Widely followed on-chain analyst Willy Woo says that Bitcoin (BTC) hasn’t bottomed out yet based on under-the-radar metrics.

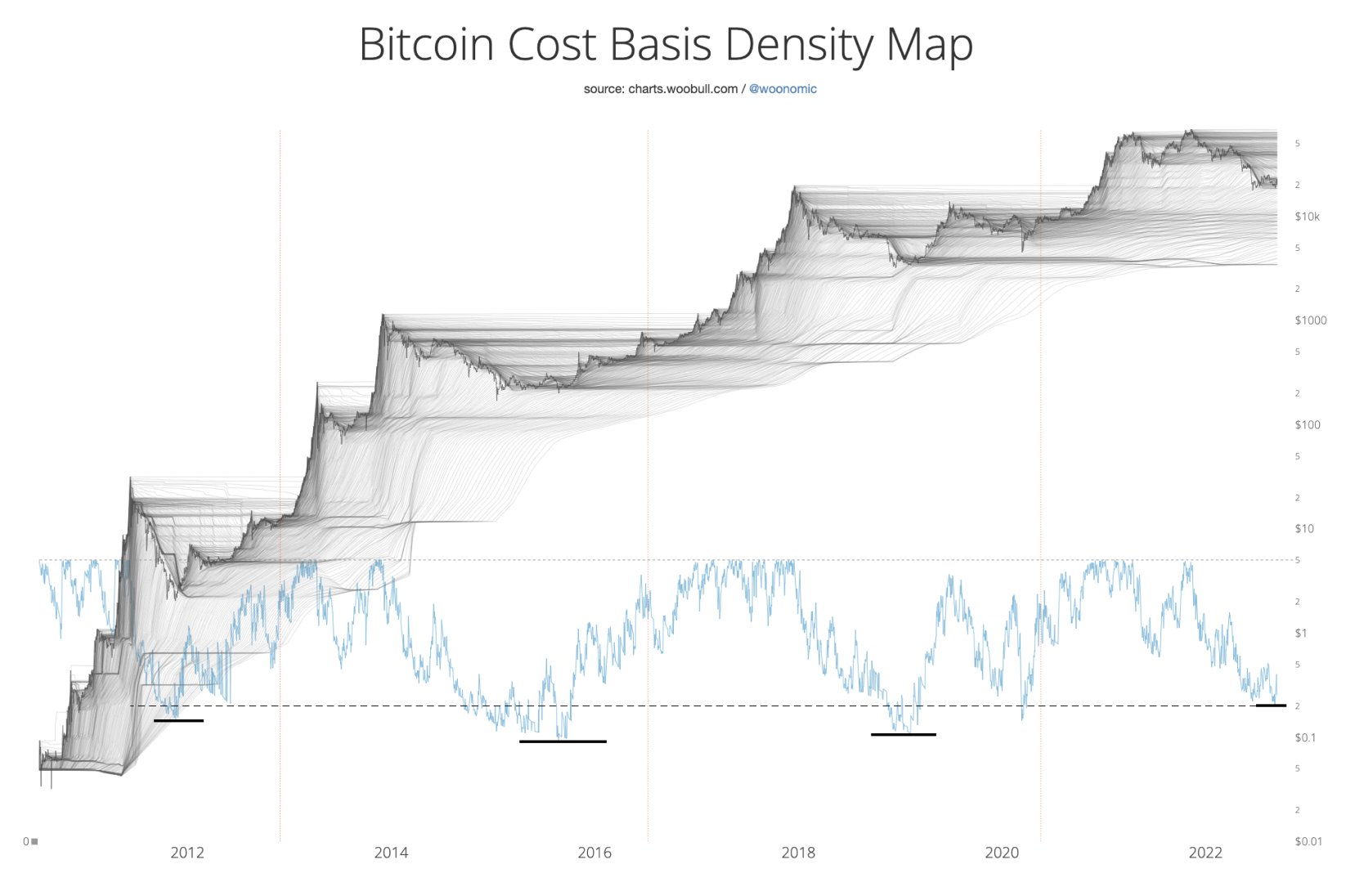

The analyst tells his 1 million Twitter followers that Bitcoin has not seen the same pain as previous bear markets when looking at the BTC market’s cost basis metric, which can show how many coins are underwater from time of purchase.

“Have we bottomed?

In terms of max pain, the market has not felt the same pain as prior bottoms. We can see this in the blue line (supply in profit by glassnode).

