Crypto analytics firm Santiment is highlighting a key indicator that could signal an end to the recent rally in the cryptocurrency markets.

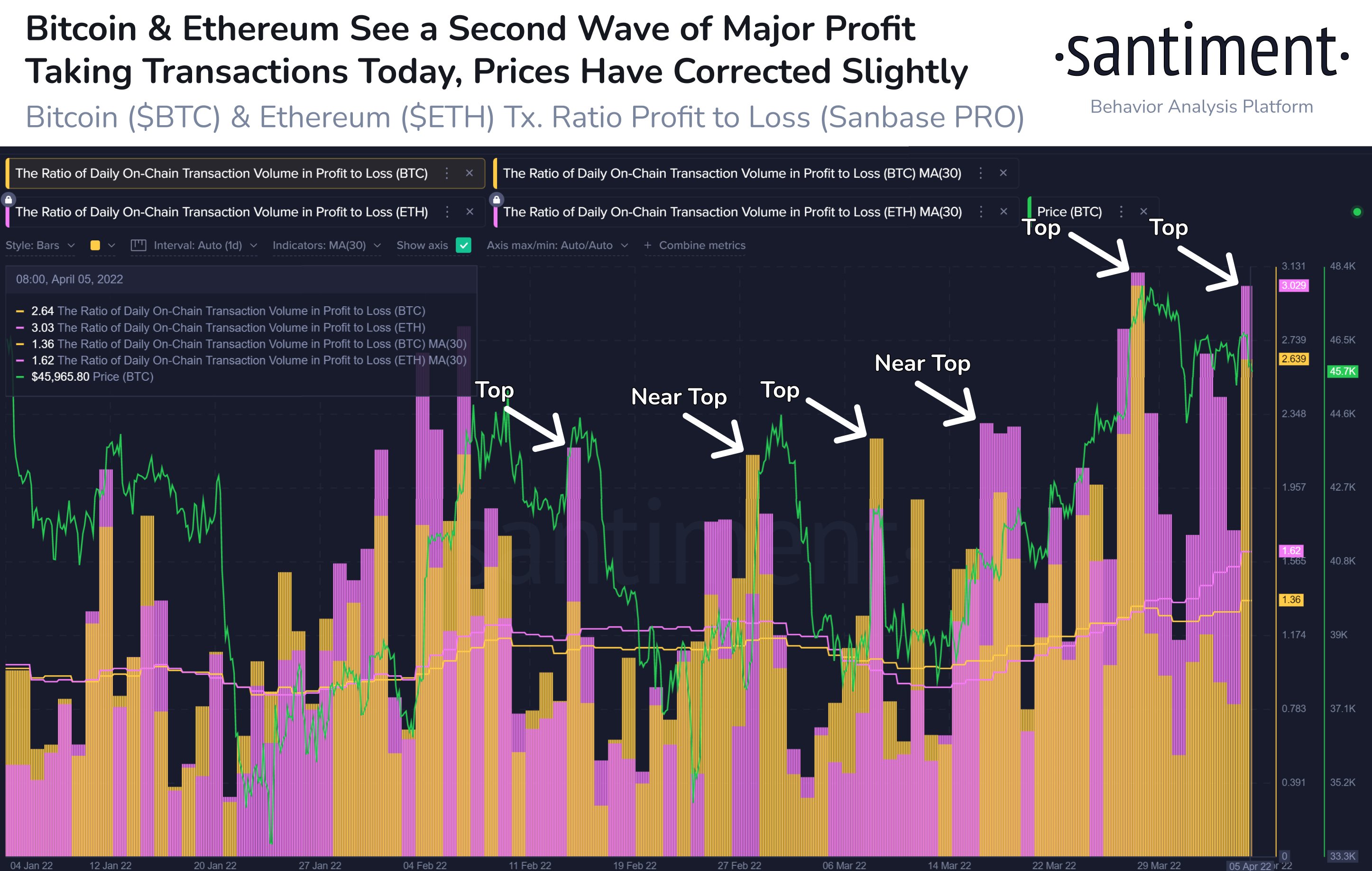

The insights agency says that the profit-to-loss ratio for both Bitcoin (BTC) and Ethereum (ETH) is the largest in nearly six months, which suggests a correction is on the horizon.

“Bitcoin is seeing its 2nd-largest ratio of transactions taken in profit vs. loss in the past 5 months today (2.64x more in profit).

