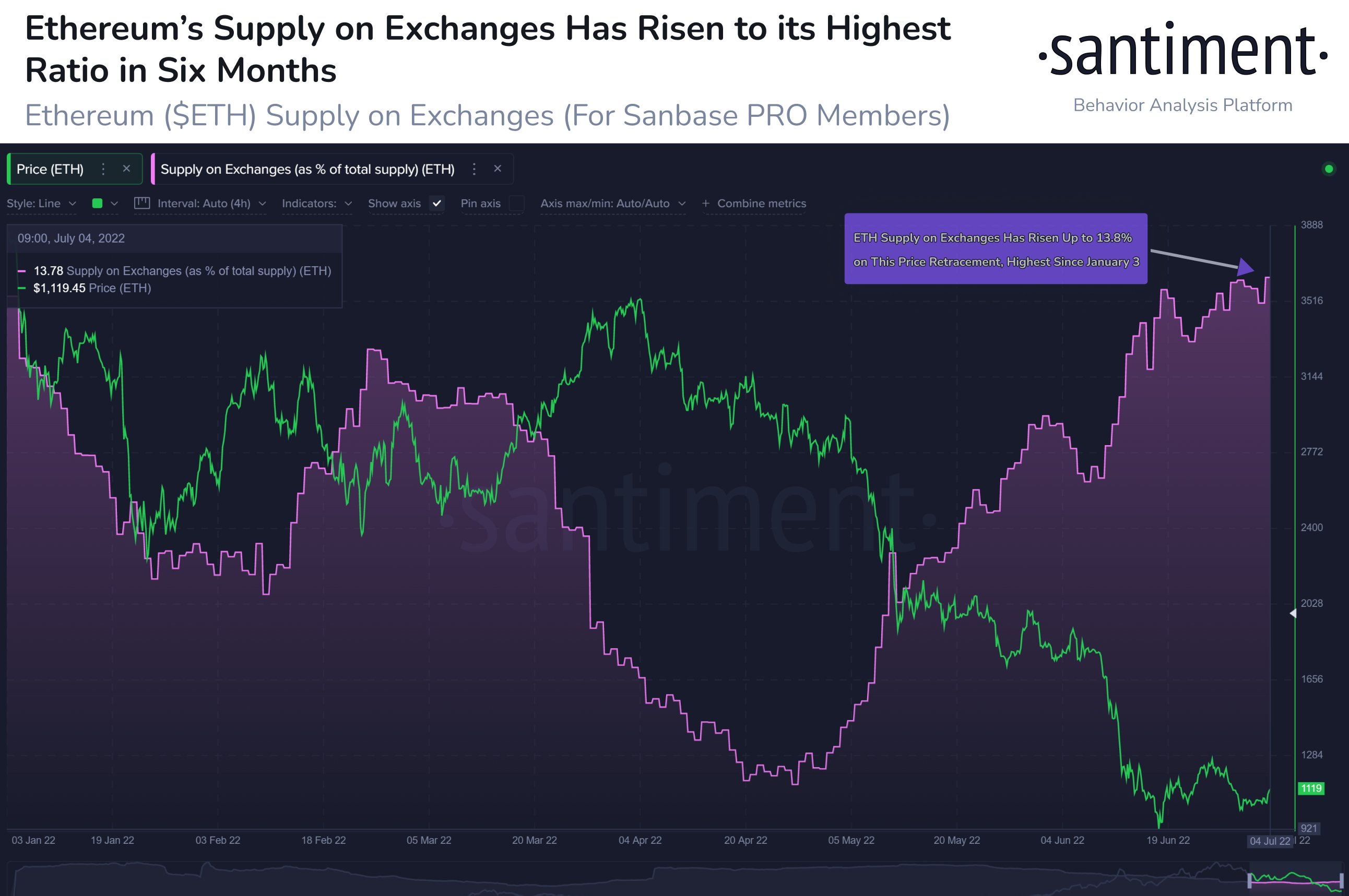

On-chain metrics indicate Ethereum (ETH) could be at risk of a sell-off, according to the crypto analytics firm Santiment.

Santiment notes ETH is moving “rapidly” onto exchanges and has risen to its highest ratio within six months.

A 2021 study published by Santiment indicates large upticks in exchange inflows tend to lead to an average price drop of 5% for crypto assets.

