A crypto-focused financial media outlet is naming the top crypto sectors to invest in before 2024.

In a series of tweets, Blockworks lists and explores seven crypto areas that they expect to produce the best investments over the next two years.

The Next Big Crypto Narratives? ?

Here are 7 areas to keep a close eye on for capital injections over the next 2 years

? by @MattFiebach

— Blockworks (@Blockworks_) April 13, 2022

First on the list is Ethereum (ETH) layer-2 (L2) solutions, referred to as L2s. Blocksworks highlights projects like Arbitrum, Optimism, and Starkware, pointing out their tremendous total value locked (TVL) values.

“These three L2s alone have a TVL of over $5 billion, a number likely to only go up. L2 token launches are imminent and worth noting.”

Next, Blockworks says that the multi-chain world is on the rise, meaning that interoperability of assets between blockchains will be important for mass adoption. Based on this assumption, Blockworks says that blockchain bridges, such as Anyswap and Wormhole, are one of the “most important factors in Web3 adoption.”

Third, Blockworks anticipates the sector of decentralized data storage to grow over the next two years, specifically highlighting top altcoins like Filecoin (FIL) and Arweave (AR).

5/ Decentralized data storage has yet to see a bullish narrative among the masses.

Projects have been innovating in this space for over 5 years and a large corporation utilizing a decentralized provider will be the catalyst needed.

Cloud storage is a $150B market. pic.twitter.com/wKJmoVMQeH

— Blockworks (@Blockworks_) April 13, 2022

Next, Blockworks expects decentralized autonomous organization (DAO) and social tokens to explode in terms of adoption.

“DAOs will purchase and control real-world assets and protocol governance alike, and these purchases will act as a testament to the power that stems from decentralized communities. Social tokens, not necessarily for managing funds, will also pop up.”

Blockworks then predicts blockchain gaming, a sector that has already been blowing up over the last year, will continue to gain mass adoption once a major gaming studio begins to assimilate digital assets.

“A significant game studio will adopt digital assets and implement them in a high-grossing game. This sector has the most potential to push digital assets into the mainstream, outside of value speculation.”

At number six, Blockworks names derivatives trading as another area that will see incredible adoption by 2024.

8/ @dYdX, @GMX_IO, @DDX_Official, @Opyn_, and @dopex_io are just a few of the builders looking to decentralize derivatives.

Keep an eye out for gargantuan desks to start trading and market making on decentralized platformshttps://t.co/D2h53JuOC3

— Blockworks (@Blockworks_) April 13, 2022

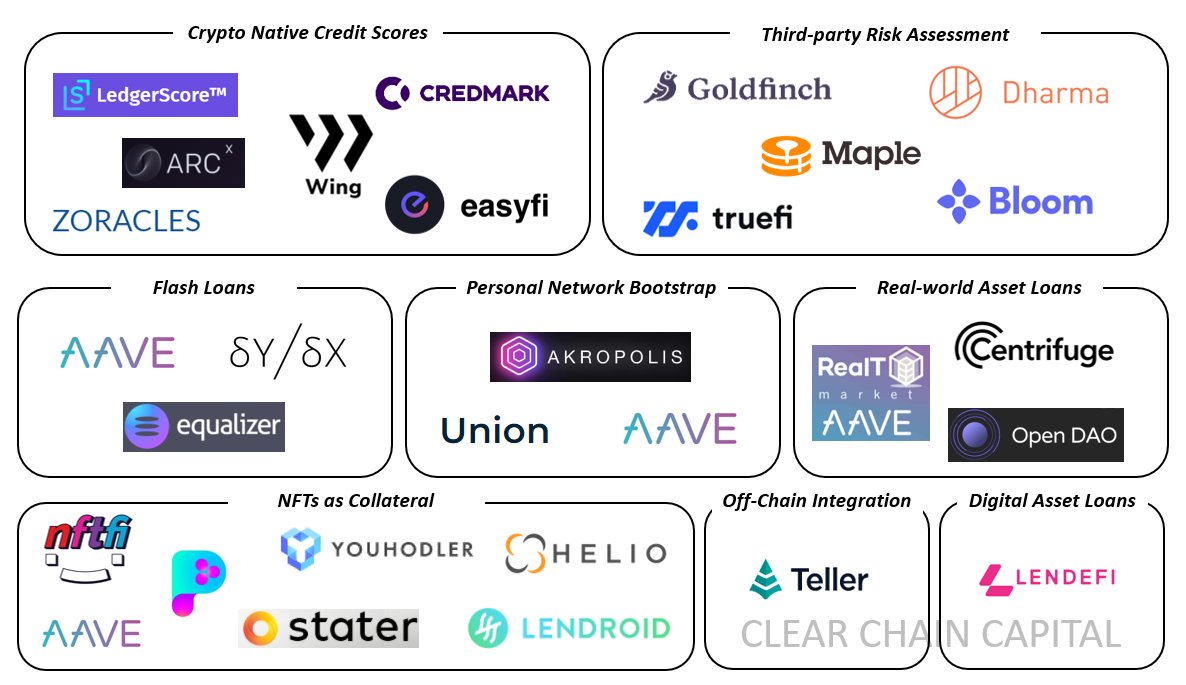

Finally, Blockworks foresees another sub-arm of decentralized finance (DeFi), undercollateralized lending, potentially infiltrating the entire lending industry.

“Under collateralized lending enables Defi will infiltrate the entire lending industry. Mortgages, exchange margin, insurance, and credit cards are just a few of the use cases.

Development here will lead to the most progress for decentralized finance.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Vink Fan/Natalia Siiatovskaia