Market intelligence firm Glassnode is assessing a trio of crypto assets as the markets seek to end the week on a positive note.

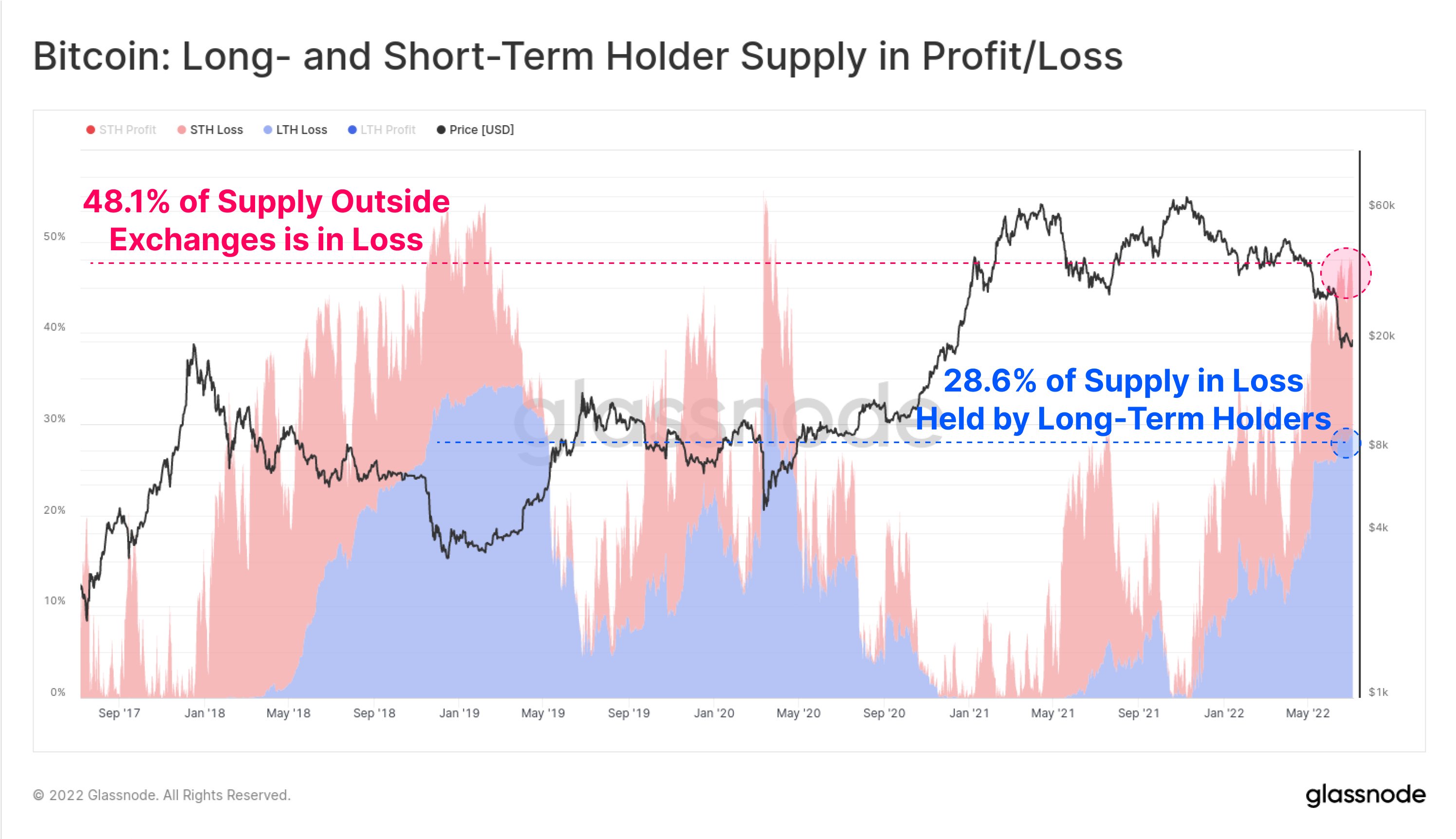

In its latest analysis, Glassnode says nearly half of the Bitcoin (BTC) located in non-exchange wallets are sitting on unrealized losses.

According to Glassnode, nearly 60% of those owners are considered long-term holders, mirroring the past two capitulation events.

“The proportion of Bitcoin supply in loss has hit 48.1% of all coins held outside exchanges.

Of these BTC in loss, almost 60% of them are held by long-term holders (28.6% of total).

Both metrics are at similar levels to the November-December 2018, and March 2020 capitulation phases.”