Ethereum is trading for $1,116 at time of writing. The second-ranked crypto asset by market cap is up more than 1% in the past 24 hours.

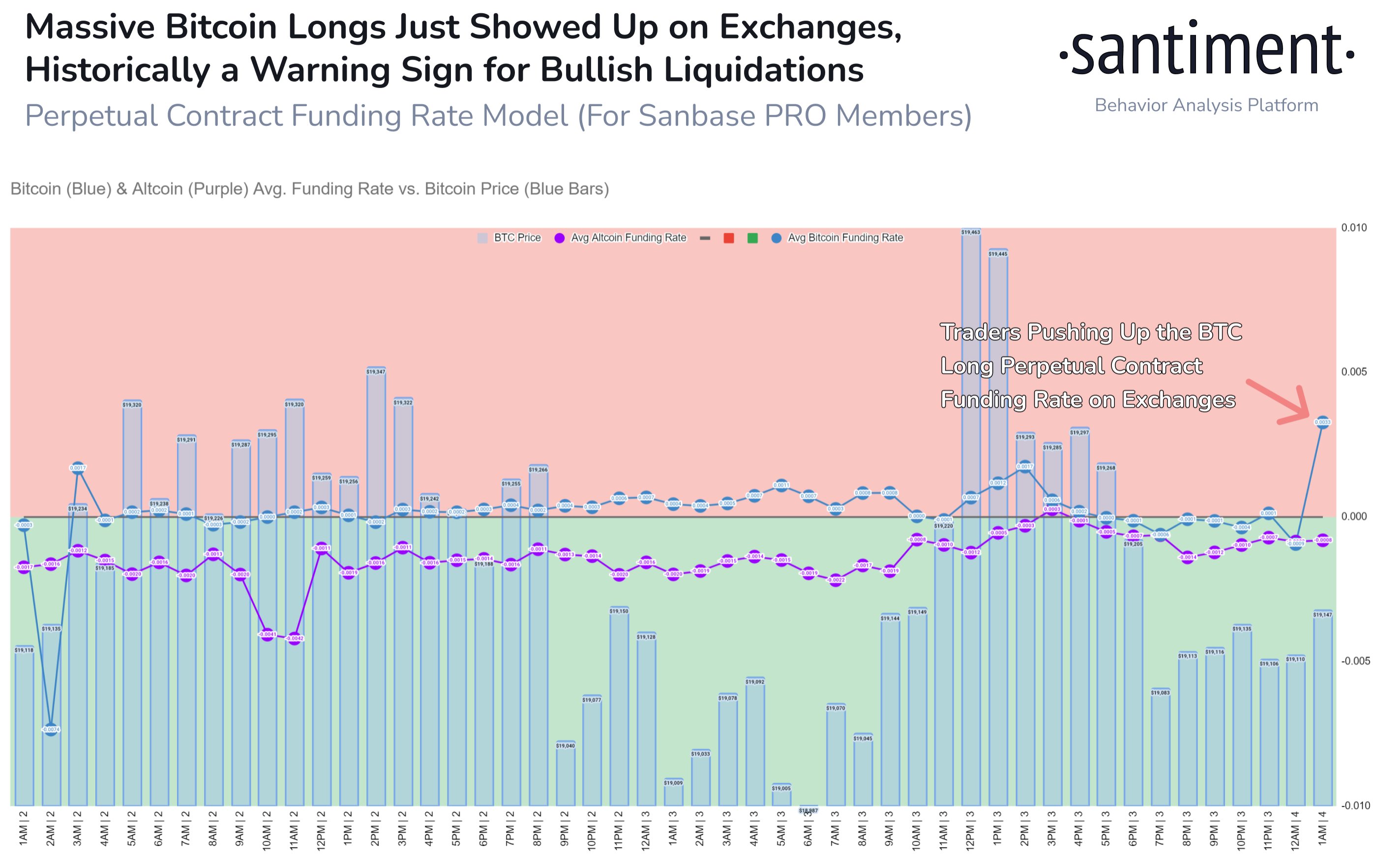

Santiment also says Bitcoin (BTC) witnessed a “massive uptick” in longs on exchanges on Monday.

Explains the firm,

“Trader optimism often correlates with holidays, which means there needs to be a greater degree of cautiousness of whales punishing the overly eager.”

