A popular on-chain analyst is revealing that Bitcoin is going through a huge accumulation phase with large entities now holding hundreds of billions of dollars worth of BTC.

In the latest edition of the Blockware Intelligence newsletter, William Clemente says that despite BTC’s volatile price action, market participants are buying and holding BTC at a historic rate.

“Underneath the surface, there is a heavy phase of accumulation on-chain.

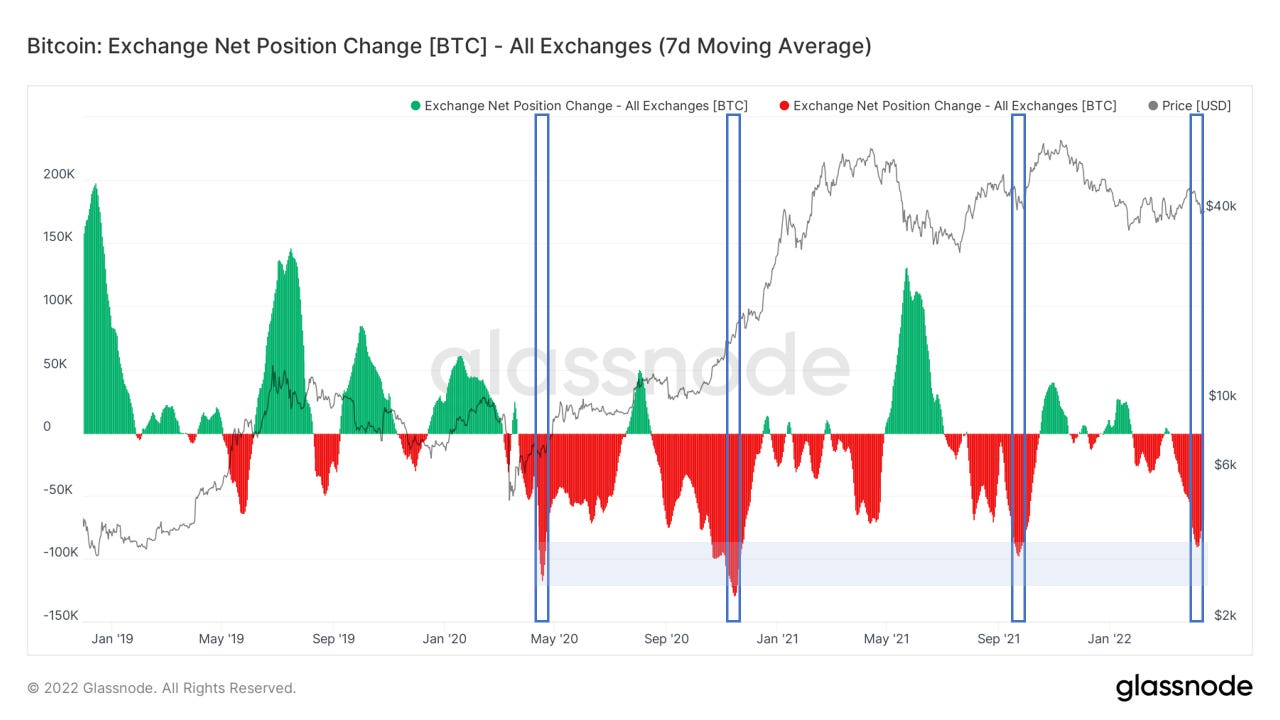

Exchange outflows have reached a rate that has only ever occurred three times before in Bitcoin’s history: following March 2020, December 2020 (a lot of which was likely GBTC), and September 2021.”

Along with the massive exodus of Bitcoin from digital asset exchanges, Clemente highlights that whales are also buying the leading by market cap after unloading their BTC stacks for most of the year.

“This week has seen an uptick in whales holdings for the first time since January, showing an increase in supply held by entities with over 1,000 BTC (filtering out for known on-chain entities such as exchanges).”

Looking at Clemente’s chart, Bitcoin whales now collectively own more than 6.95 million in BTC worth over $280.59 billion at time of writing.

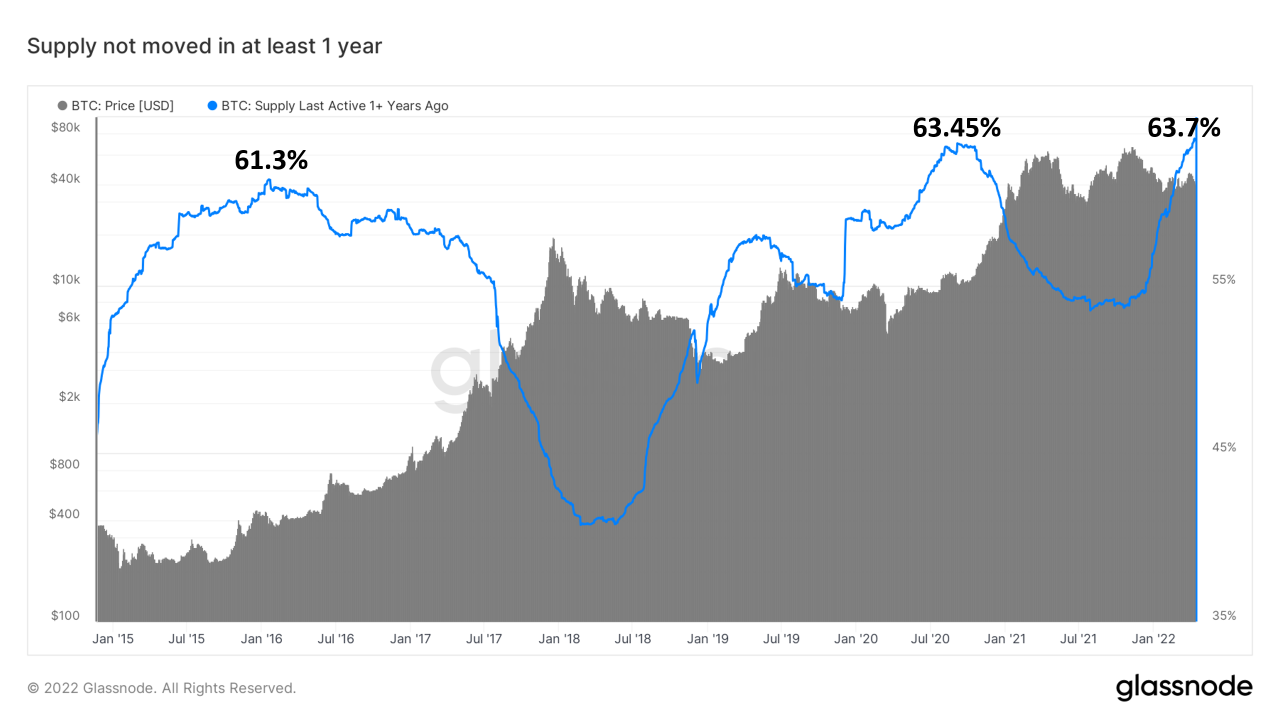

Clemente also highlights one on-chain metric that shows the tendency of market participants to hold on to their BTC troves. According to the analyst, the supply of Bitcoin that has remained untouched for at least one year is at a record high.

“Another measure of holding behavior is simply looking at the amount of supply last active a year+ ago; a simple but powerful metric. As of this week, an all-time high 63.7% of Bitcoin’s supply hasn’t moved in at least a year.”

Even with the available supply of Bitcoin dwindling, Clemente says that BTC is currently in “no man’s land.” According to the analyst, he sees Bitcoin a value investment in the low $30,000 range or a momentum trade once BTC moves above $47,000.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/vanitjan/Konstantin Faraktinov