April 11, 2022 – Singapore, Singapore

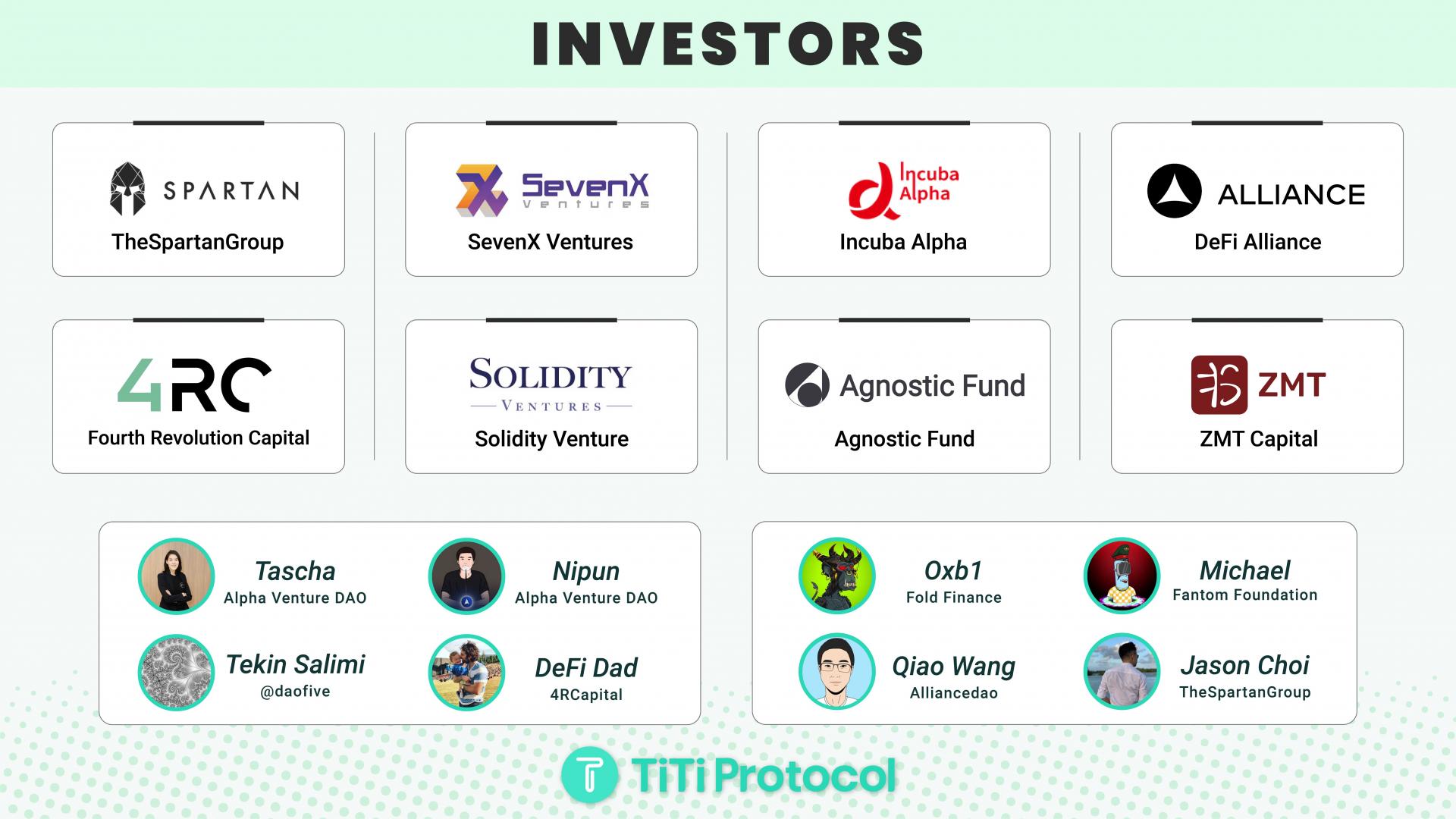

TiTi protocol announces a successful fundraising round of $3.5 million, led by Spartan Group, with participation from SevenX Ventures, Incuba Alpha, DeFi Alliance, Agnostic Fund, Fourth Revolution Capital (4RCapital), Solidity Venture and other institutions, as well as other individual investors including 0xb1 (Fold Finance), Tascha and Nipun (Alpha Venture DAO) and Michael (Fantom Foundation).

