Despite its recent price stagnancy, Ethereum (ETH) is flashing a potentially bullish signal, according to the crypto analytics firm Santiment.

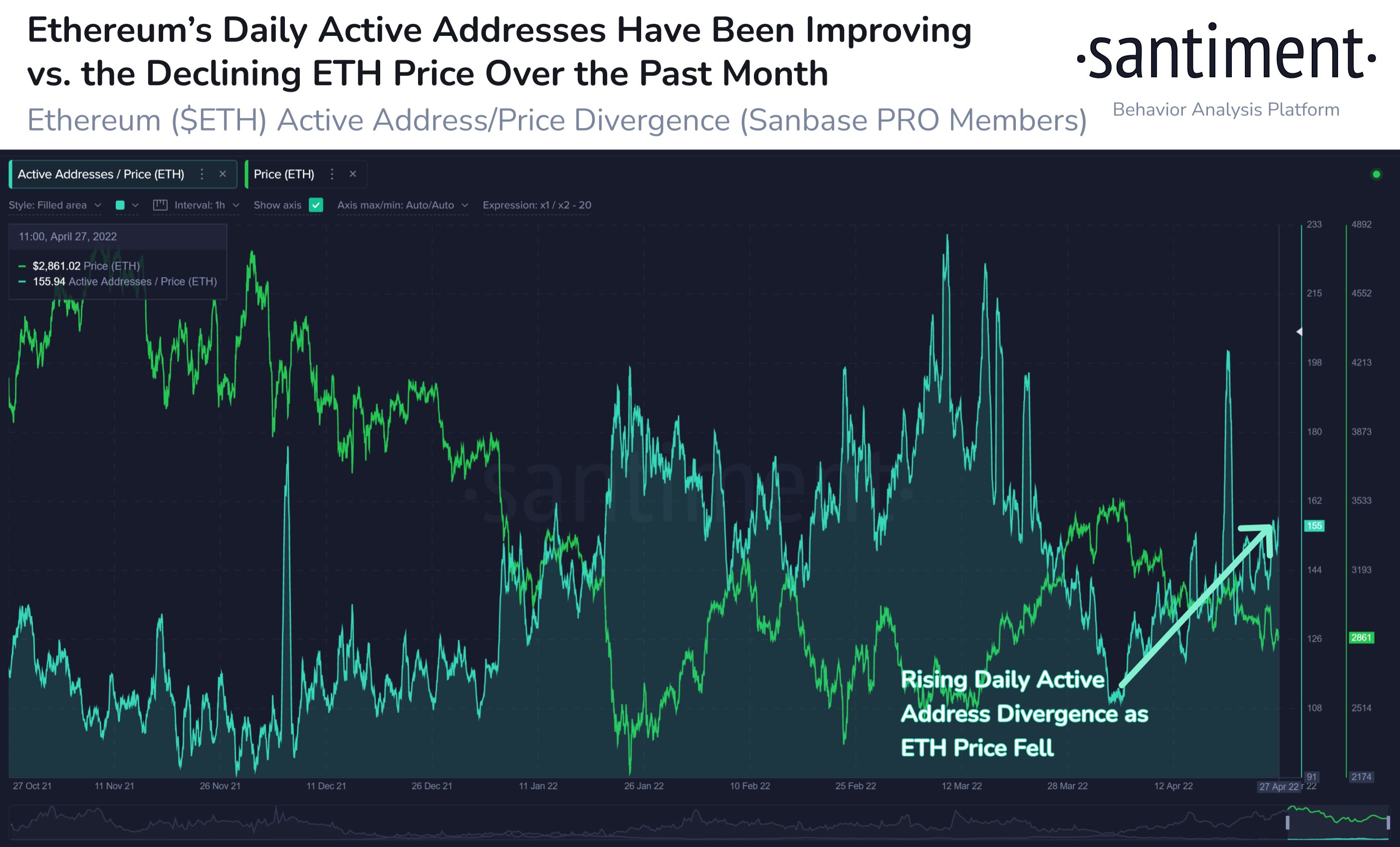

Santiment notes that the amount of unique addresses interacting on the Ethereum network this week has improved as ETH’s price has moved downwards.

The firm says the increase in daily active addresses has created an “upward trend and bullish divergence” for ETH.

“Utility growing while prices drop is a strong case for prices turning positive.”

Ethereum is trading at $2,933.22 at time of writing, up 1.66% in the past 24 hours. The second-ranked crypto asset by market cap is down more than 2% in the past seven days and down more than 12% in the past month.