We have only reached 52% of coins being underwater so far.

Prior bottoms were 61%, 64%, 57%.”

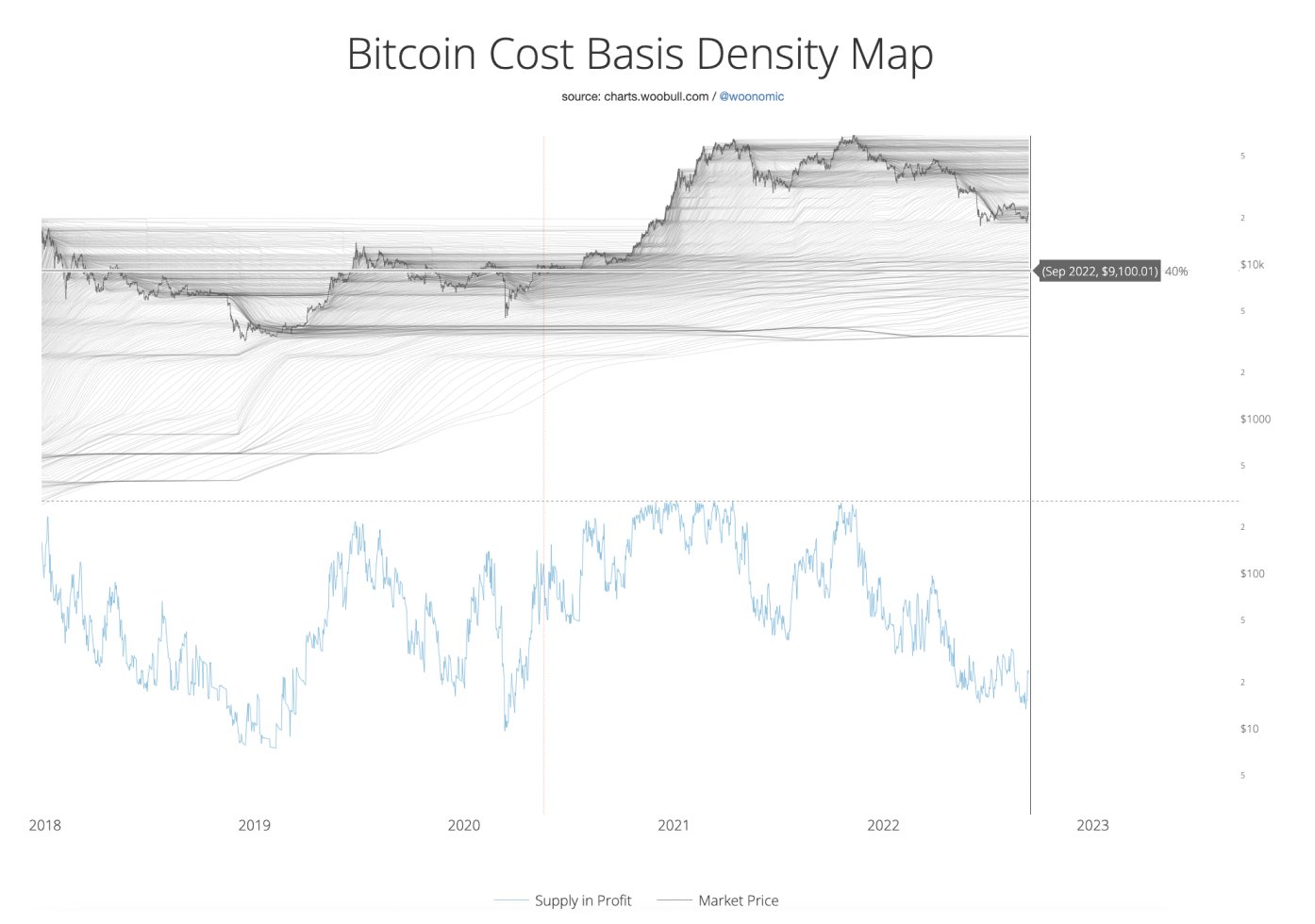

While the current bear market doesn’t necessarily need to bleed out as much as in the past, Woo says if it does, a max pain target near $9,000 might still be in play.

“History doesn’t need to repeat, especially in the modern era with futures hedging available that is not picked up on-chain.

But if we do get a repeat with max pain reaching 60% of the supply underwater, that price is currently at $9100, and slowly drifting upwards with time.”