Bitcoin is trading for $20,026 at time of writing. The top-ranked crypto asset by market cap is down more than 0.5% in the past 24 hours.

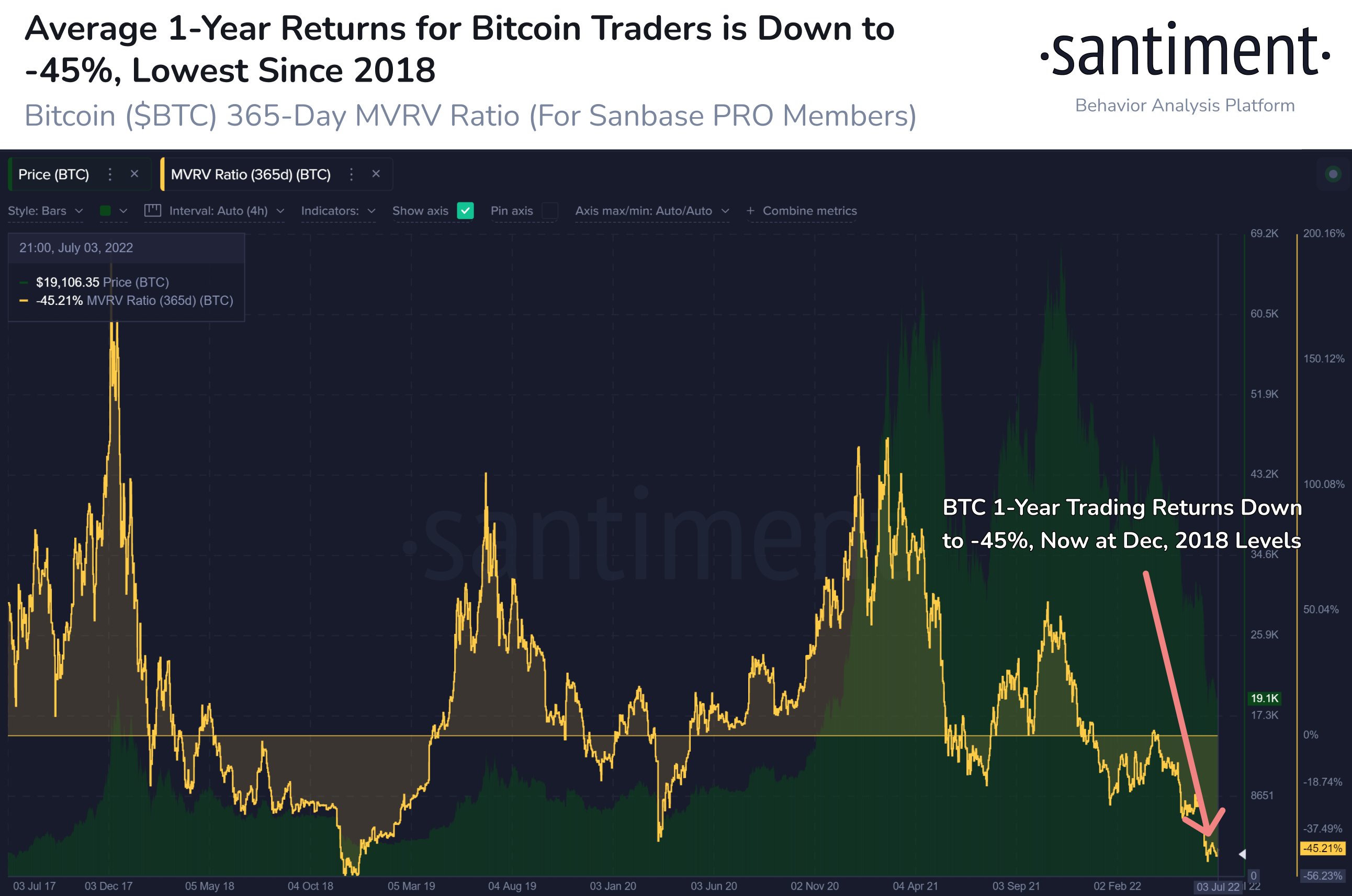

Santiment also notes the 365-day return for the average Bitcoin trader is -45%.