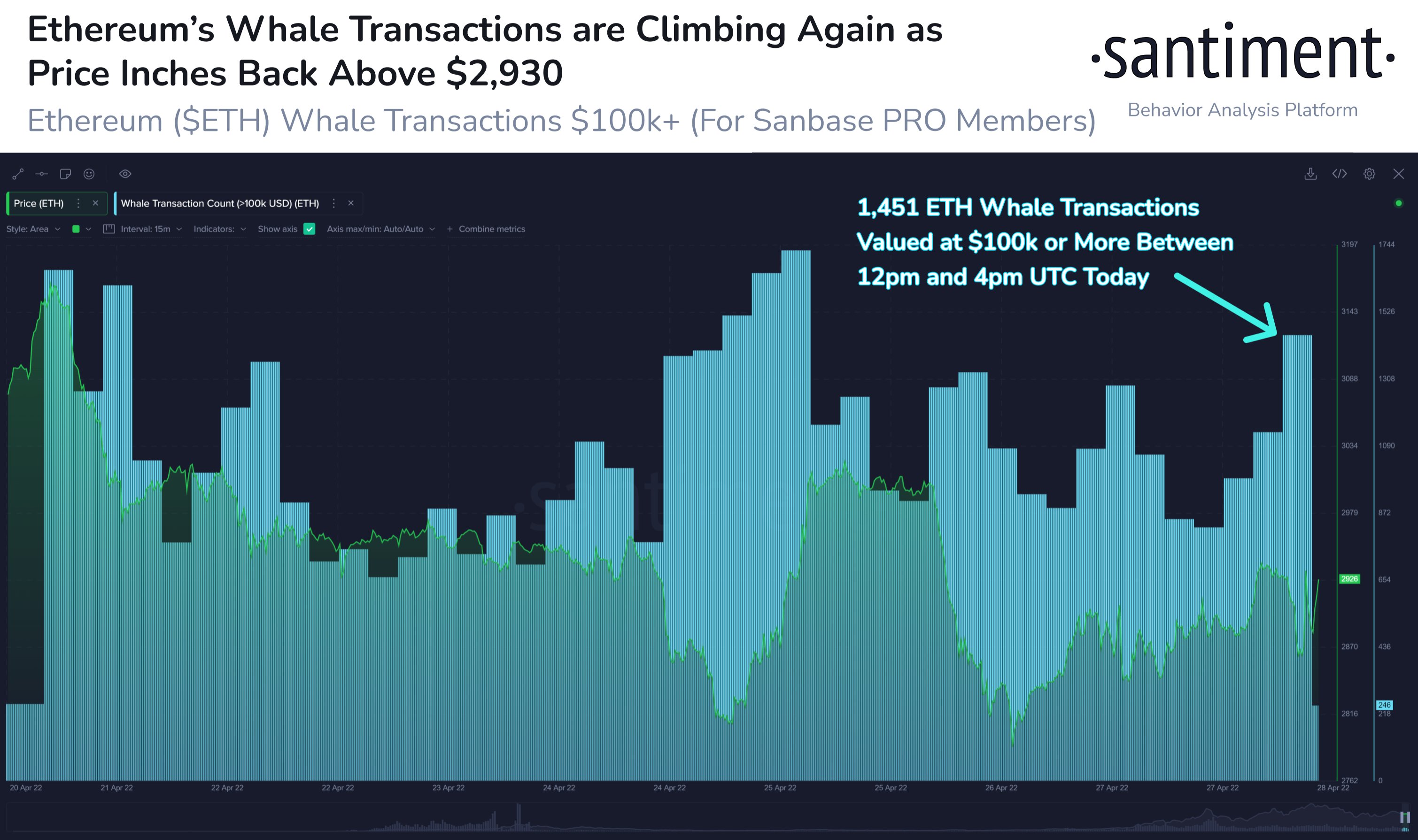

Santiment also says the amount of whale transactions exceeding $100,000 is rising, which the firm notes indicate “key stakeholders” are taking notice of ETH. The analytics firm also notes that Ethereum has displayed a tight correlation to the equities market.

Conversely, Santiment says Ethereum’s average exchange funding rates have remained “close to neutral” this week.

“Average funding rates on BTC and ETH are close to neutral. Neither longs are paying shorts, neither shorts are paying longs on derivatives markets.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/3DD Character/monkographic