Also, Ethereum is having its 2nd largest in 4 months (3.03x more in profit). These high ratios foreshadow corrections.”

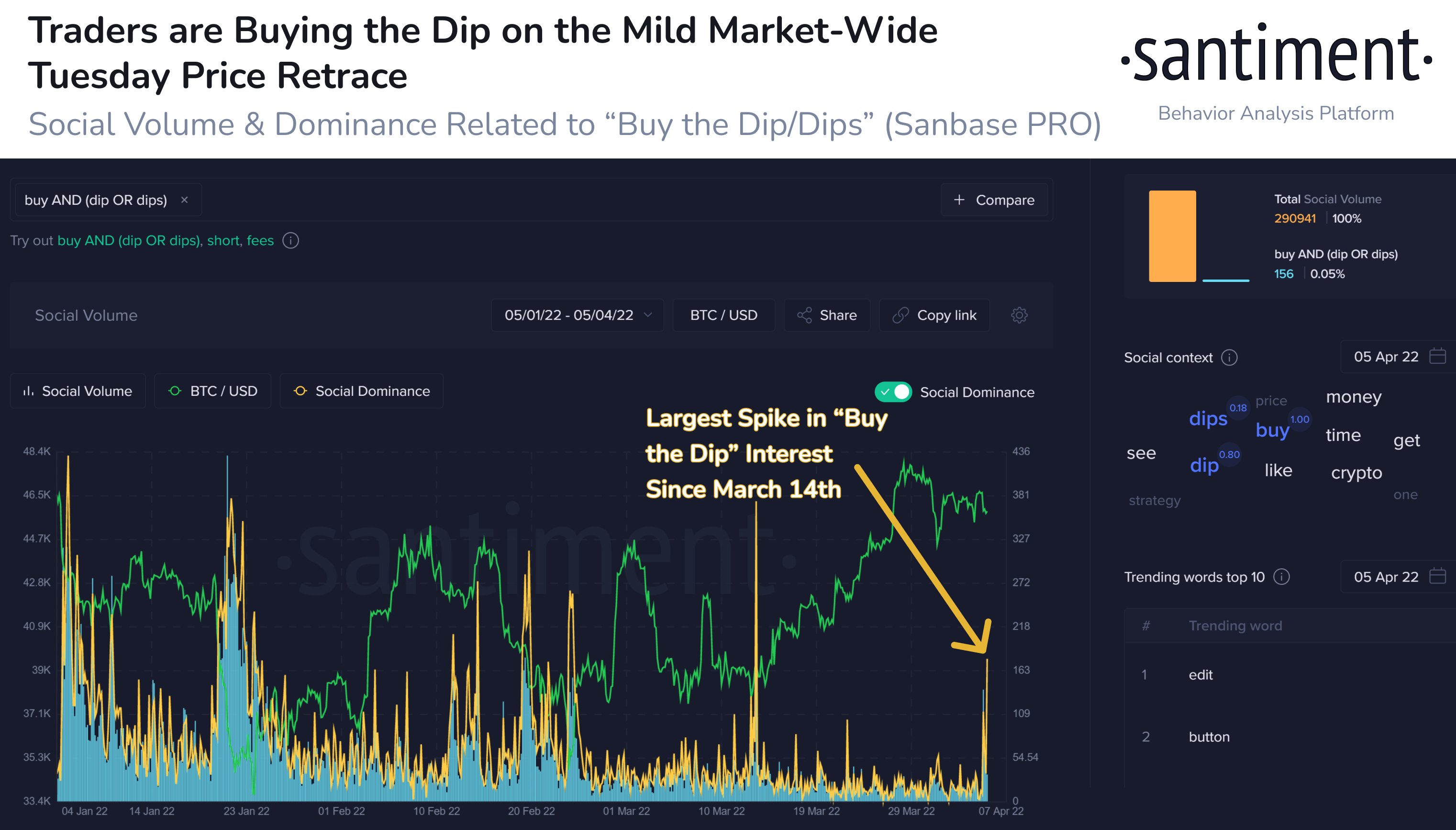

The data firm also says there was a lot of talk about “buying the dip” on social media amid BTC’s pullback.

“This may not be a major price drop with Bitcoin down -1.3% over the past 24 hours.

However, after quite a bit of FOMO over the past two weeks, there is some major buy-the-dip optimism on social platforms. This is the largest crowd spike in three weeks.”