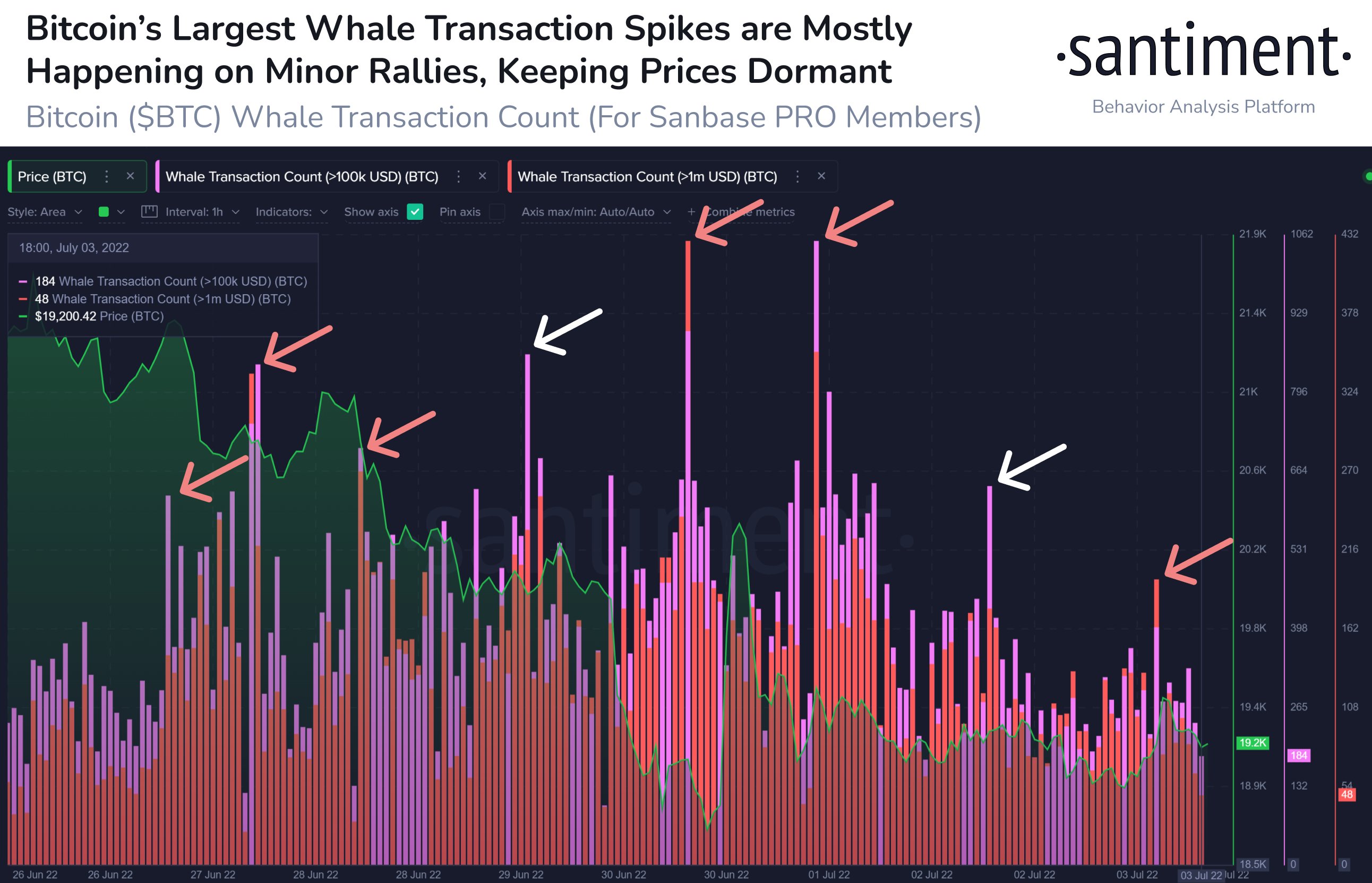

Additionally, the analytics firm says BTC whale transaction spikes are occurring mostly on minor price rallies, which it argues is keeping the top crypto asset’s prices dormant.

“The vast majority of the largest spikes in Bitcoin whale transactions over the past week are occurring after small $100 to $200 BTC price gains. Prices have subsequently fallen after each of these temporary increases in $100,000+ or $1 million+ transactions.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/NextMarsMedia/monkographic