Veteran trader Peter Brandt is offering up his latest take on Bitcoin (BTC) and Dogecoin (DOGE) competitor Shiba Inu (SHIB).

Brandt tells his 674,000 Twitter followers that SHIB has just completed an inverse head and shoulders (IH&S) pattern, a traditionally bullish formation that suggests the end of a downtrend.

Brandt suggests that SHIB is either on the edge of a bullish rally after retesting the previous resistance as support, or a breakdown that takes the memecoin to lower prices.

“Will SHIB hold above neckline support, or will we need to drop the letter ‘B’ and adopt a different letter that comes later in the alphabet?”

At time of writing, SHIB is trading at $0.000013, up 5% in the last seven days and still above the pattern’s neckline.

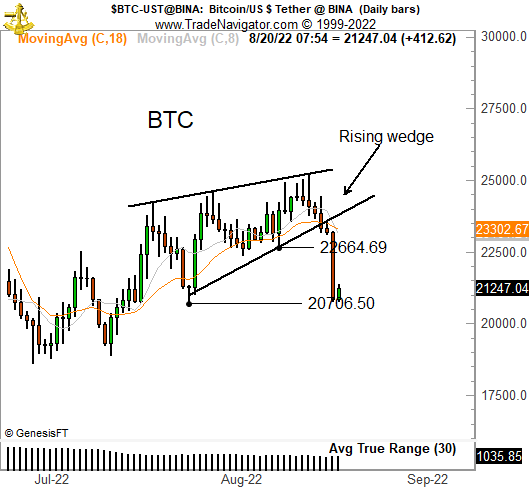

Looking at Bitcoin, the seasoned trader says that the largest crypto asset by market cap completed a bearish rising wedge pattern and is now vulnerable to seeing lower prices.

“For all practical purposes the target of the rising wedge in Bitcoin BTC has already been met. That is not a reason per se to be bullish and it does not mean BTC cannot go lower yet.”

Last week, Brandt warned crypto traders of a possible crash after spotting that Bitcoin was printing the bearish pattern.

At time of writing, Bitcoin is changing hands for $21,544, down about 10% on the week.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Sergey Nivens/karnoff