Ethereum (ETH) is flashing a bullish on-chain metric as it counts down the last few hours until it merges to a proof-of-stake consensus mechanism, according to crypto analytics firm Santiment.

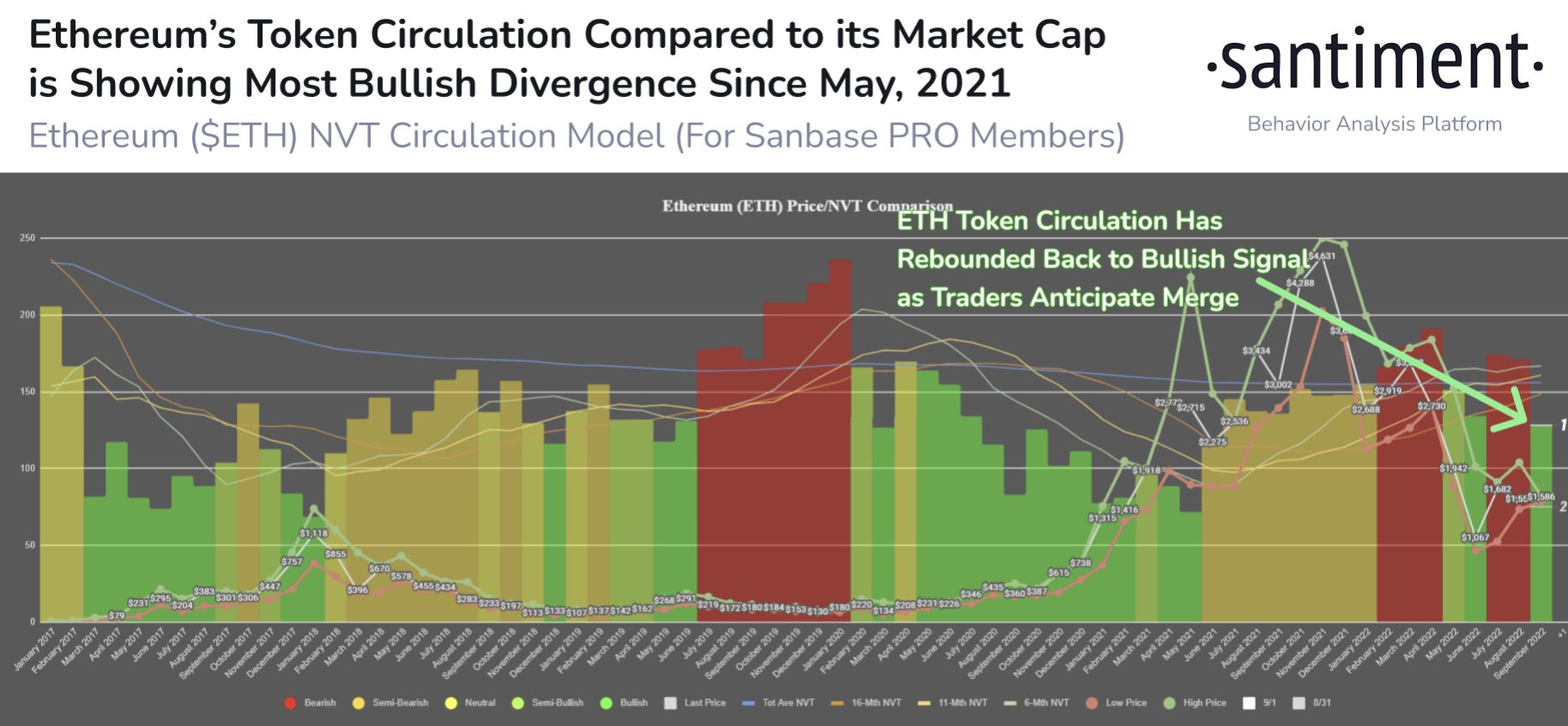

Santiment notes that Ethereum’s Network Value to Transaction (NVT) Model is in “its best state in 16 months.”

“We are officially less than two days from the big Ethereum merge, & on-chain metrics are looking positive for the #2 market cap asset. According to our NVT model, the ratio between unique ETH being moved and the network’s current market cap is in its best state in 16 months.”

NVT describes the relationship between transfer volume and market capitalization.

