An Ethereum-based altcoin that rallied over 11x from this year’s bottom is now likely to witness a corrective move, according to a leading analytics firm.

BarnBridge (BOND), a blockchain protocol that aims to tokenize risk, exploded from its 2022 low of $2.18 last month to a high of $24.99 on July 24th, marking an increase of 1,046%.

Santiment says several on-chain metrics are flashing signs of significant growth amid BOND’s exponential price increase.

“Onchain activity is increasing along with price. It’s generally good. More action is able to support price trend up. [Also] It’s amount of new addresses interacting with BOND daily. Same here, new blood keep flowing into BOND. No divergence with price. Only support.”

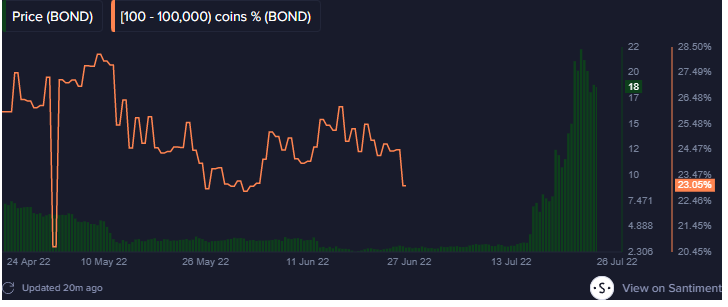

In addition, Santiment notes that holders of 100 to 100,000 BOND have sold their coins throughout the rally.

“Owners from 100 to 100,000 BOND decreased their holdings on this pump. They all gave up. And price can keep pumping on this denial. To punish many holders that dumped.”

Although a number of on-chain metrics support BOND’s explosion from the bottom, Santiment highlights that the coin is now flashing strong bearish signals.

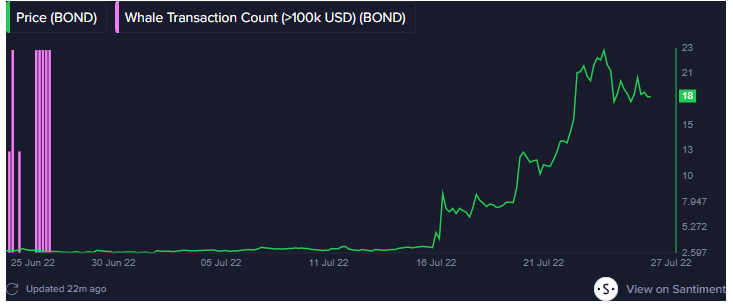

According to the insights platform, the number of whale transactions have already topped out, indicating that BOND is at a high risk of price correction.

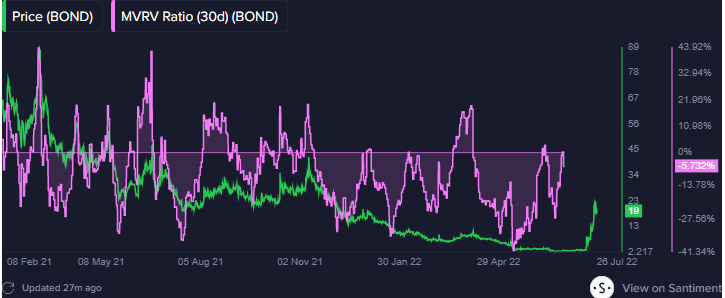

Santiment also says that the 30-day market value to realized value metric, which shows the ratio between the current price and the average price of every coin/token acquired, is currently elevated, suggesting that BOND is overvalued.

“It’s too high. Basically, it’s never ever been that high for BOND since it matured. Very high risk correction and cooling down.”

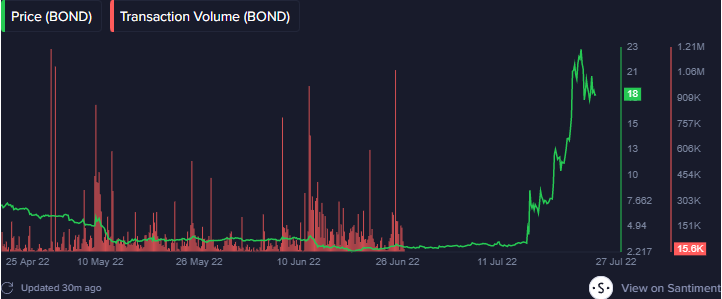

Another metric showing bearishness for BOND is transaction volume. According to Santiment, BOND’s transaction volume has topped out and fading.

“This metric in an onchain alternative of trading volume. It shows how many BOND has been moved onchain. And it has topped already and fading. High risk.”

Lastly, Santiment notes that BarnBridge whales, or entities that hold between one million to 10,000 BOND, have begun distributing their coins after heavily accumulating in June, around the time the coin bottomed out.

At time of writing, BOND is trading for $19.47, down nearly 3% on the day.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/laskoart/WindAwake