Top smart contract platform Ethereum (ETH) is flashing a potentially bullish signal amid the current bear market, according to crypto analytics firm Santiment.

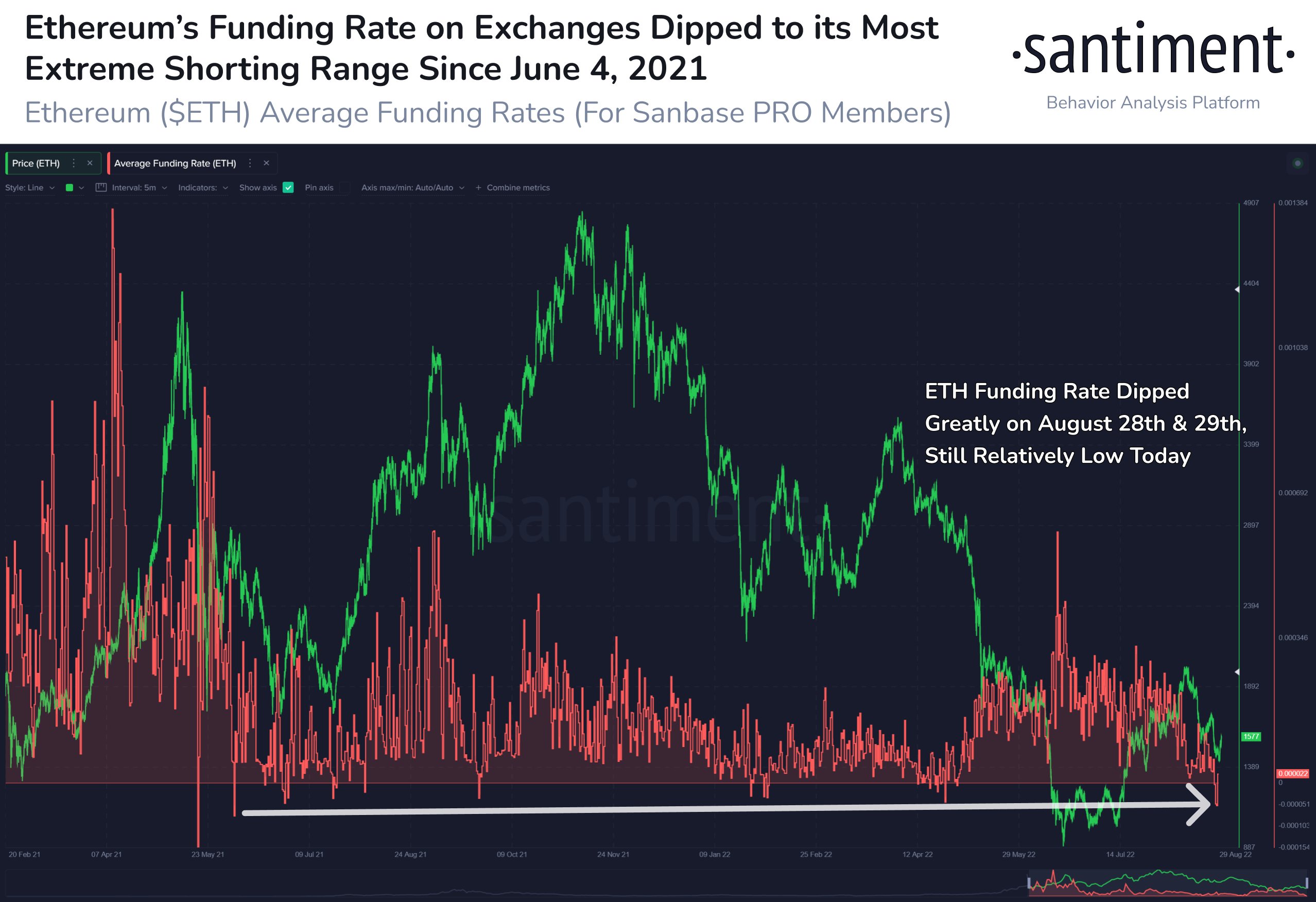

The market intelligence platform notes that traders are shorting Ethereum at the highest rate seen since June of last year.

The firm says price upswings have historically been prevalent during these kinds of market conditions.

“The Ethereum disbelief is strong from traders during a particularly volatile week of trading. The crowd has shorted, across exchanges, at the largest ratio since June of 2021. Historically, price rises are more prevalent in these conditions.”

Traders are also aggressively betting against Bitcoin (BTC), according to Santiment.