At time of writing, Bitcoin is down nearly 5% over the last 24 hours and trading for $44,202.

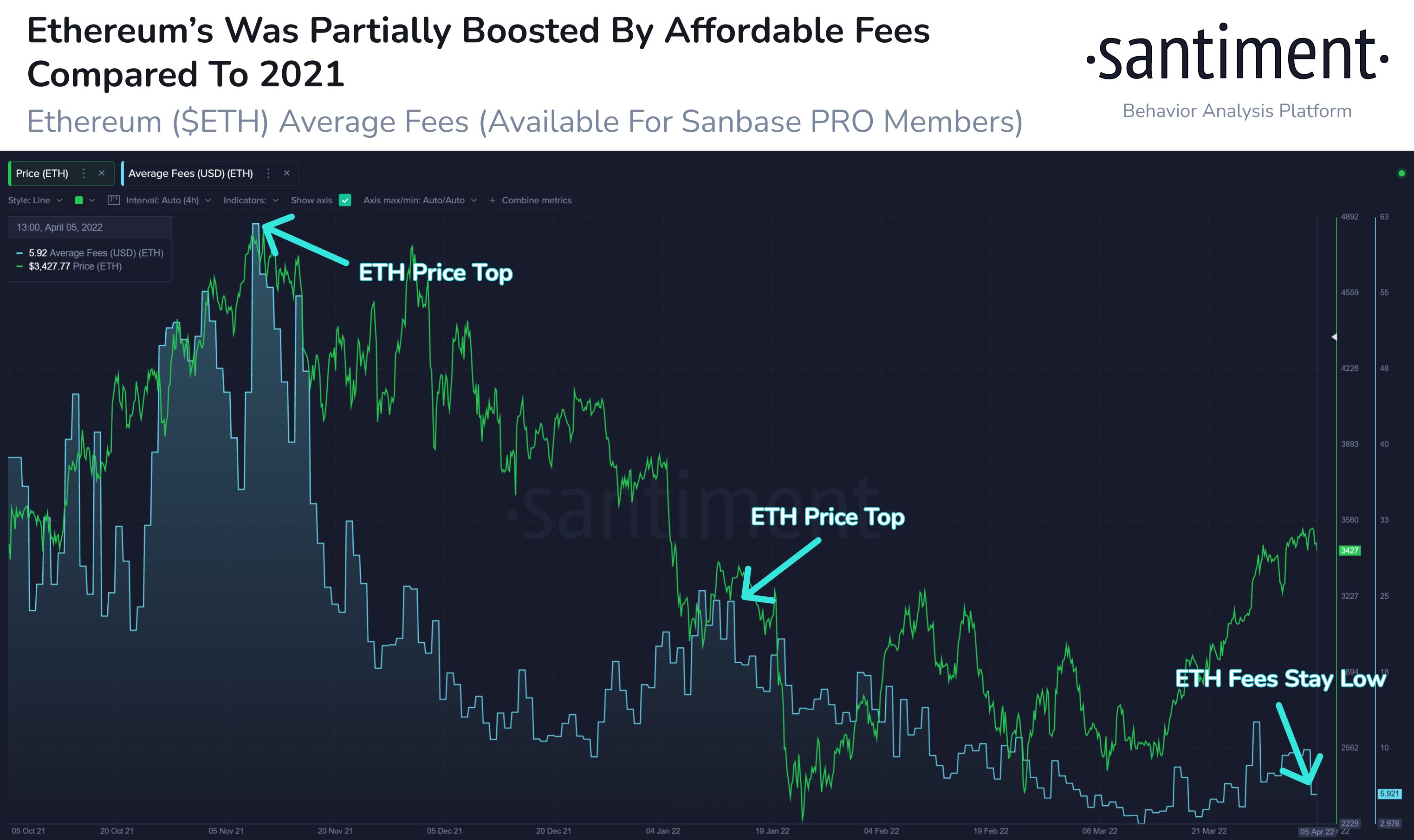

Santiment is also looking at how a significant reduction in transaction fees might account for Ethereum’s recent price increase.

“Ethereum’s fees have been much more affordable than we’ve seen for the past 8+ months. The average gas fee sits at just $5.81.

For comparison, average fees bloated to $69.57 on May 11, 2021, and $62.85 on November 8, 2021.”

Ethereum is also in the red, down almost 7.5% and priced at $3,244.

