A prominent market intelligence firm says that Ethereum’s (ETH) gas fees have dropped to levels not seen since the crypto markets collapsed in May of 2021.

In a new report, Santiment says that the depressed gas fees on Ethereum suggests that interest in using the leading smart contract platform have significantly declined.

“Ethereum fees are so low [in the] last days. We could even notice they’ve been that low before previous bottoms. Low fees mean very little activity, no one is interested to do anything.”

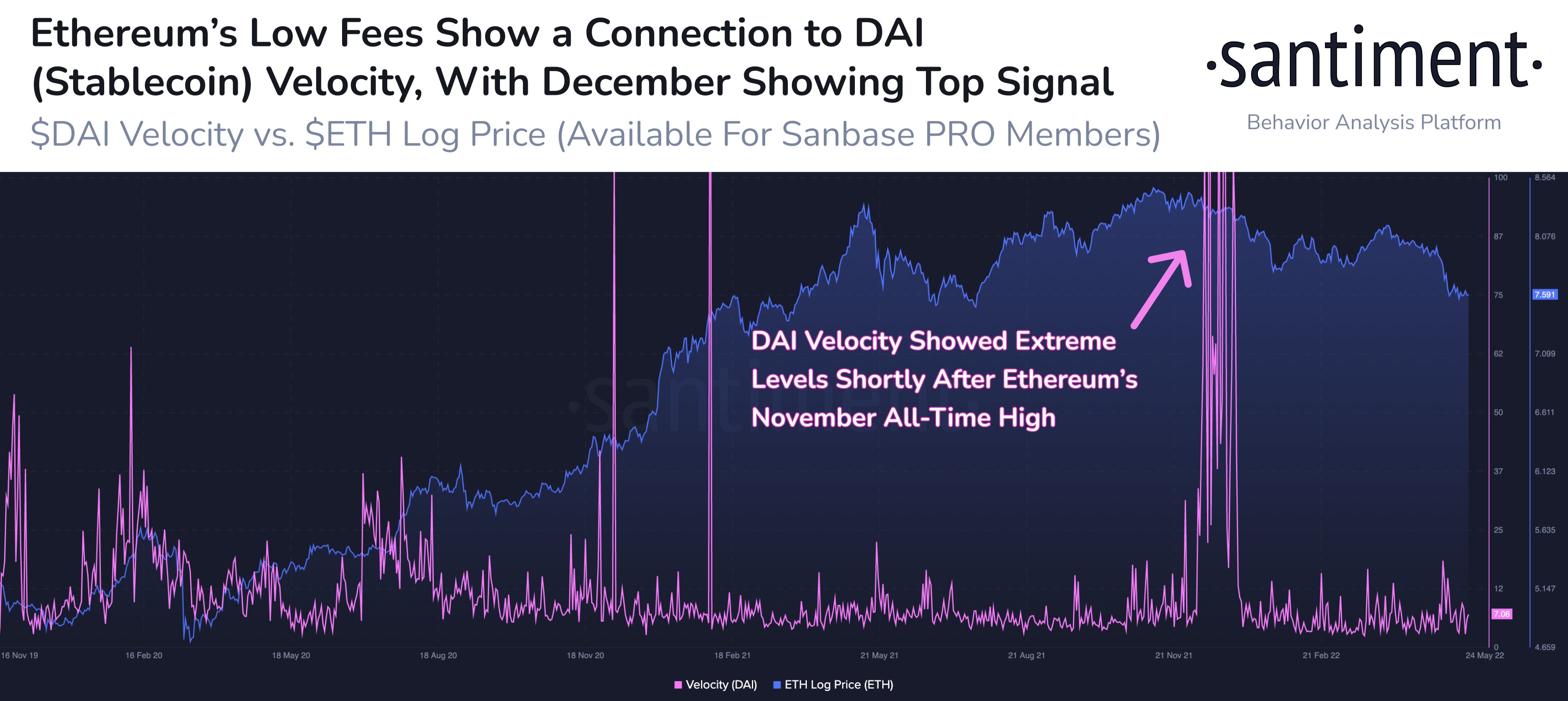

The crypto analytics firm is also looking at Dai (DAI), a stablecoin built on the Ethereum blockchain. According to Santiment, DAI’s money velocity supports the notion that market participants currently have very little interest in using the second-largest crypto asset by market cap.

“It looks like velocity (a measure of how quickly money is circulating in the crypto economy) has always [increased] when we went to the top. Quite low now. What these two charts [are] showing together is hibernation. It happens typically in winter. Bears sleeping in winter. Waiting for a trigger…”

The crypto insights firm says that Dai’s money velocity and Ethereum’s extremely low gas fees are hinting at “stagnancy” and “fear” among market participants.

Ethereum is changing hands at $1,796 at time of writing, a 13% drop from its seven-day peak of $2,070.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/ppl/monkographic