Crypto analytics firm Glassnode says that Bitcoin (BTC) is still in the bear market despite a recent relief rally.

The market intelligence firm says that on-chain metrics suggest that recovery is still a ways off for Bitcoin since its short-term price increase was followed by a sell off.

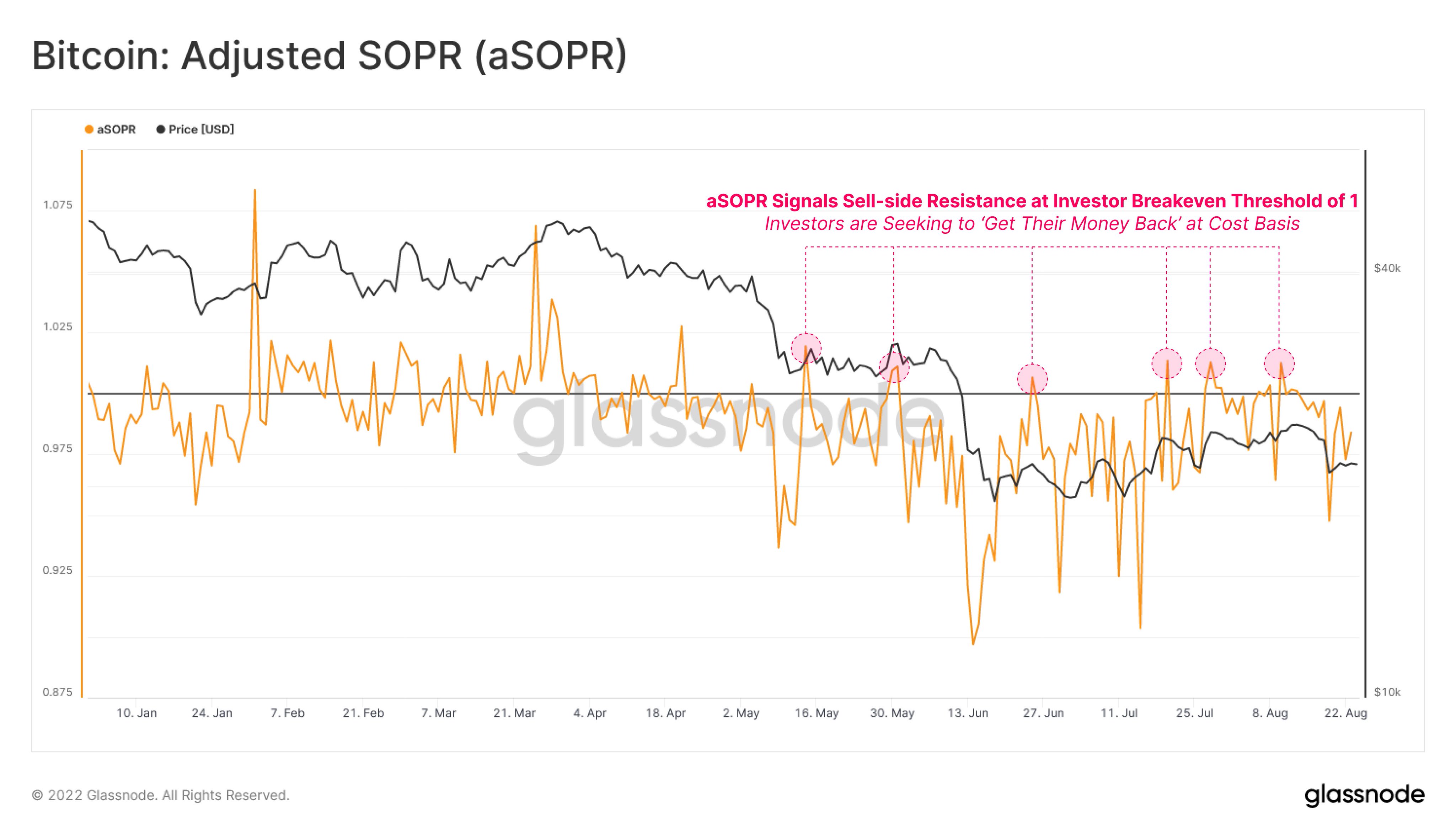

The adjusted SOPR (aSOPR), which reflects the ratio between the selling and purchase prices of the flagship crypto asset, suggests that investors are looking to recoup their investments.

“Bitcoin aSOPR continues to face heavy resistance at the break-even threshold of 1.0.

This suggests BTC investors are taking profits during bear market rallies, and are spending coins at their cost-basis to simply ‘get their money back’.”