The project was incubated by Alpha Venture DAO. With this latest funding, TiTi Protocol aims to work with world-class investors to build the future of DeFi.

What is TiTi Protocol

TiTi Protocol is a fully decentralized, multi-asset, reserve-backed, use-to-earn algorithmic stablecoin that aims to provide diversified and decentralized financial services based on the crypto-native stablecoin system and autonomous monetary policy.

Its unique design brings a new paradigm of algorithmic stablecoin solution to decentralized finance (DeFi) and web 3.0 that combines the multi-assets reserve mechanism and the peg mechanism of the reorders algorithm. By doing so, it aims to take over the torch of algorithmic stablecoins and bring a brand new solution to DeFi and web 3.0 ecology.

TiTi Protocol’s new use-to-earn token economic design will greatly boost algorithm stablecoin adoption and maximize the benefits for DeFi users, thus enabling the interoperability of algorithmic stablecoins with other DeFi projects.

All this is only possible due to the research and experimentation of the TiTi Protocol team in DeFi especially the algorithm stablecoin track that the team has been testing for several years. In no time, TiTi will be able to write a glorious chapter in the algorithmic stablecoin track and the whole DeFi world.

Furthermore, the TiTi protocol is more than a stablecoin protocol the stablecoin protocol is just the beginning. Its ultimate goal is to provide global users with diversified DeFi services based on the crypto-native stablecoin system and autonomous monetary policy.

How is TiTi different compared with other algo stablecoins

The very nature of algorithmic stablecoins is to maintain a stable price by automatically adapting the stablecoin supply to meet demand. TiTi’s most unique feature is that it can improve algorithmic stablecoins’ liquidity and user adoption on the premise of ensuring stability. All of this can be achieved through several core innovation modules of TiTi.

1. New stablecoin issuance paradigm TiTi-AMMs greatly boosts stablecoin on-chain liquidity, increases capital efficiency and is free from impermanent loss.

It is the module where TiUSD is issued and burned, controlling TiUSD inflation and deflation. It is impermanence loss-free and has triple mining rewards, due to the unique liquidity rebalance algorithm. Stablecoin users need not worry about their assets being liquidated. All they need to do is swap back and forth.

Liquidity providers don’t need to open a position for TiUSD when they would like to participate in liquidity mining. Instead, they need to provide single-sided liquidity to TiTi-AMMs because the protocol will do the math and mint an equal value of TiUSD for them, which will be stored in the trading pairs enhancing the liquidity. Due to the improved TiUSD liquidity features of the TiTi-AMM, users can enjoy a wider array of liquidity options.

TiTi can effectively mitigate single-point risks because the stablecoin issued by the protocol is always backed by corresponding crypto assets with more than one dollar, and this data is completely on-chain, transparent and easy to gain users’ confidence.

However, unlike the designs of Maker and Fei, it does so to allow all risk in the reserves to be dispersed. The stablecoin is not relying entirely on custodial stablecoins and maintains some resilience even as the value of the reserves fluctuates and flexibility to survive. The cherry on top is that it can break the upper limit of the issuance of native cryptocurrencies.

2. Multi-asset reserve ensures stability and raises the upper limit for the issuance size.

To begin with, it needs to be clear that TiTi Protocol is not a pure algorithmic stablecoin. It is more like a decentralized, multiple crypto assets backed not collateralized stablecoin whose supply and demand are adjusted by an algorithm nlike Ampleforth and YAM, who are purely controlled by algorithms and rely entirely on the stability mechanism of the ‘game theory,’ which cannot be durable and bears great potential risks.

Instead of just using an algorithm, each and every TiUSD the stablecoin issued by TiTi Protocol is supported by sufficient crypto assets in the reserve, such as WBTC, ETH, USDC, etc., and supported by the continuous yields from the ‘rainy day fund.’

