April 15, 2022

AlgoBlocks raised $1.9 million in its strategic and private funding, thanks to the addition of investors Draper Dragon and Kyber Ventures.

The total funding goal is to reach $2.3 million through raising an additional $400,000 in the public round through two market leading launchpads Poolz and KrystalGo.

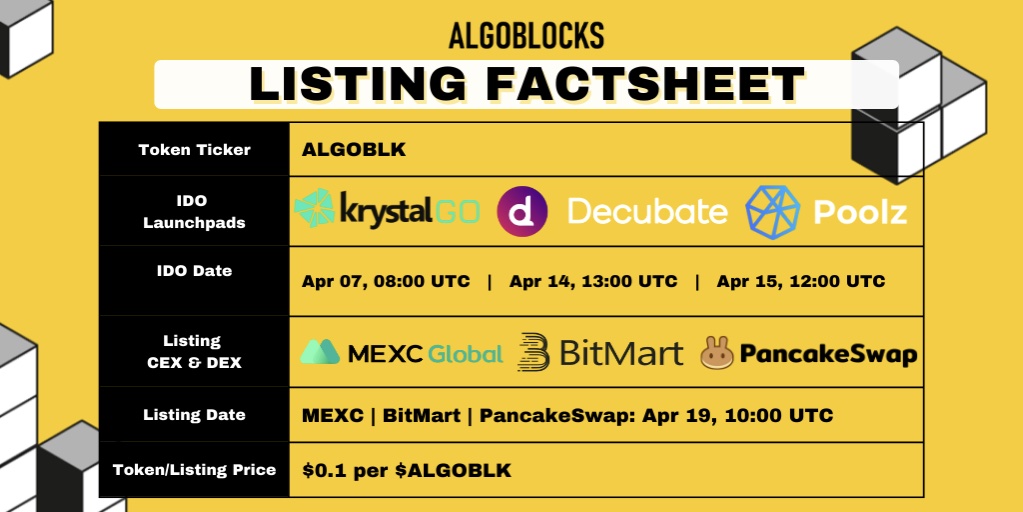

Public round fundraising with KrystalGO (April 7), Decubate (April 14) and Poolz (April 15). After the public round fundraising, it will be a simultaneous listing on MEXC, BitMart and PancakeSwap on April 19, 2022, 10:00 UTC.

The money raised will be used for product development and growth initiatives, such as partnership and technical integration with other protocols.

The investors

- Draper Dragon is an early-stage venture capital fund focusing on cross-border tech. Its investments include Vechain, Ledger and Thundercore, among others.

- Kyber Ventures is the investment arm of Kyber Network. They support entrepreneurs building the next giants of the decentralized world.

- Big Brain Holdings is the name behind Solana and the Graph. Its investment portfolio is at $15 million across over 50 projects.

- MEXC is a centralized exchange founded in 2018. AlgoBlocks has a standing agreement with MEXC for listing.

- Lancer Capital is a private equity firm for blockchains founded in 2017. It is known to be a backer of Polkadot.

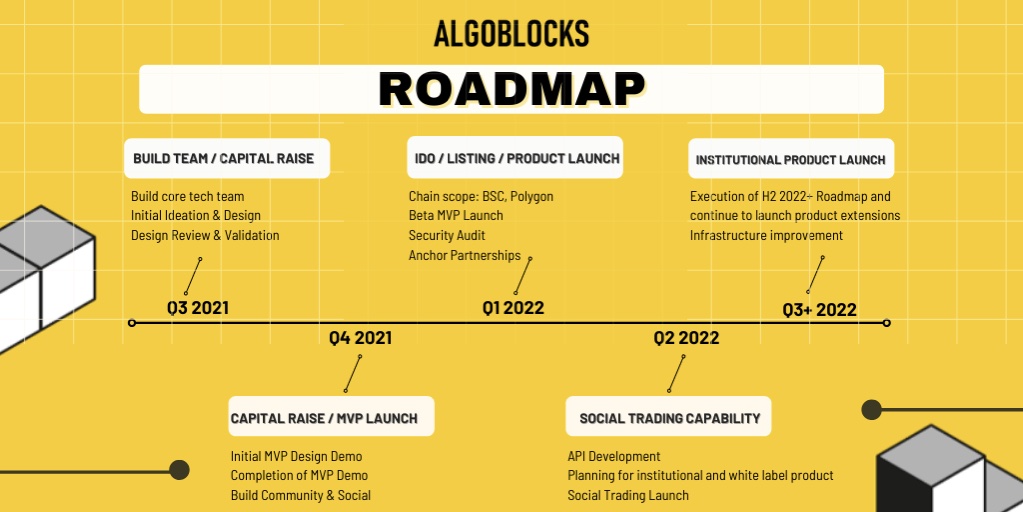

Roadmap

The team at AlgoBlocks remains within schedule to achieve its goals in the first quarter of 2022. Its public round fundraising is expected to start on April 7, 2022. The public round fundraising is launching with KrystalGO, Decubate and Poolz. It will also be listed on MEXC, BitMart and PancakeSwap.

With the availability of AlgoBlocks in these platforms, its reach will expand to bring seamless and beginner-friendly DeFi to more users. One of the core goals is to provide an avenue to discover, invest, manage and automate DeFi investments with personalized signals and strategies in one place.

The platform will embrace cross-chain services to bring various blockchains in one platform. It aims to support a flexible integration with the largest number of supported products in the market.

