Crypto analytics firm Santiment is revealing one factor that is likely to foreshadow the start of a bullish phase for Ethereum (ETH).

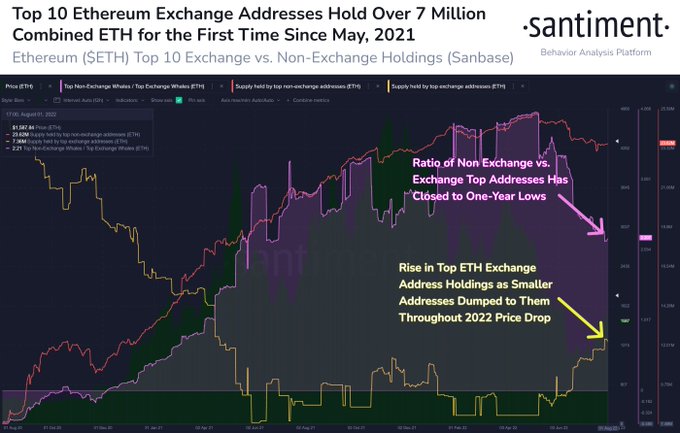

Santiment says that the volume of Ethereum on exchanges has risen and a decline of the same would signal the start of a bullish cycle.

“Ethereum has seen its supply held by top exchange addresses rise, which makes sense with traders dumping their holdings onto large exchanges during the 2022 slide. Watch for a decline in top ETH exchange address holdings as a bullish signal.”

According to Santiment, the amount of Ethereum held on the leading ten crypto exchanges is now over seven million, a figure last reached in May of 2021.

Santiment says that the ratio of Ethereum held outside of crypto exchanges relative to the Ethereum held by exchanges has reached a one-year low.

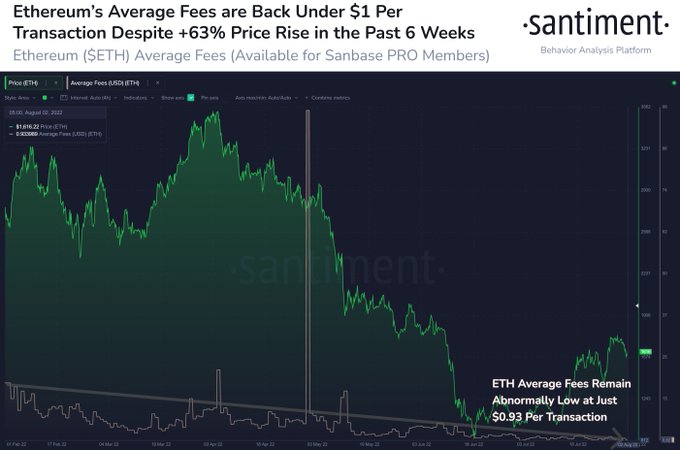

The crypto analytics further says that the reason that the transaction fees of the second-largest digital asset by market cap have remained low is due to the limited number of Ethereum in circulation.

“Ethereum’s transaction fees have remained ultra-low despite the price jump since mid-June. Scarcer circulation has played a big role in the lower costs, and fees can be expected to remain reasonable until a fair degree of fear of missing out kicks in from the crowd.”

According to Santiment, Ethereum transactions are costing less than $1 on average.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Refluo