“Traders continue to short whenever prices see a notable price dump. According to the BTC average funding rate across Binance, BitMEX, DYDX, and FTX, the reaction to Friday’s drop was the most aggressive traders went against markets since May.”

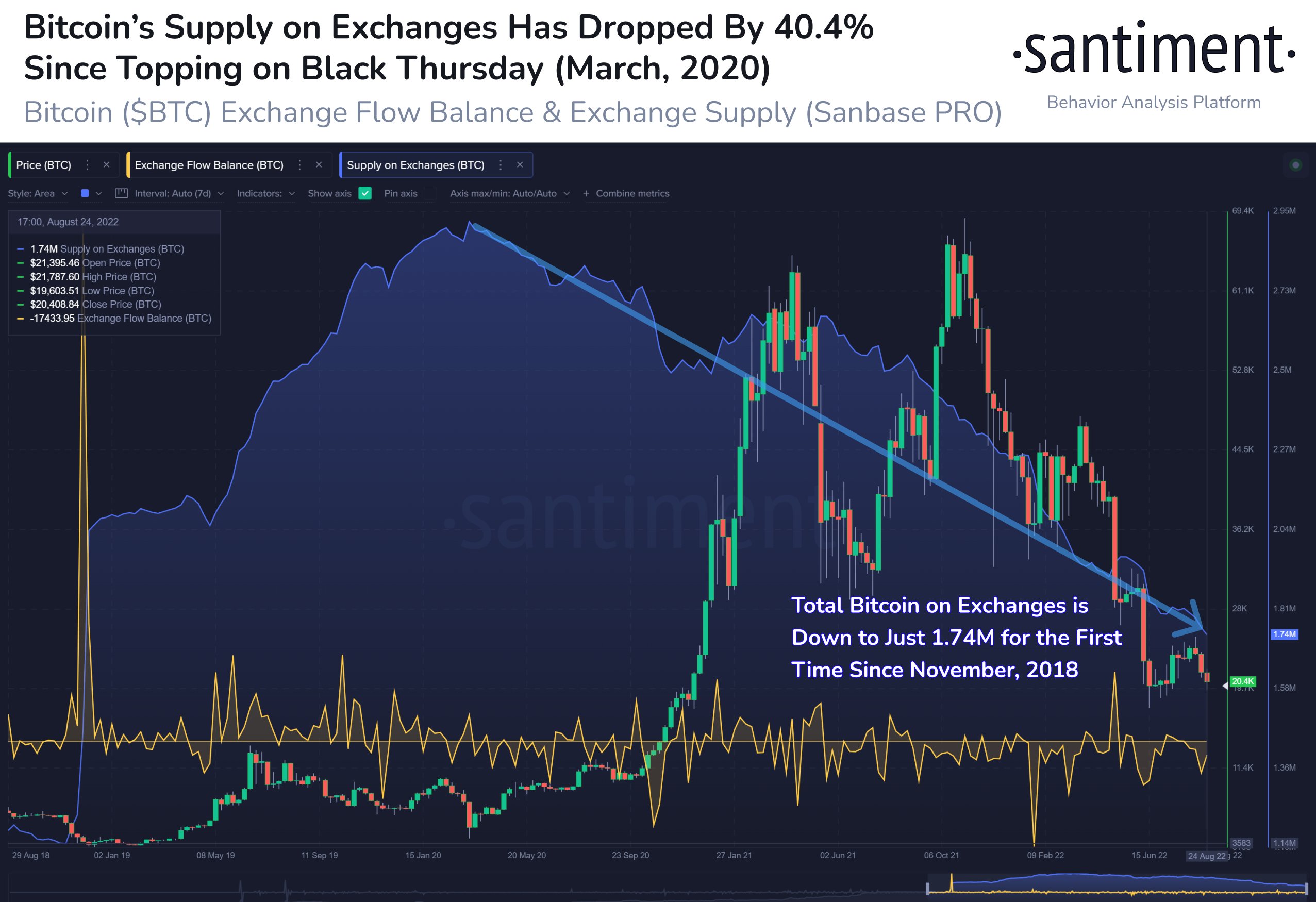

The crypto analytics firm notes that Bitcoin continues to move off exchanges despite its price volatility throughout the past couple of years. The king crypto’s exchange supply recently hit its lowest level since late 2018.

“During downtrends such as crypto’s 2022, it is familiar to see long-term hodlers making up a greater percentage of overall supply held.”

Ethereum is trading at $1,570 at time of writing. The second-ranked crypto asset by market cap is up more than 1% in the past 24 hours while Bitcoin is changing hands for $20,206, up nearly 1% in the past day.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Raggedstone