The robustness of the protocol in dealing with the risks of market fluctuations in reserve assets has been improved, allowing the protocol to introduce multi-crypto assets as reserves. This addresses two of the most important issues in the algo stablecoins race stability and liquidity.

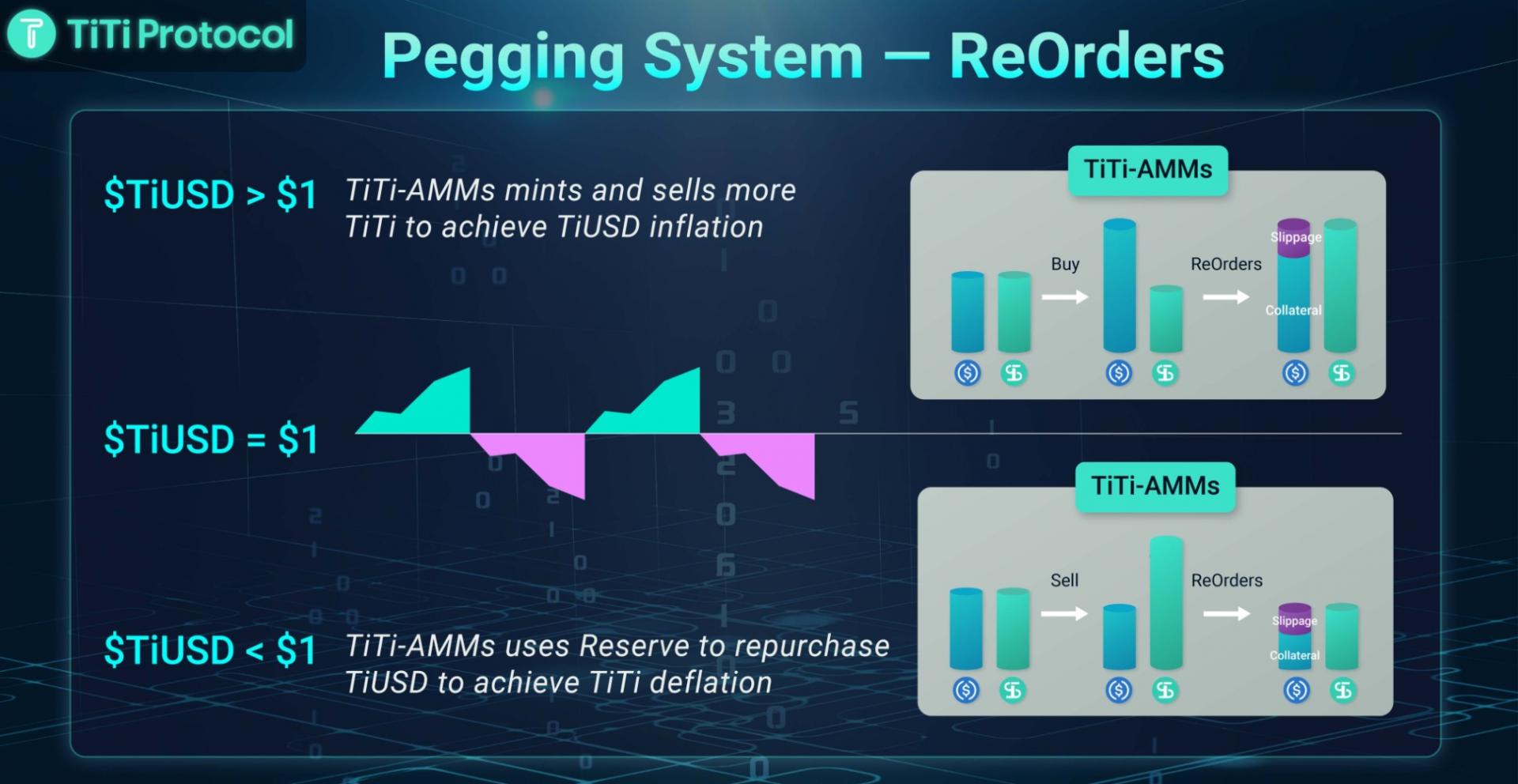

3. The reorders can cohesively make TiUSD pegging to one dollar via reshaping liquidity pairs’ value.

TiTi maintains price anchoring dynamically and effectively adjusts the supply and demand of the primary and secondary markets of stablecoins through a new supply and demand algorithm, the ‘reorders.’ TiTi induces a peg coordination mechanism, which fosters high liquidity around the peg while curtailing speculative attacks and bank run effects with reorders and the rainy day fund in case coordination breaks.