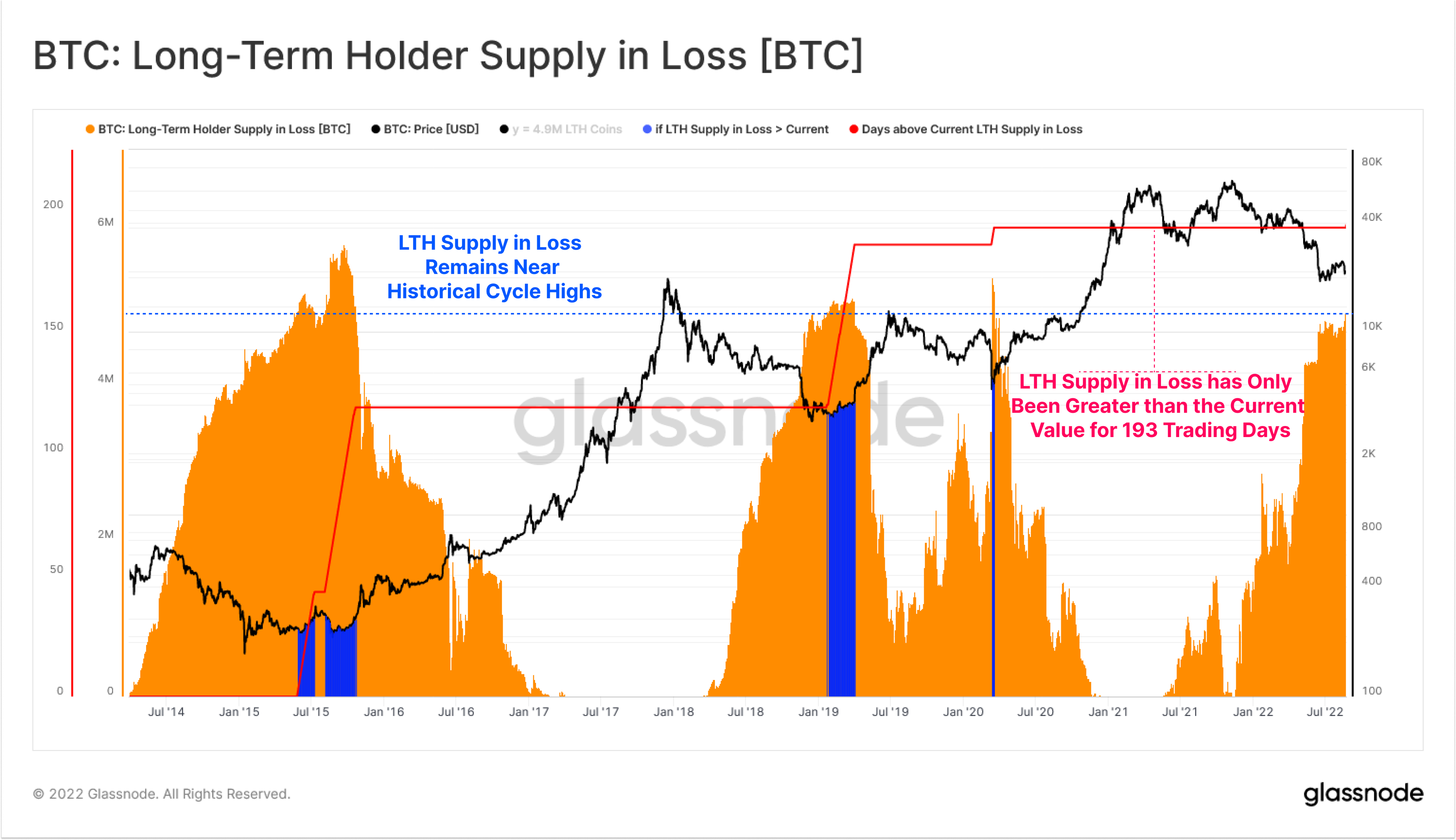

The supply of long-term Bitcoin investors, or those who have been holding their assets for over 155 days, also tends to decrease during the bull market, but Glassnode says this is not currently the case as indicated by the Long-Term Holder Supply in Loss metric.

“Bitcoin Long-Term Holder Supply in Loss remains near historical cycle highs, with only 193 out of 4421 trading days (4.4%) closing with greater BTC denominated losses.

This suggests LTH profitability is under extreme bear market stress.”

In a recent newsletter, Glassnode says that Bitcoin’s recent uptrend is not attracting investors. The crypto asset neither sees drivers that can sustain its rally.

“The current market structure is certainly comparable with the late-2018 bear market, however does not yet have the macro trend reversal in profitability and demand inflow required for a sustainable uptrend.

Therefore, the ongoing cycle bottom consolidation phase is most likely, as Bitcoin investors attempt to lay a firmer foundation, subject of course to the persistent uncertainty and unfavorable events of the macroeconomic backdrop.”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Vadim Sadovski/Fotomay