Bitcoin has officially surpassed a massive network milestone.

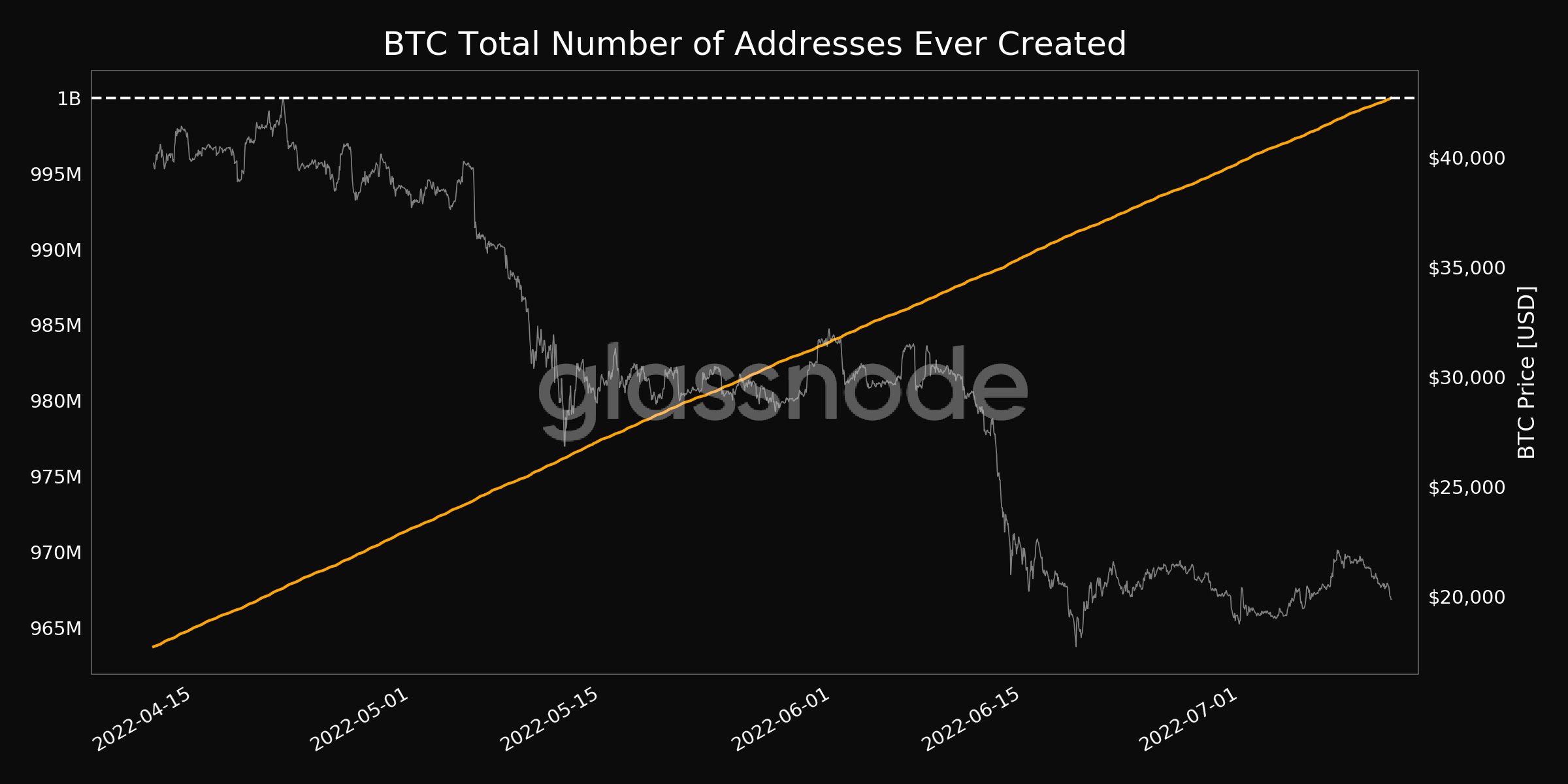

Users have now created more than 1 billion Bitcoin addresses, according to the crypto analytics firm Glassnode.

Each unique address is essentially a series of letters and numbers representing a virtual location that BTC can be sent to.

“Bitcoin (BTC) total number of addresses ever created just went above 1,000,000,000. Current value: 1,000,002,559.”

The milestone comes as long-term and highly convicted crypto holders with “diamond hands” face pressure to hold tight and avoid capitulation.

According to Glassnode, the proportion of BTC held by long-term holders (LTHs) compared to short-term holders (STHs) suggests that Bitcoin has not yet reached a bottom.

“In the depths of previous bear markets, the proportion of supply that was held by LTHs, and at a loss, reached above 34%. Meanwhile, the proportion held by STHs declined to just 3% to 4% of supply.

At the moment, STHs still hold 16.2% of the supply in loss, suggesting that freshly redistributed coins must now go through the process of maturation in the hands of higher conviction holders. This indicates that whilst many bottom formation signals are in place, the market still requires an element of duration and time pain to establish a resilient bottom. Bitcoin investors are not out of the woods yet.”

Glassnode also points to the risk that in the months ahead, an increasing number of Bitcoin miners that power the network will have to sell their BTC to stay afloat.

“The duration of miner capitulation in the 2018-2019 bear market was around 4-months, with the current cycle only having started in 1-month ago. Miners currently hold approximately 66.9k BTC in aggregate in their treasuries, and thus the next quarter is likely to remain at risk of further distribution unless coin prices recover meaningfully.”

The big picture, according to the firm, is that Bitcoin appears to be entering the final stages of a bear market, with both long-term and short-term holders facing mounting pressure to sell.

Glassnode analysts describe a wide swath of crypto investors as essentially living in a pressure cooker.

They say further moves to the downside may be required to test the true conviction of crypto holders and ultimately form a final market bottom.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/3000ad