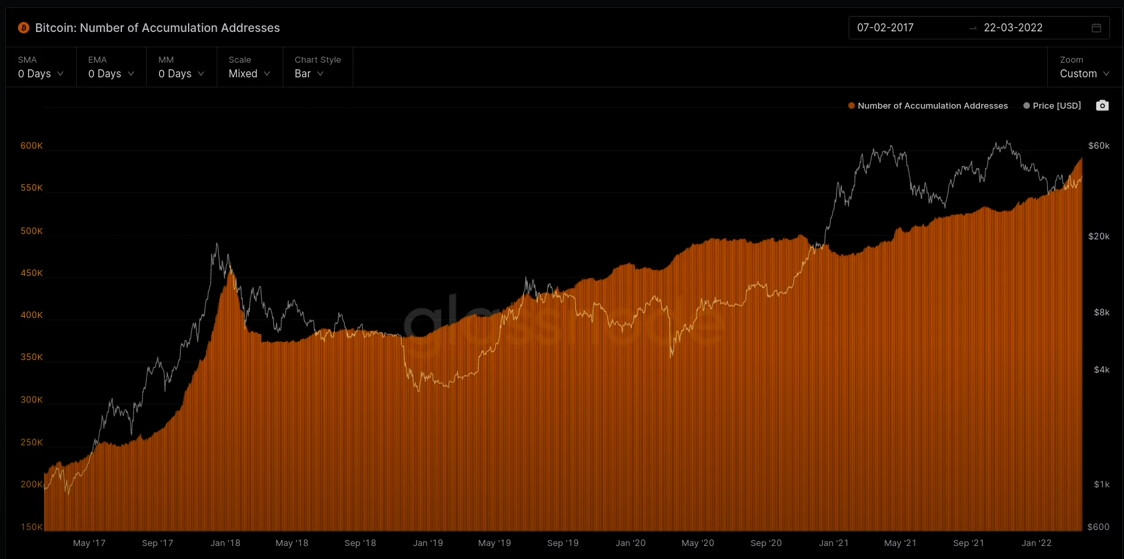

According to Glassnode, another metric that shows the growing demand for Bitcoin is BTC’s number of accumulation addresses. The insights firm defines the metric as the number of addresses that continue to add BTC to their stacks.

Says Glassnode,

“Over the recent weeks, note how much this has ticked higher. Very, very significant uptick in overall accumulation balance so it’s showing that we do have more and more people in the immediate term who are stacking. It’s painting a picture that we’ve got short squeeze on one side but it also appears that there’s a true organic demand that we can see through address growth.

I

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Kiselev Andrey Valerevich