Another unique function is that the reorders can curtail speculative and arbitrage from taking transaction slippage. Instead, the reorder will proactively collect the slippage and distribute it to the rainy day fund and protocol fee, thus benefiting protocol users rather than speculators.

Compared with the current stablecoin pegging mechanism e.g., the rebase, reweight the reorders’ triggering conditions are more easily predictable and more precise. It can be triggered when TiUSD is five percent away from peg or every 30 minutes instead of eight hours or 12 hours, which is far too late to restore pegging and gain user confidence.

TiTi’s multi-asset reserve can be recapitalized or restored through reorders ecause for each reorder, the slippage will be allocated to the rainy day fund and will be distributed to the multi-asset reserve subsequently.

4. Use-to-earn the first-ever stablecoin tokenomic design that will tremendously boost algorithmic stablecoin user adoption.

The user adoption of major algorithmic stablecoin is the core of organic market growth. TiTi invented the first-ever use-to-earn mechanism to ensure the organic adoption of algorithm stablecoin, which will significantly boost TiUSD’s market competitive advantage and beyond.

Use-to-earn is a brand new stablecoin earning concept. It’s short for using stablecoin to earn protocol fees passively and proactively. To be specific, use-to-earn means that users can earn protocol fees by holding or using TiUSD. Holding and using TiUSD versus other stablecoins does have a meaning.

The TiUSD is inherently an interest-bearing algorithmic stablecoin. TiUSD users or holders can claim extra rewards the protocol fee in a totally decentralized, ‘Merkle proof’ way.

At the same time, the technical architecture also guarantees the distribution of protocol fees can be adaptable to more complex incentive models, which also provides greater flexibility for TiTi Protocol’s organic growth and expansion.

For example, just like play-to-earn, the use-to-earn rewards can be distributed to users or offer targeted incentives to use TiUSD to an external transaction’s behavior in the product, etc. The technical solution of use-to-earn is based on Merkle proof to verify users’ reward distribution on chains.

The off-chain part is responsible for the calculation of rewards according to how users are using TiUSD. The use-to-earn rewards algorithm and distribution pattern are mainly judged by how users are using TiUSD in the crypto world.

The use-to-earn algorithm and distribution pattern are designed and adopted based on the protocol’s organic growth in the early stage and will be fully determined by TiTi DAO in the later stage.

5. Aligned DAO governance TiTi Protocol has a governance mechanism that incentivizes the long-term health of the stablecoin for a few decades and beyond, rather than short-term profit.

Another protocol defense line is auctioning governance tokens or future reserve yields. Governance is incentivized to do this at opportune times as opposed to solely as last resort in the middle of a crisis.

If the situations are good and the governance token TiTi’s valuation is high, governors are incentivized to auction off new tokens early to boost the multi-asset reserve for the robustness of the system.

About TiTi Protocol

TiTi Protocol aims to bring a new type of elastic supply algorithm stablecoin solution to DeFi and web 3.0 that incorporates the multi-asset reserves mechanism.

TiTi Protocol always monitors changes in the total value of reserve to calculate the average price of TiUSD in circulation and adjusts the market-making peg price of TiUSD in the primary market through the reorders mechanism.

Join our Telegram and Discord for the latest updates, follow us on Twitter and read more about us via our blog and documents.

Contact

Hyman, CMO of TiTi Protocol

This content is sponsored and should be regarded as promotional material. Opinions and statements expressed herein are those of the author and do not reflect the opinions of The Daily Hodl. The Daily Hodl is not a subsidiary of or owned by any ICOs, blockchain startups or companies that advertise on our platform. Investors should do their due diligence before making any high-risk investments in any ICOs, blockchain startups or cryptocurrencies. Please be advised that your investments are at your own risk, and any losses you may incur are your responsibility.

Follow Us on Twitter Facebook Telegram