Legendary commodities trader Peter Brandt says Bitcoin (BTC) is forming a classic bearish pattern, hinting at lower prices for the leading crypto asset by market cap.

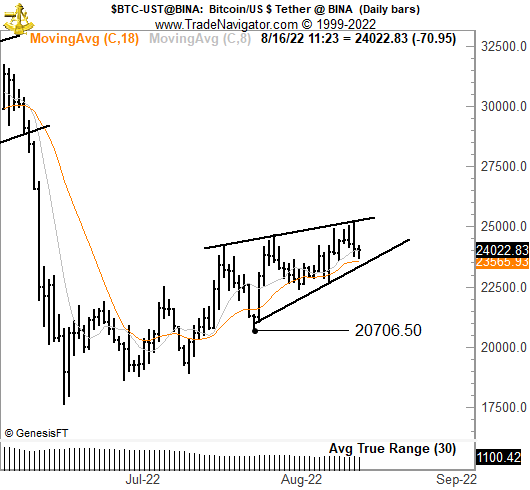

In a tweet to his 672,000 Twitter followers, Brandt says that Bitcoin is forming a rising wedge, a price action pattern that traditionally suggests an eventual dip to the downside after completion.

However, the trader says there’s two caveats that come with BTC’s bearish price action.

“Pattern formation in progress — Rising wedge in BTC.

Caveats:

-Most forming patterns morph into something else.

-Even if it is a rising wedge, it must first be completed.”

Brandt also says that judging by how many people agree with his take, the pattern might be too obvious, and destined to fail.

“Too many people are agreeing with me. That makes me think that morphology may be most likely, but we will see.”

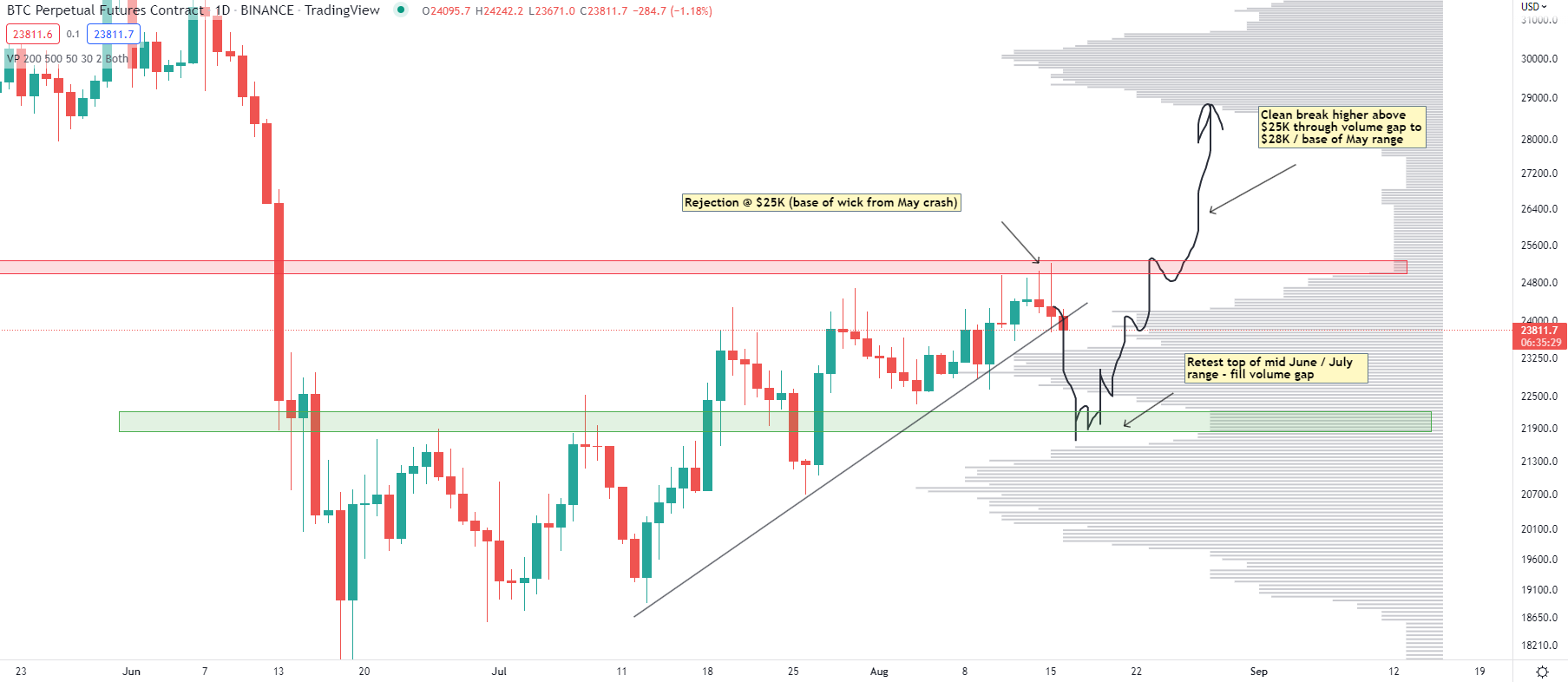

Fellow crypto analyst Kaleo also suggested a pullback could be in store for Bitcoin, with a price target around $21,000 before it moves another leg upward to around $28,000.

“Bitcoin / BTC

Just rip the bandaid off already plz.

I’m ready to see my timeline go into mass hysteria again and start calling for sub $10K because they have so much PTSD from the previous dips – only to flip bullish again a few days later when we reclaim current levels.”

The pseudonymous analyst says that the stock market seeing more red days recently could be the catalyst that pulls BTC down for a local low.

“Stonks have continued lower since the close yesterday in the premarket, and Bitcoin looks weaker – but still hasn’t had a sharp move quite yet.

Shouldn’t be much longer before the weakness gives and we get our lower bids filled.”

At time of writing, BTC is trading for $23,874.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/GoodStudio