Tron (TRX) founder Justin Sun says the Tron DAO Reserve will deploy $2 billion to defend the Decentralized USD (USDD) peg.

Sun recently unveiled his plan to keep TRX and stablecoin USDD from collapsing amid the sustained sell-off in the crypto markets.

“[Tron DAO Reserve] will deploy $2 billion USD to fight them. I don’t think they can last for even 24 hours. Short squeeze is coming.”

Last month, algorithmic stablecoin UST lost its peg to the US dollar and collapsed along with the entire Terra (LUNA) ecosystem, wiping out $40 billion in crypto market capitalization.

Prior to the UST meltdown, the Tron decentralized autonomous organization worked in conjunction with other blockchains to launch Decentralized USD, which bills itself as “over-collateralized decentralized stablecoin.” It aims to be pegged to the US dollar.

On Monday, USDD lost that peg, dropping to the $0.979 range. The stablecoin is trading at $0.989 at time of writing.

Losing the peg for USDD does not bode well for both the stablecoin and TRX. The ecosystem will have to issue more TRX to market participants who are looking to get rid of their USDD holdings, adding more selling pressure for Tron.

Explains Sun,

“When USDD’s price is lower than one US dollar, users and arbitrageurs can send one USDD to the system and receive one US dollar worth of TRX.

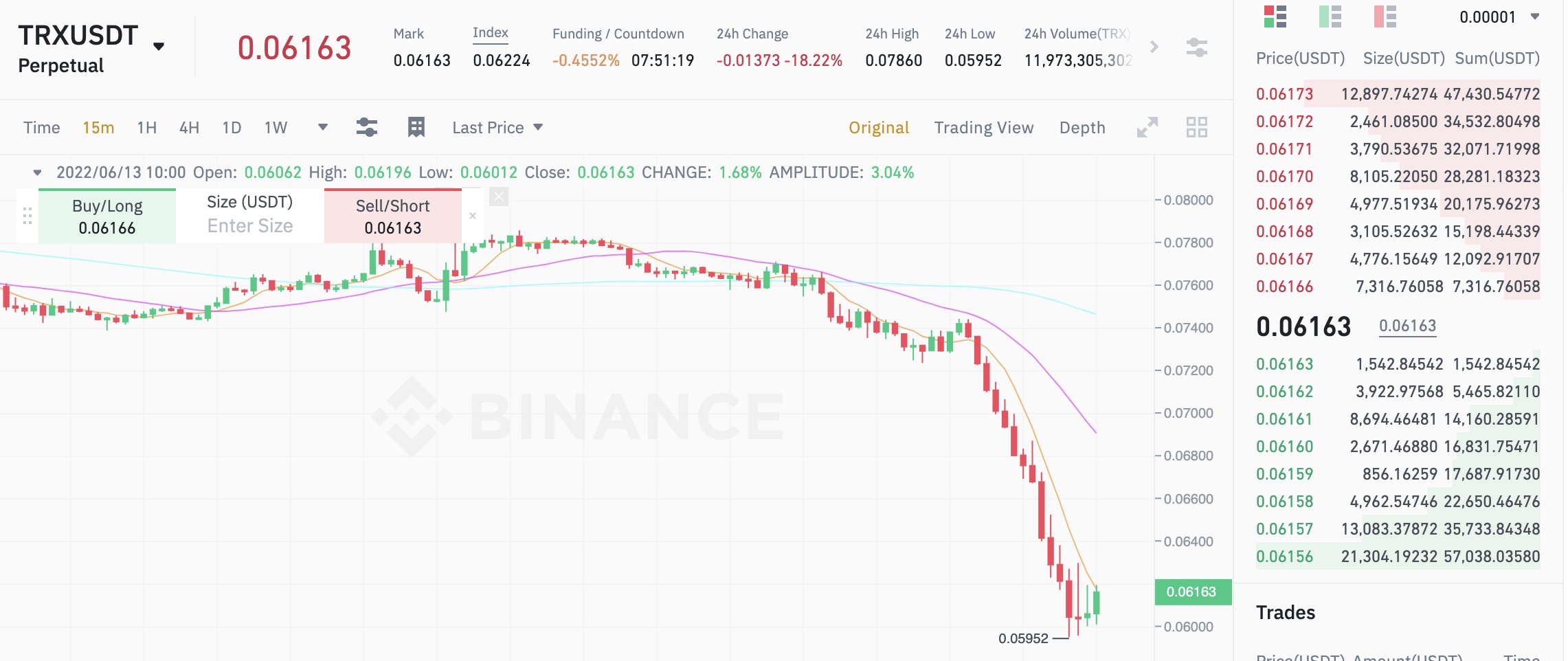

Tron is down more than 18% in the past 24 hours.

USDD has a collateralization ratio of 246.07% at time of writing with $1.77 billion in total collateral, according to its website.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Design Projects