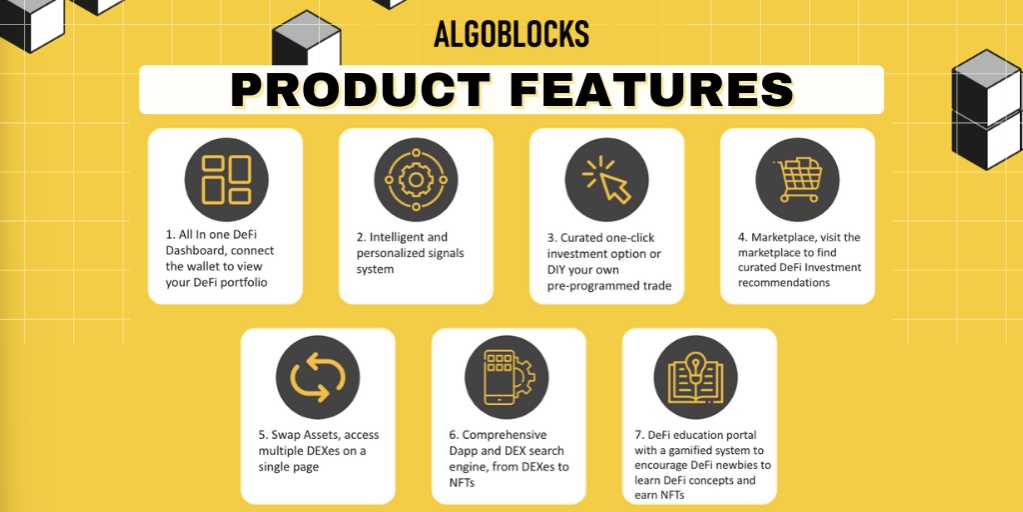

Product features

As an all-in-one DeFi management platform, AlgoBlocks aims to simplify the process of interacting with multiple DeFi protocols across different blockchains. Here is the summary of product features that AlgoBlocks will offer to DeFi users.

- All-in-one DeFi dashboard connect the wallet to view your DeFi portfolio

- Intelligent and personalized signals system

- Curated one-click investment option or DIY your own pre-programmed trade

- Marketplace isit the marketplace to find curated DeFi Investment recommendations

- Swap assets access multiple DEXs on a single page

- Comprehensive DApp and DEX search engine from DEXs, to NFTs

- DeFi education portal with a gamified system to encourage DeFi newbies to learn DeFi concepts and earn NFTs

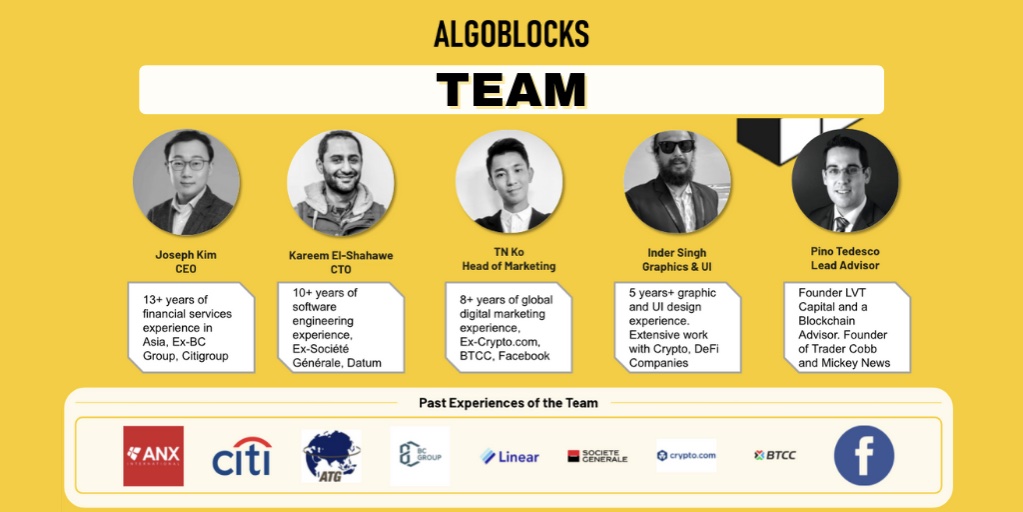

The team

The team is composed of CEO Joseph Kim, CTO Kareem Elshahawe and CMO TN Ko.

Joseph has over 13 years of financial services experience in and out of the blockchain space and held senior positions at Citigroup and BC group.

Kareem has over a decade of software engineering experience and held senior positions at Societe Generale and Datum Blockchain.

Ko heads the marketing block with over eight years of experience in global marketing. He previously held roles at Crypto.com, BTCC and Facebook.

Follow AlgoBlocks on its community and social channels to be the first to know about updates.

Website | Whitepaper | Twitter | Telegram | Discord | Medium | LinkedIn | YouTube

This content is sponsored and should be regarded as promotional material. Opinions and statements expressed herein are those of the author and do not reflect the opinions of The Daily Hodl. The Daily Hodl is not a subsidiary of or owned by any ICOs, blockchain startups or companies that advertise on our platform. Investors should do their due diligence before making any high-risk investments in any ICOs, blockchain startups or cryptocurrencies. Please be advised that your investments are at your own risk, and any losses you may incur are your responsibility.

Follow Us on X Facebook Telegram