A closely tracked crypto analyst says that smart contract platforms Ethereum (ETH) and Solana (SOL) are gearing up for rallies leading into September.

In a new video update, the host of InvestAnswers tells his 442,000 YouTube subscribers that investor trends in the options markets are hinting toward the likeliness of ETH rallying in the next couple of months rather than seeing further downside.

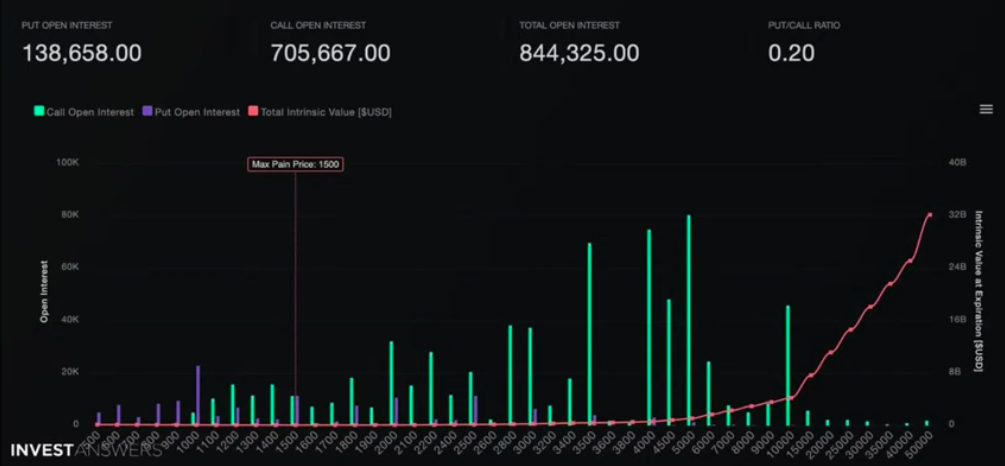

The host points out the lopsided ratio of call options versus put options in Ethereum, suggesting overwhelming bullish conviction on Ethereum’s upcoming merge.

A call option is a type of option that increases in value when the underlying asset rises.

“It’s important to to think about where the bets are being placed based on us now having this date of The Merge of September 19th…

Peculiarly enough, the max pain price is at $1,500, but look at that put to call ratio: 0.2. That is insane. It’s basically five times the number [of] people buying call options over put options, and that is quite impressive.

Also, there are lots of bets at $3,500, $4,000 Ethereum and $5,000 Ethereum by September. Of course, this doesn’t mean anything, we don’t know exactly what’s going to happen, but it is interesting to see that complete lack of bearishness for Ethereum.

So that tells me that maybe it will be ‘number go up’ time for Ethereum, and it has been smashed hard compared to many other things.”

The Merge is the highly anticipated upgrade that will allow Ethereum to shift from a proof-of-work to a proof-of-stake consensus mechanism, setting the stage for the blockchain to solve its scalability issues.

The analyst then looks at Solana’s option markets and says he also sees general bullishness from investors.

He points out that Solana’s max pain price, according to the derivative traders, is at $42, which is currently above SOL’s price of $39. He also notes Solana bears are betting relatively conservatively, with most put options placed at the $34 level, only about 15% below current prices.

A put option is the type of option that increases in value when the underlying asset falls.

“Thinking about September, and September could be a very good month for crypto. It could also be the time that the Fed pivots. I know a lot of people are talking about a 100 basis point hike in a week or two, but I don’t see that happening. Seventy five [basis points] yes, but 100 basis points, it just puts the country under too much pressure…

But here, we see the max pain price for Solana is $42, and the price of Solana just hit $40…

People are buying puts at $34, so overall, September looks good.”

I

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/vectorpouch/Vladimir Sazonov