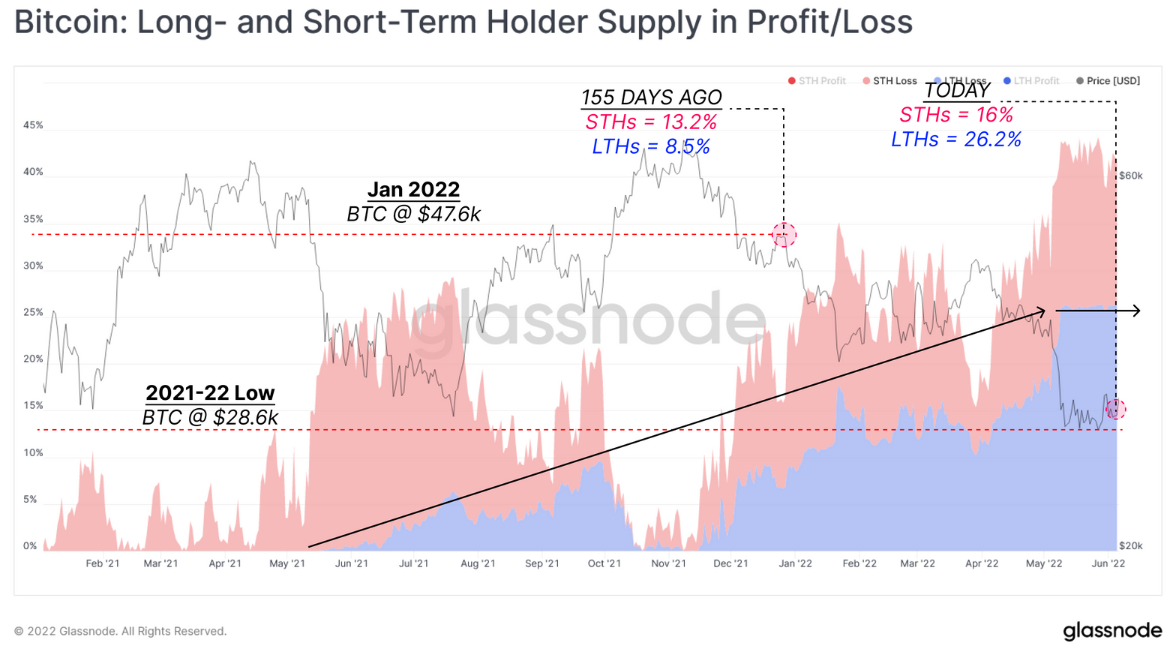

Analytics firm Glassnode is revealing short-term Bitcoin (BTC) holders are sitting on losses as the flagship crypto asset trades below a key psychological level.

Glassnode says nearly all the short-term holders (STH), or those who have held Bitcoin for a period of fewer than 155 days, are counting losses.

“At the moment, almost 58% of the circulating supply is in profit while in the last three market capitulations this metric fell down to <50% levels. STH-Supply in profit is just 2.2% meaning the short-term holders are almost entirely at a loss.”

The crypto analytics firm says long-term holders (LTH) are holding the lion’s share of the profits in the prevailing bear market.

According to Glassnode, Bitcoin’s short-term holders are currently holding less than 10% of the profit in the market, as was the case during the previous two bear markets. The figure is based on the 14-period displaced moving average (DMA) of the Supply in Profit Held By Long-Term Holders metric.

The long-term holders, on the other hand, hold over 90% of the profit in the market as Bitcoin hovers below $30,000.

“In the last two extended bear markets, the 14 DMA of this metric broke above the 90% threshold line.

This means under the psychological pressure of bearish price action, short-term holders were holding < 10% of the profit in the market.

With the recent leg down to sub $30,000 range, this metric crossed over the 90% threshold. Above this level, STHs have essentially reached a near-peak pain threshold, with almost no unrealized profits held while LTHs dominate the remaining profitable supply.”

Bitcoin is trading for $29,682 at time of writing.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/PremiumArt/maksum iliasin