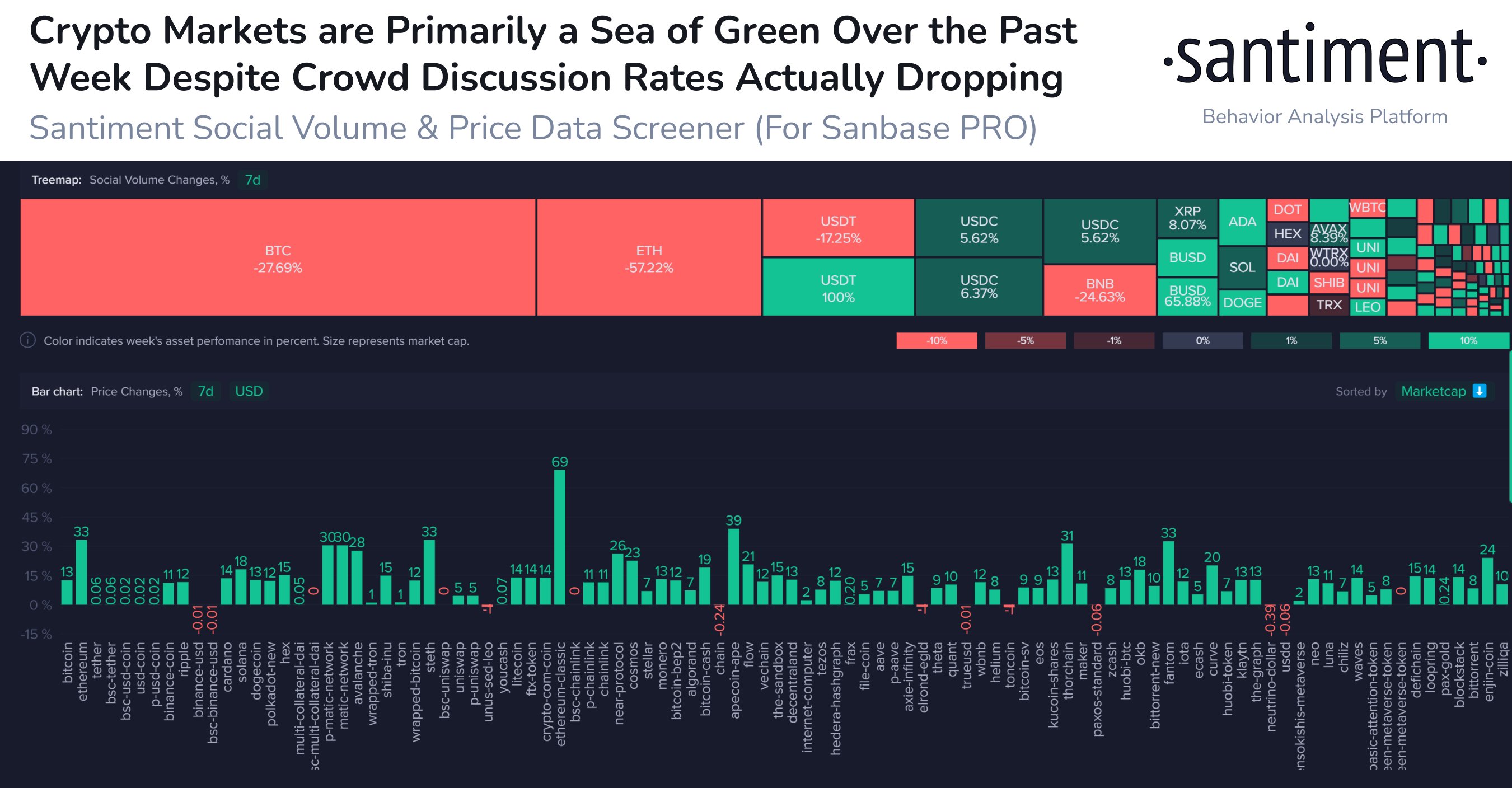

Analytics firm Santiment says the crypto market is primarily a “sea of green” as major digital assets begin to rally.

Santiment says that despite Bitcoin (BTC), Ethereum (ETH) and altcoins such as ApeCoin (APE), Fantom (FTM), Ethereum Classic (ETC) and THORChain (RUNE) recording double-digit growth percentage-wise, social media mentions are declining.

According to Santiment, the falling discussion rates of crypto assets on social media forums indicate the fear of missing out (FOMO) on gains has not gripped retail investors, suggesting that the markets is likely not yet overheated.

“Bitcoin is +12% and has jumped back over $23,000 this week. The bigger story has been Ethereum (+33%) and altcoins like ETC (+69%), APE (+39%), FTM (+33%), and RUNE (+31%). As long as social volume stays down, the crowd isn’t having FOMO fever just yet.”

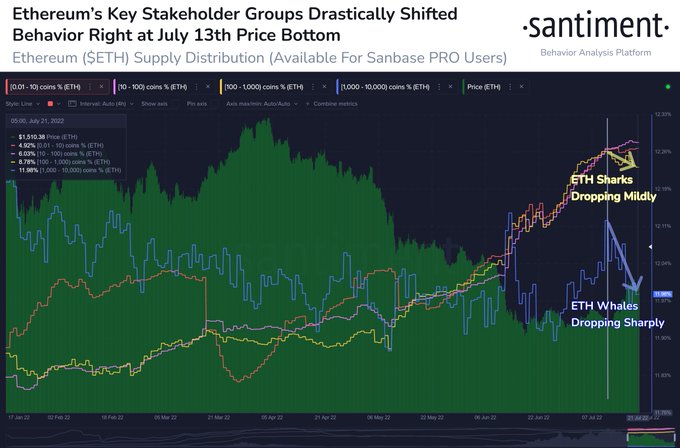

Looking at Ethereum, the analytics firm says the key stakeholder groups of the second-largest crypto asset by market cap changed behavior after July 13th when ETH fell to a low of around $1,000.

According to Santiment, holders of between 1,000 to 10,000 ETH are reducing their balances. The analytics firm says those holding 10 to 100 ETH is expanding while those owning between 100 to 1,000 ETH are adding their balances after initially selling off their holdings.

“Especially the group from 1,000 to 10,000 ETH, their holdings are decreasing. Of course, we can not say it’s a real dumping because of a number of liquidity pools and perhaps exchanges in this group. But for sure their balance is decreasing.

10-100 ETH group is slowly but growing.

Small holders 0-10 ETH don’t know what to do, doing nothing, probably scared by the latest bottom and still in concerns.

100-1000 ETH holders initially took some profits but then went up again.

And all of them were triggered by July 13th bottom.”

ETH is trading for $1,559 at time of writing while BTC is exchanging hands for $22,813.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Troyan