New data from intelligence firm CoinGlass shows that $288.22 million worth of digital assets have been liquidated in the last 24 hours as the market experiences increased volatility in the wake of Ethereum’s (ETH) merge update.

According to CoinGlass, Ethereum is the most affected by the sell-off followed by Bitcoin (BTC).

The world’s leading smart contract platform sustained $169.64 million worth of losses, or more than four times the $38.24 million in value that Bitcoin, the largest crypto asset by market cap, shed in the last 24 hours.

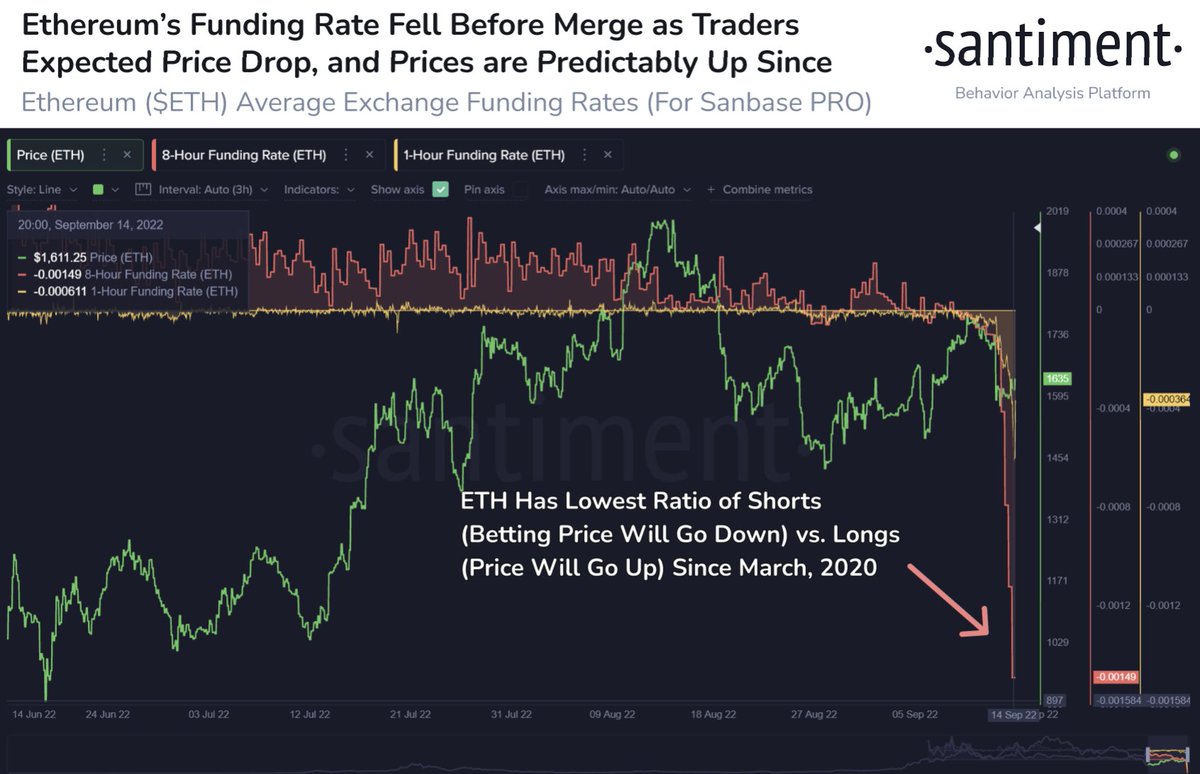

According to market intelligence platform Santiment, the price of the largest altcoin dropped as traders expect ETH to plunge before the merge happens.

“As traders bet Ethereum would fall leading up to the merge, short liquidations have been the story thus far. After ETH prices dropped to $1,565 after Tuesday’s CPI report, traders expecting a drop bet wrong after this mild bounce back up to $1,635.”

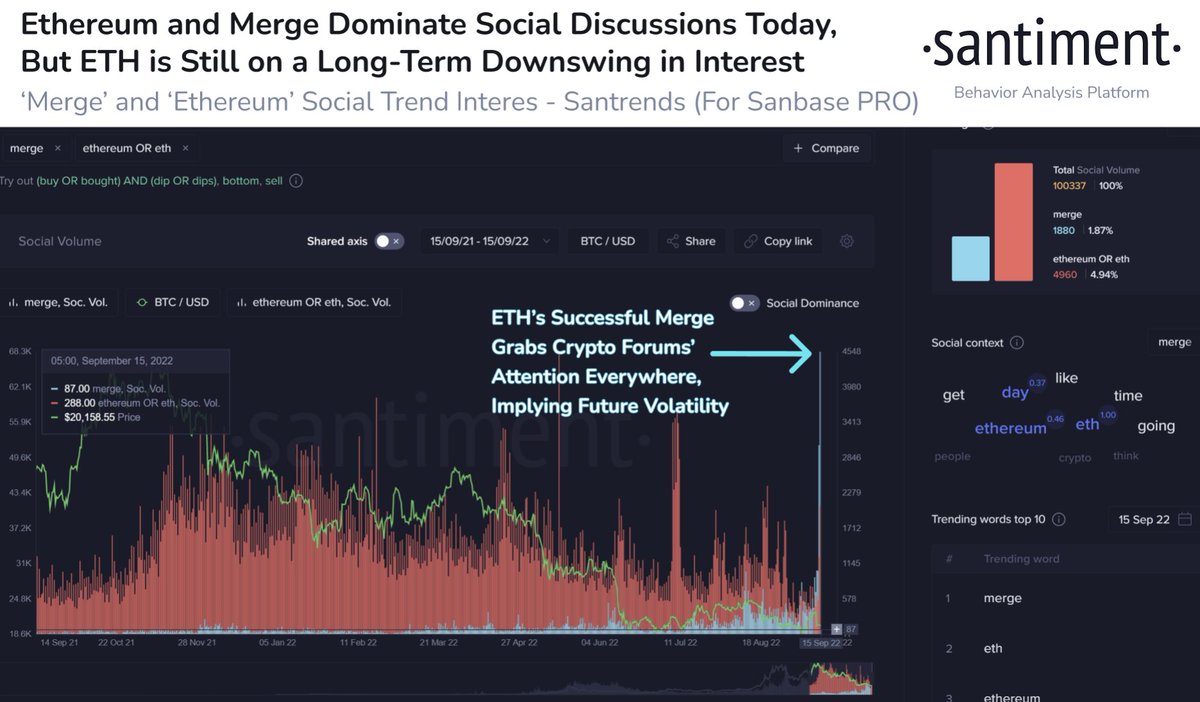

Santiment says that Ethereum will continue to see increased volatility now that it transitioned into a proof-of-stake network.

“Ethereum’s merge day has justifiably been the overarching trend, even with its now concluded and relatively drama-free, expected outcome. Over the past year, ETH has seen less interest, but this event will propel volatility for the near future.”

At time of writing ETH is trading for $1,471, down by 9.57% in the last 24 hours. BTC is changing hands for 19,682, down by 2.75% over the same period.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Philipp Tur/LongQuattro