Bitcoin is rallying today, up 5.19% over the last 24 hours, trading for $21,705.

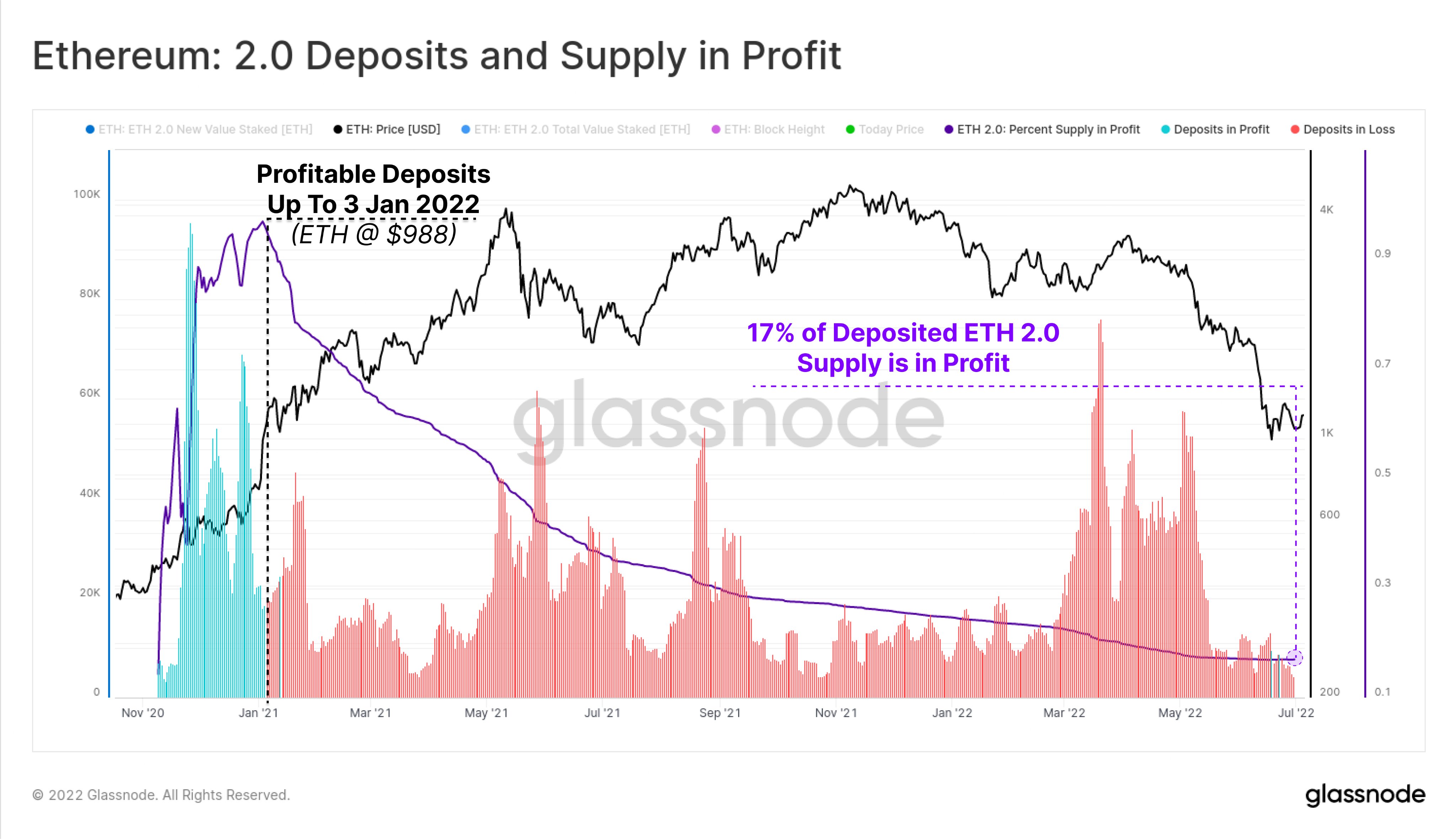

Moving onto Ethereum (ETH), the analytics firm observes the vast majority of stakers on ETH 2.0 are in the red because ETH has collapsed by over 75% since November of 2021 and staked tokens will remain locked until the upcoming Shanghai hard fork is complete.

“Ethereum 2.0 stakers have deposited over 12.98 million ETH, with 62% of it flowing in before the November [all-time high].

However, with ETH prices collapsing over 78%, and coins unable to be withdrawn, only 17% of staked ETH is now in profit.”

Ethereum is changing hands for $1,221 at time of writing.