Ethereum is trading at $1,576 at time of writing and is down nearly 7% in the past 24 hours. Ethereum’s merge to proof-of-stake is currently scheduled to happen on Wednesday night, according to the Web3 infrastructure company Blocknative.

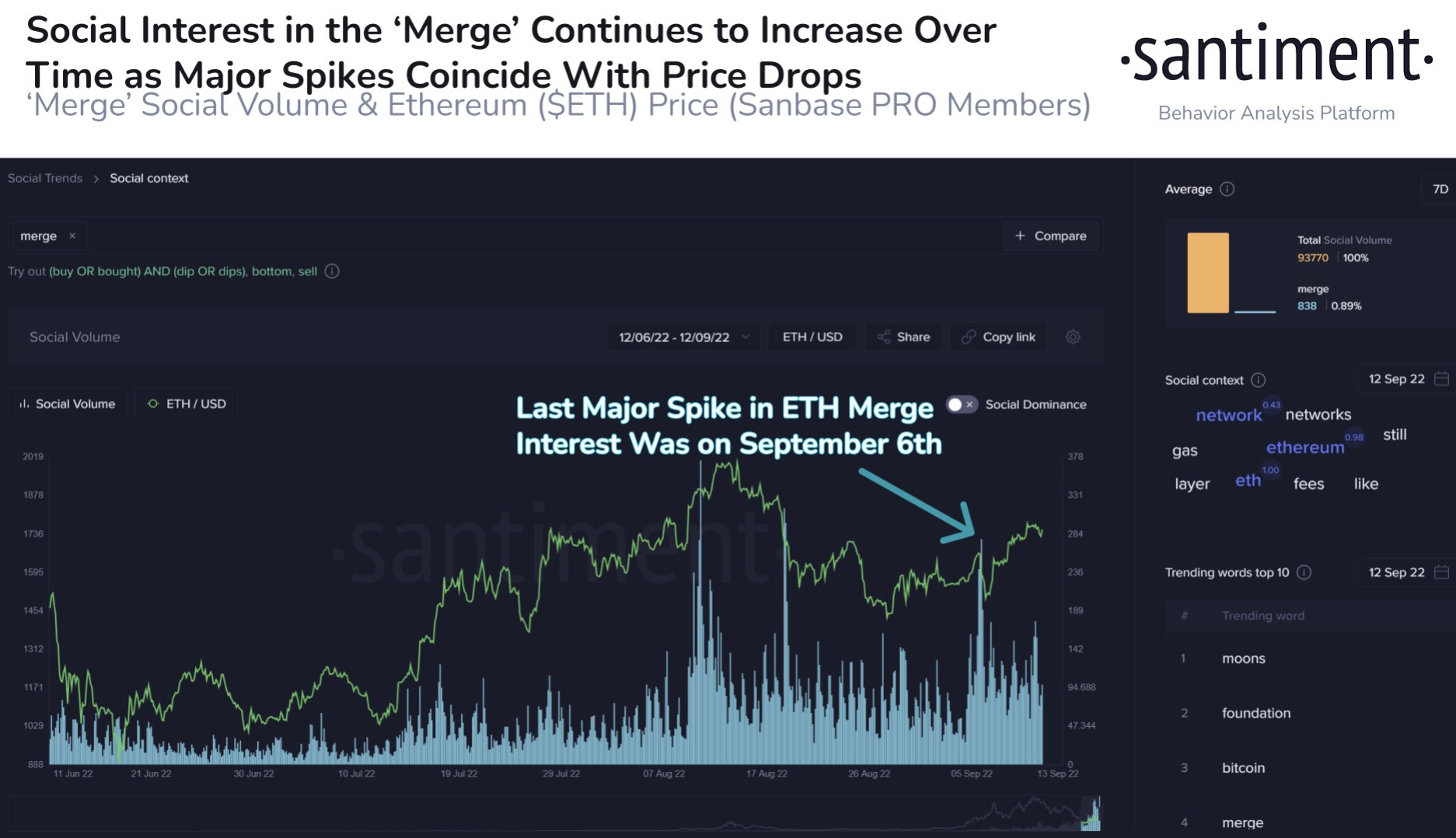

Santiment also warns that the massive upgrade could have a downside in terms of ETH’s price.

“With Ethereum’s merge happening this week, we see that mentions related to the monumental event are very high on social platforms. As traders anticipate the inevitable ETH volatility, watch for big FOMO social spikes, which coincide with downswings.”

