A new study from one of the biggest accounting firms in the world is revealing that the majority of crypto hedge fund managers anticipate a rebound for Bitcoin this year despite BTC’s shaky performance as of late.

PricewaterhouseCoopers (PwC) shares data from a survey conducted by digital assets manager CoinShares in Q1 2022, focusing on crypto hedge funds and excluding crypto index funds and crypto venture capital funds.

Data from the study shows that even though the crypto winter was already ongoing at the time of the survey, (April 2022), hedge fund managers remained extremely bullish on Bitcoin.

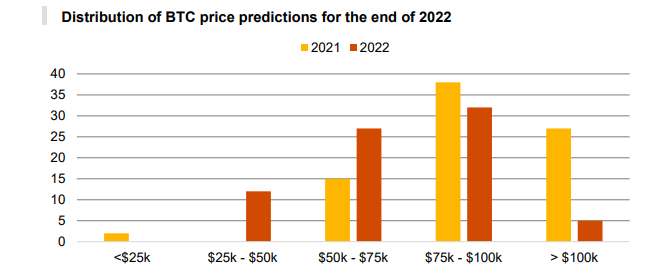

“All respondents predicted that BTC would end the year above the prevailing price upon survey closure, $40,000, with the median prediction of BTC price being $75,000.

The majority of predictions were within the $75,000 to $100,000 range (42%), with another 35% predicting the BTC price to be between $50,000 and $75,000 by the end of 2022.”

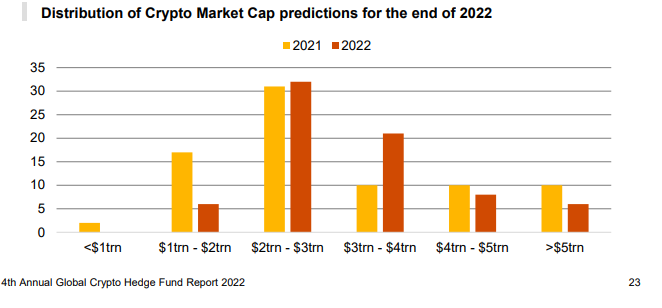

The respondents were also optimistic that by the end of the year, crypto’s total market capitalization will exceed the $1.5 trillion level.

“Fund managers were also bullish towards the crypto market capitalisation changes in the upcoming year, with over 97% of fund managers expecting the market to finish the year significantly above current levels and with the median predicted level at $3 trillion. Most forecasts ranged between $2 trillion and $3 trillion.”

The report says it remains unclear how recent events and changes to market sentiments can affect the estimates.

At time of writing, BTC is trading for $27,376. The global crypto market cap is at $1.10 trillion, according to CoinMarketCap.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/maddrest/Sensvector