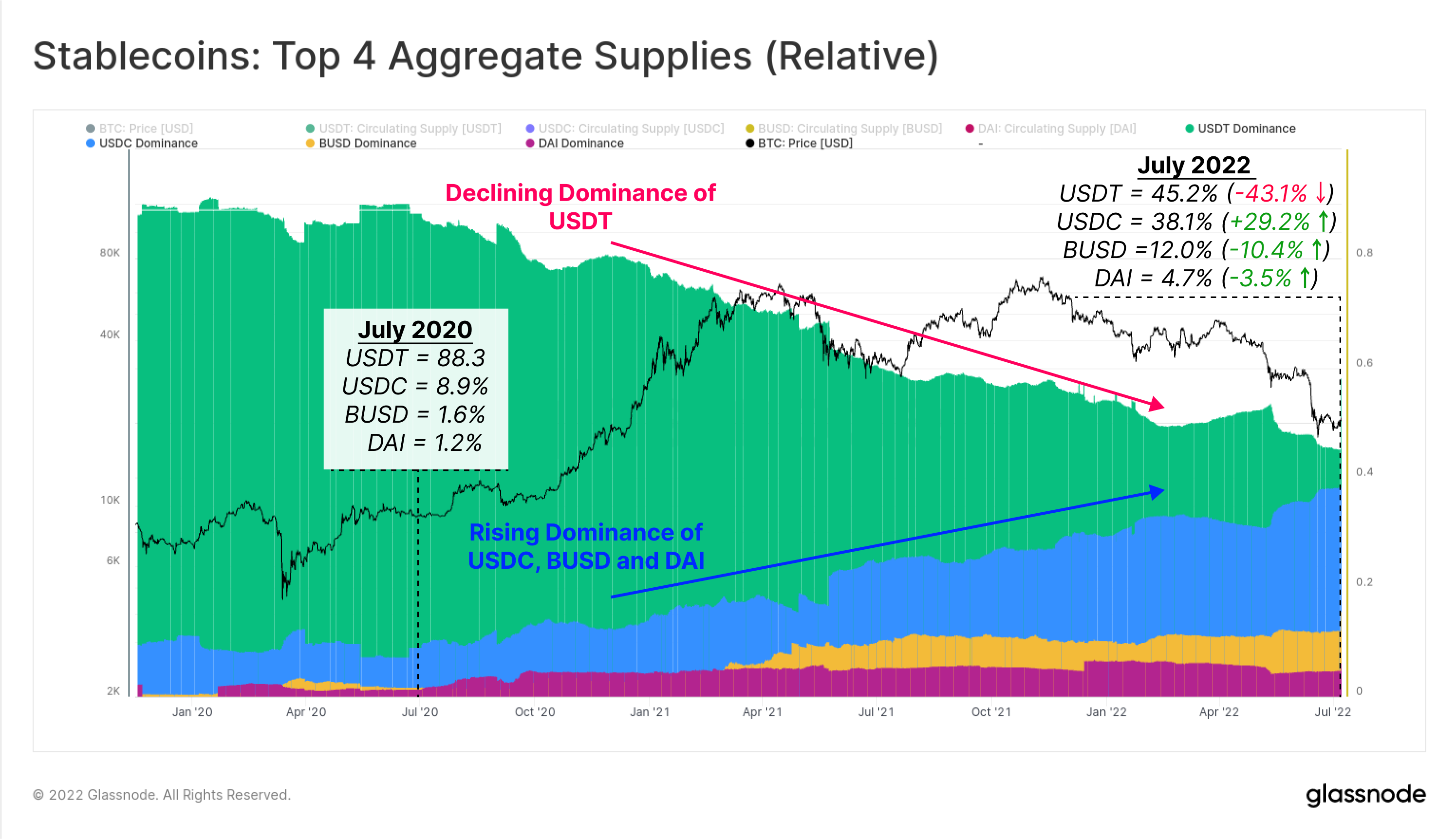

Glassnode then analyzes the changing stablecoin landscape. The US dollar-pegged Tether (USDT) dominated the niche up until two years ago but has since declined in popularity by nearly 50%.

The firm highlights three other stablecoins which have gained market share, including US Dollar Coin (USDC) at 38.1%, Binance USD (BUSD) at 12.0% and Dai (DAI) at 4.7%.

“Over the last two years, the dominance of Tether has been in macro decline.

USDT has fallen from 88.3% of the stablecoin market to 45.2% today, now less than half of the market.

USDC dominance has grown 4.2x, BUSD by 7.5x, and DAI by 3.9x over the same 2-year time frame.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Blue Planet Studio/Chuenmanuse