On-chain analyst Willy Woo says Bitcoin (BTC) is seeing historically unparalleled spot market demand despite the underwhelming price action that has unfolded over the last several weeks.

The popular analyst tells his one million Twitter followers that institutional capital is pouring into Bitcoin while BTC’s price action emulates late 2020, just before crypto markets went on massive rallies.

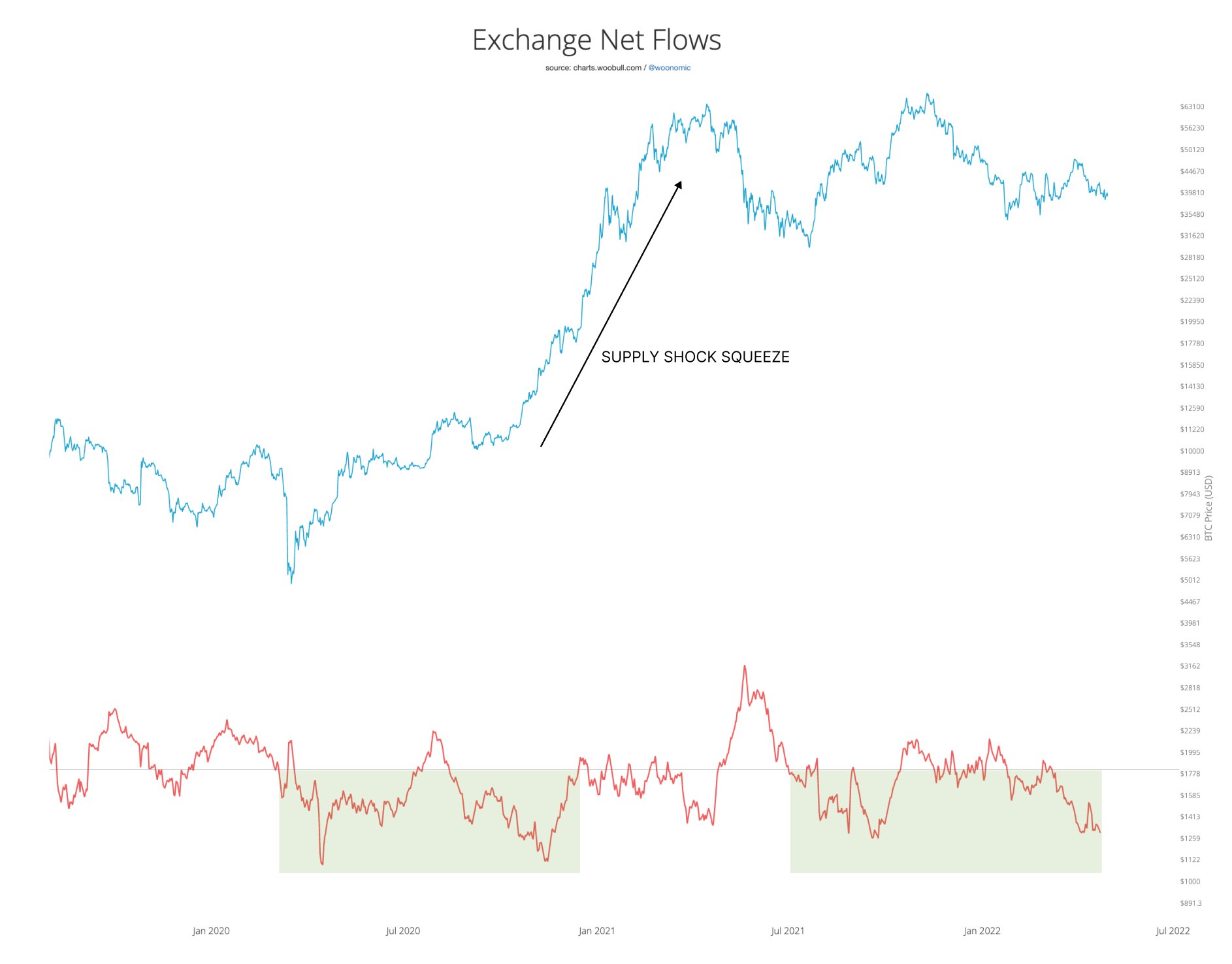

“Bitcoin price is sideways because Wall St is selling futures contract in a macro risk-off trade. Meanwhile, institutional money is scooping spot BTC at peak rates and moving to cold storage.

It’s times like these I remember the Q4 2020 supply shock squeeze.”

According to Woo, investors may already be looking at BTC as a legitimate safe-haven asset class given Bitcoin’s ability to avoid a complete collapse in the face of a steep stock market correction.

“BTC price holding up well while equities tank and USD Index moons is testament to the unprecedented spot buying happening right now.

In other words: investors already see BTC as a safe haven. It will take time for price to reflect. Wait for the futures sells to run out of ammo.”

In the short term, Woo says Bitcoin faces headwinds from macroeconomic factors. However, he notes that the USD dollar index (DXY) is at a critical resistance level, which could result in a rejection that could aid Bitcoin and other assets in igniting rallies.

Woo also points out to veteran commodities trader Peter Brandt that the TD (Tom DeMark) sequential, an indicator that attempts to identify turning points in trends, has flashed a major bearish reversal signal for DXY.

When the TD sequential records nine consecutive candles above the closure of the four prior candles, it prints a TD9 signal. Woo says the DXY has officially flashed a TD9, which could have big implications for Bitcoin and other assets in the near future.

TD9 reversal on the monthly and weekly candles. Will be interesting to see what happens next week.

— Willy Woo (@woonomic) April 28, 2022

At time of writing, Bitcoin is trading at $38,117.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/SergZSV.ZP/Gorodenkoff