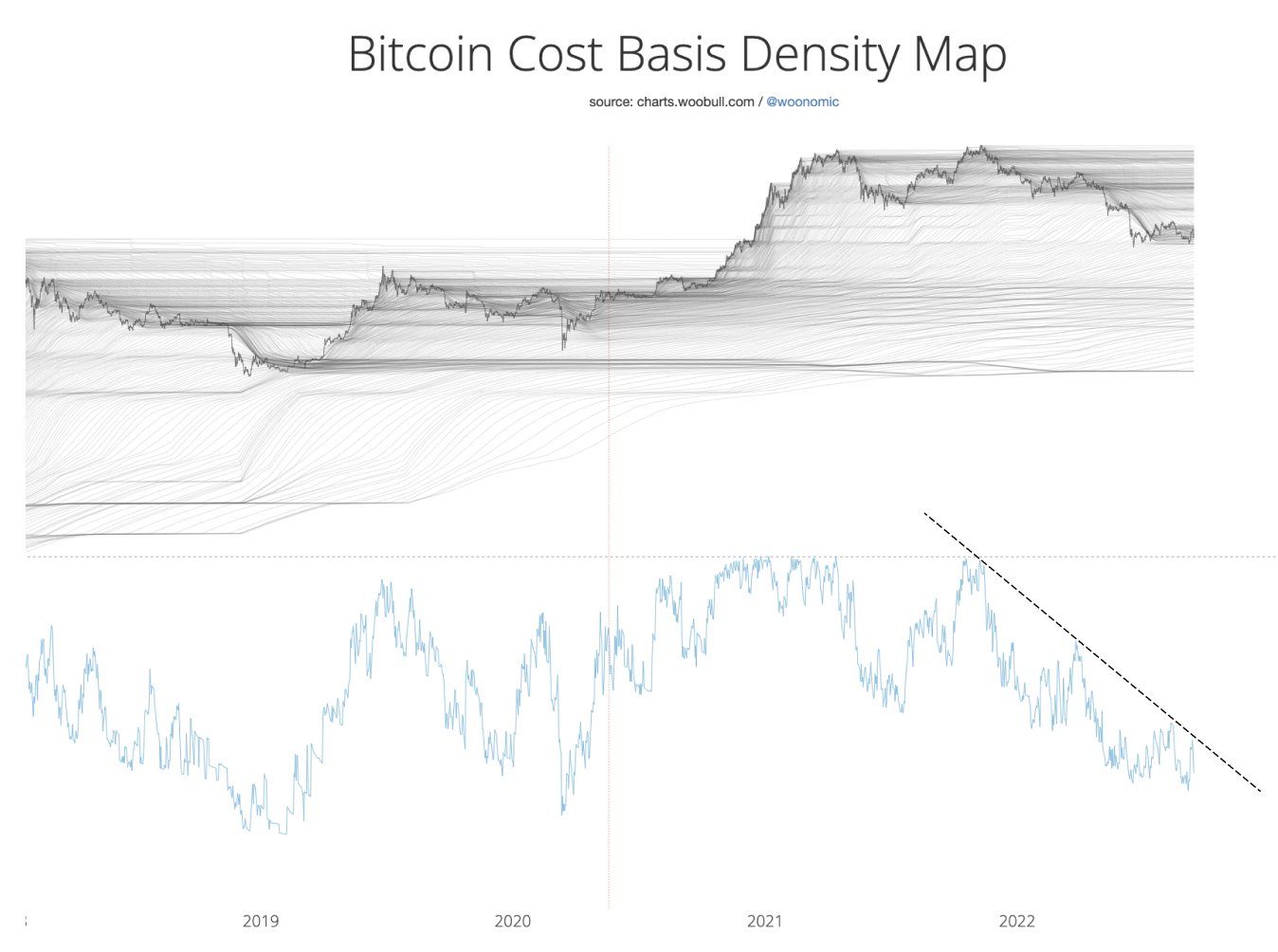

The popular analyst says that before he starts thinking about flipping bullish on Bitcoin, he wants to wait for a break in the trend of the BTC supply in profit.

“Which brings me to one of the signals I’m watching before rotating capital back in…

Supply in profit trend-line break. It broke cleanly in all of the prior bear market bottoms.”

At time of writing, Bitcoin is trading at $21,145, flat on the day and down about 10% this week so far.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Aleksandra Sova/Konstantin Faraktinov