The CEO of an on-chain insights platform says institutional investors are dominating Bitcoin (BTC) trading.

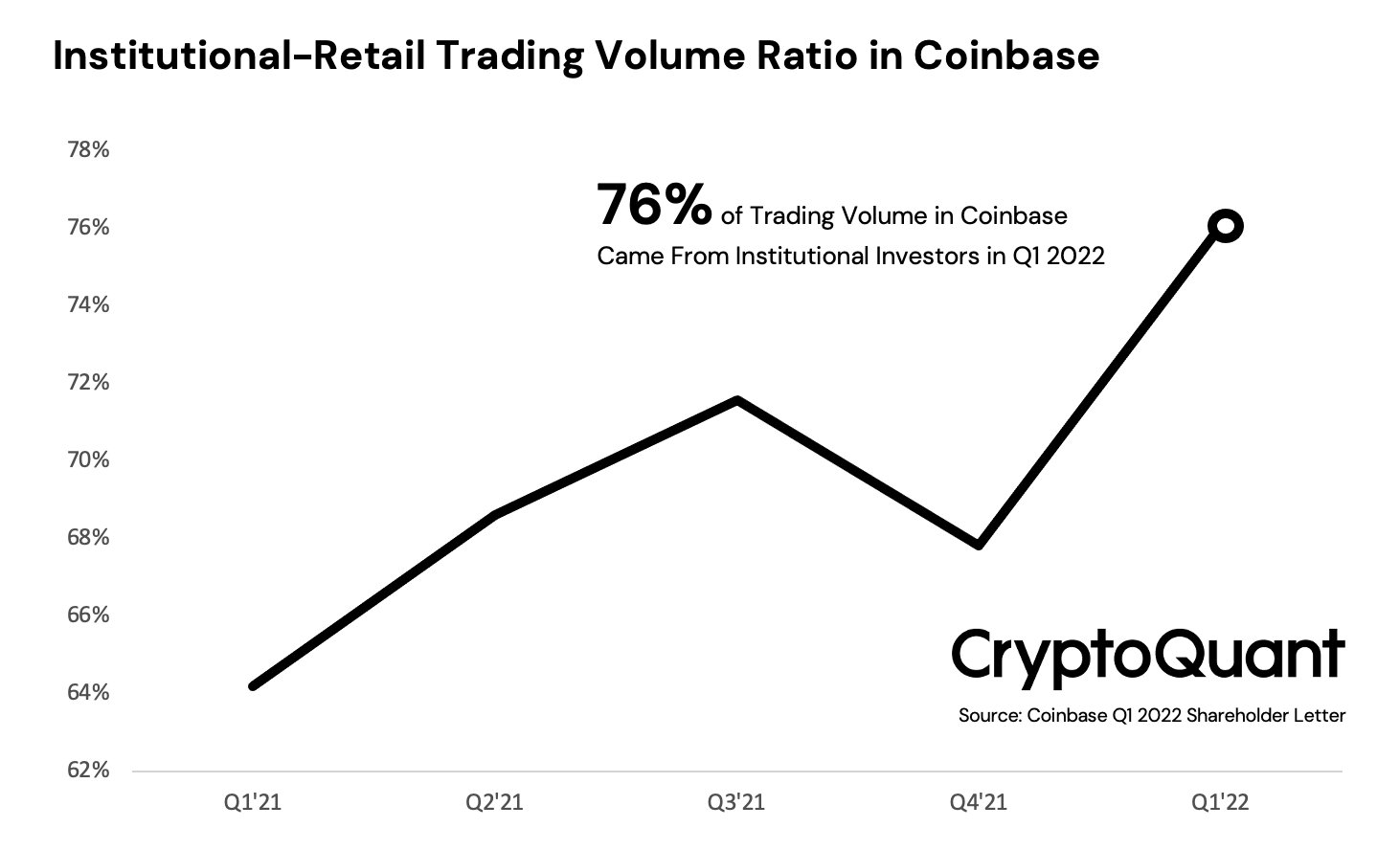

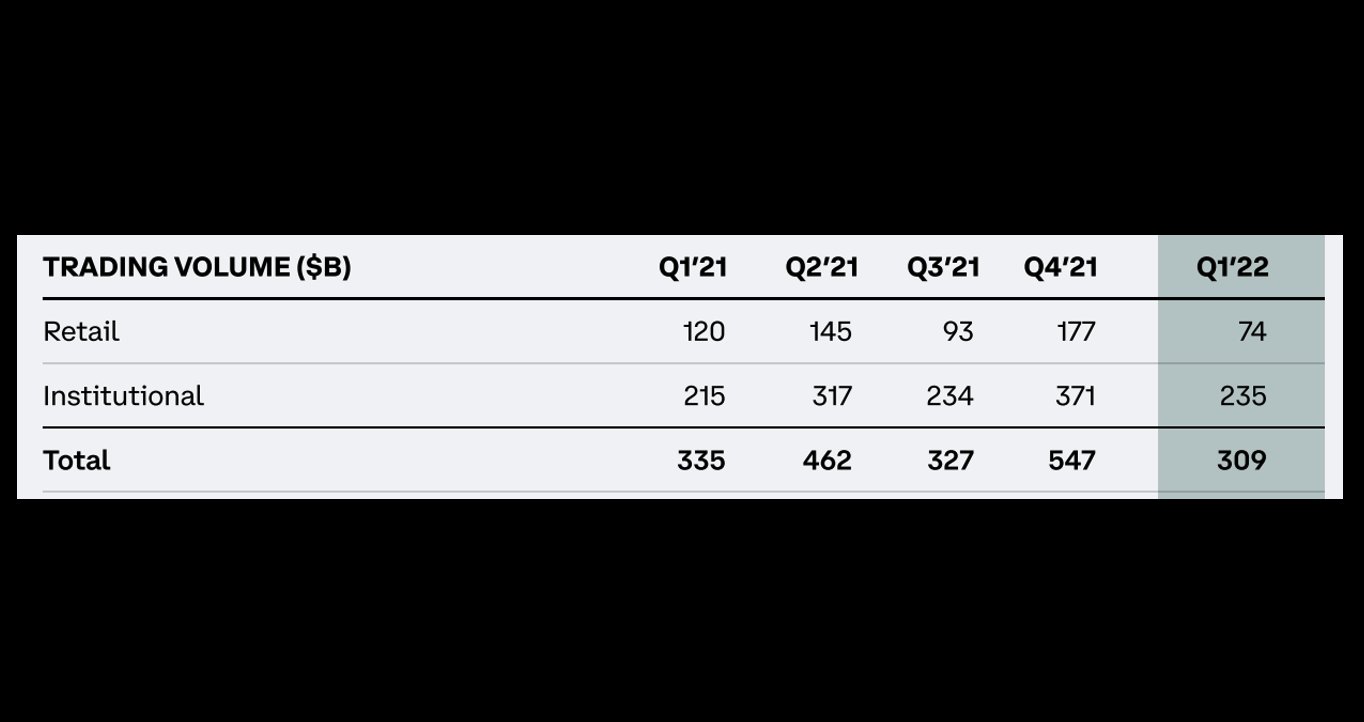

Ki Young Ju of CryptoQuant notes that 76% of the trading volume at Coinbase came from institutional investors in the first quarter of 2022.

Explains the CEO,

“Retail investors are leaving the crypto market. Not bad for accumulating Bitcoin with institutions, but still worried about overall volume, which is significantly decreased compared to last year.”

Ju says institutional investors have likely been buying BTC from market makers during the crypto price collapse last week.

“Market maker(s), including the ones hired by LFG [Luna Foundation Guard], already sent 84,000 BTC(~$2.5 billion) to multiple exchanges last week.

Not sure they finished selling, but it is highly likely for the accumulation from institutions since Coinbase digested the majority of selling pressure.”

LFG refers to Luna Foundation Guard, a non-profit organization built to support the Terra (LUNA) ecosystem. The LFG dumped more than $2.4 billion worth of Bitcoin last week as the stablecoin TerraUSD (UST) imploded.

“Consistent with its non-profit mission and focus on the health of the Terra ecosystem, beginning on May 8, when the price of UST began to drop substantially below one dollar, the Foundation began converting this reserve to UST.

The Foundation did so by directly executing on-chain swaps and transferring BTC to a counterparty to enable them to enter trades with the Foundation in large size and on short notice…

Transferred 52,189 BTC to trade with a counterparty, net of an excess of 5,313 BTC that they have returned, for an aggregate 1,515,689,462 UST.”

Bitcoin is trading for $28,863 at time of writing. The top-ranked crypto asset by market cap is down almost 5% in the past 24 hours.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/studiostoks