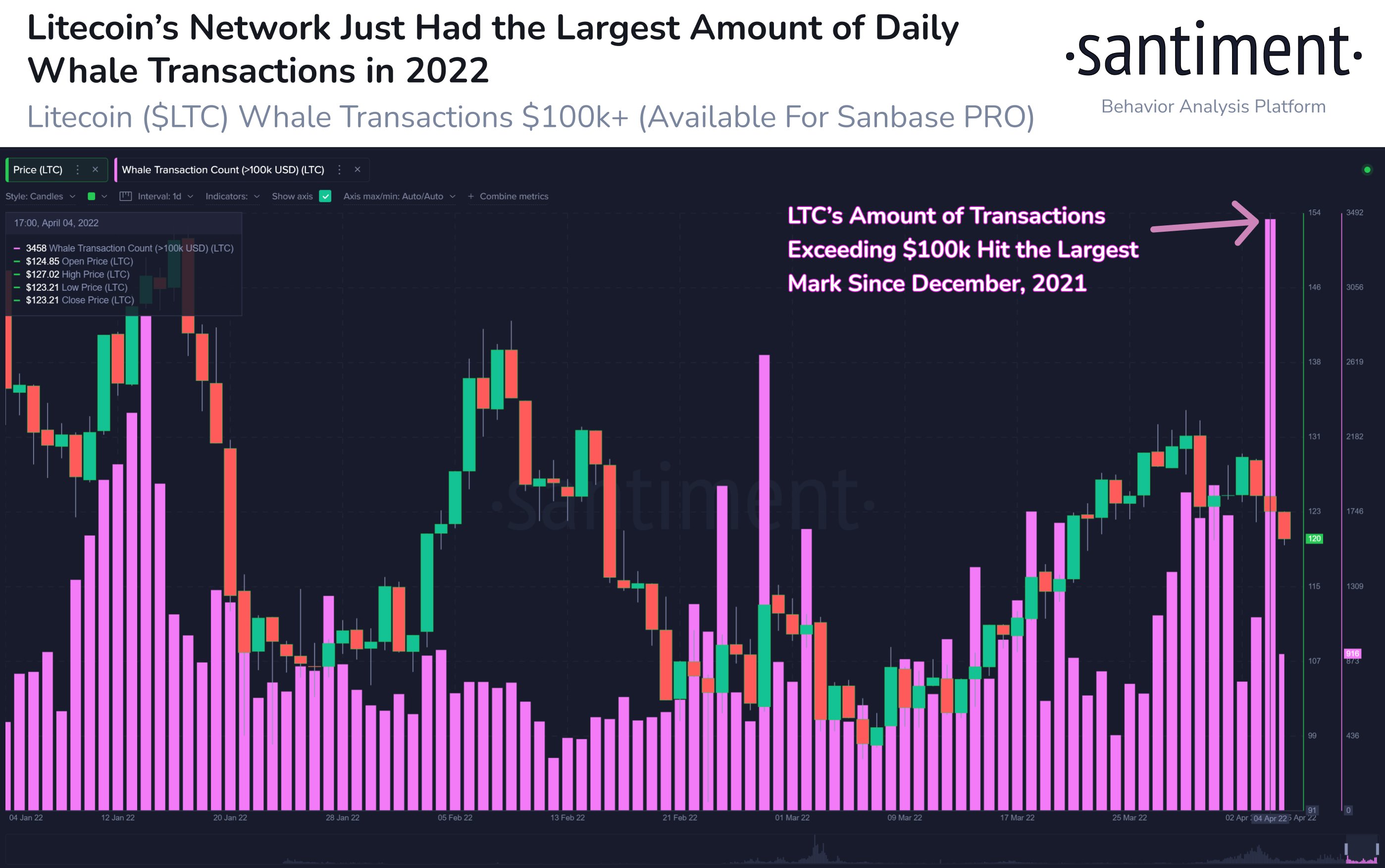

Lastly, Santiment calls attention to peer-to-peer virtual currency Litecoin (LTC). The market research firm says that whales have been devouring the altcoin in large numbers lately.

“Litecoin may not be on many traders’ radars right now, but it quietly just saw the largest amount of daily LTC whale transactions exceeding $100k+ (3,458 transactions) in 2022.

Typically, this is an indicator of mid-term price direction shifts.”

At time of writing, Litecoin has dipped by 8.08% over the last day and is valued at $115.97.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/jovan vitanovski