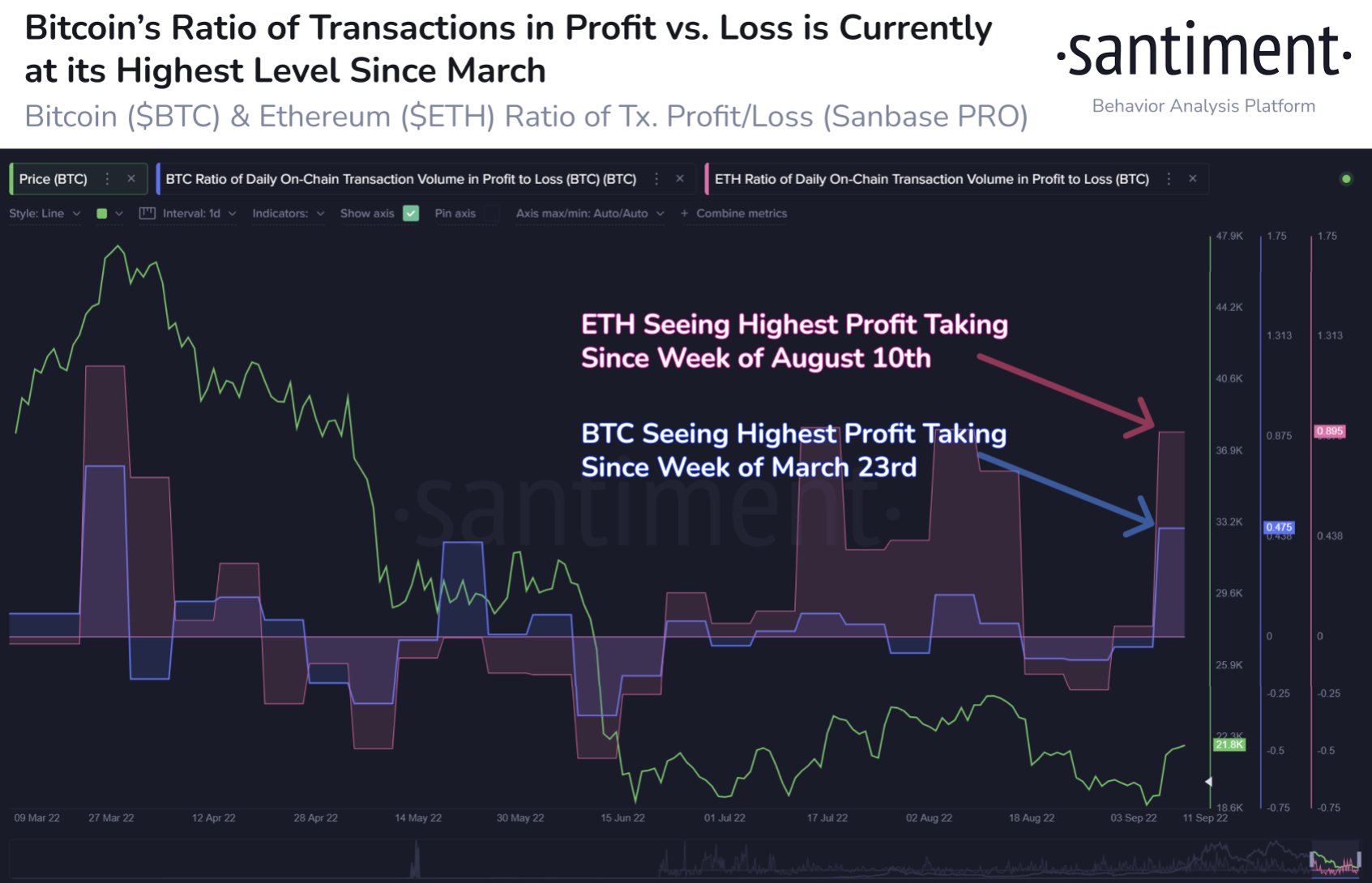

The crypto analytics firm also notes that Bitcoin’s (BTC) ratio of transactions in profit vs. loss hit its highest level since March. Santiment says traders viewed Bitcoin’s price bounce earlier this week “as the trigger to trade again.”

Bitcoin is trading at $20,178 at time of writing. The top-ranked crypto asset by market cap is down nearly 10% in the past 24 hours.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Panuwatccn/VECTORY_NT