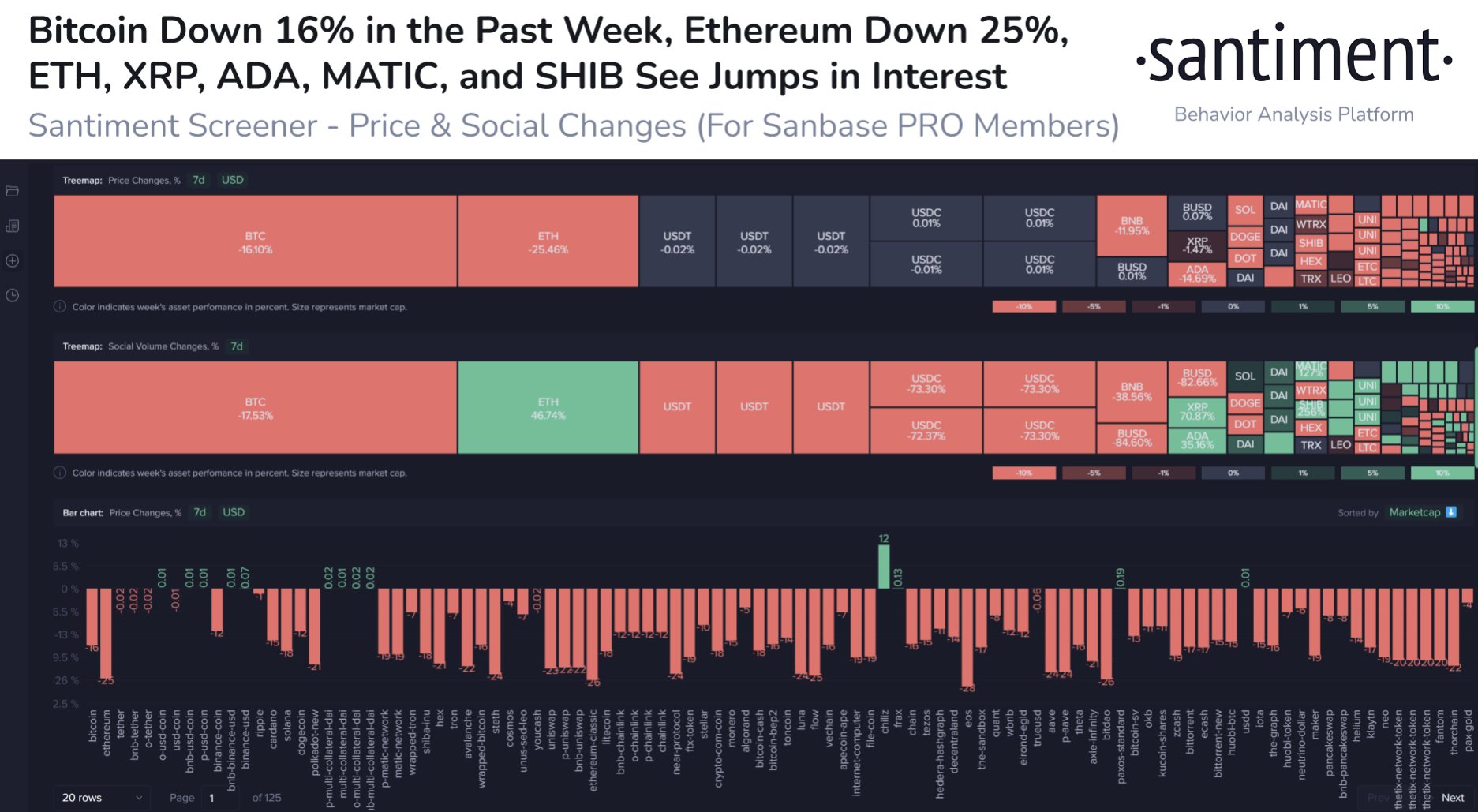

A handful of crypto assets are witnessing a surge in social media interest despite the market’s price struggles this week, according to the analytics firm Santiment.

Santiment notes Ethereum (ETH), XRP, Cardano (ADA), Shiba Inu (SHIB) and Polygon (MATIC) have been discussed more online in the past week, while most other crypto assets have been talked about less.

The analytics firm also says social trends indicate there is disagreement among members of the crypto community about whether to buy the current price dip.

“The ‘buythedip’ birds are chirping after prices have faded. Last week, just before the CPI [consumer price index] report crash, traders were bragging that they had bought the dip. Now there is legitimate polarization on whether to do it again. What a difference a week makes.”

In terms of whale activity, Santiment notes that large addresses are buying up decentralized lending and borrowing platform Aave (AAVE).

“Aave key whale addresses holding between 1,000 and 1 million AAVE in their wallets are up to 54.5% held. This is the highest amount held by these addresses of all-time. Still a relatively young asset, the key will be seeing this line improve even when founder and top exchange addresses (holding 10 million or more AAVE) finally stop circulating their coins out for active traders and circulation purposes.”

The analytics firm says whales are also targeting the decentralized oracle network Chainlink (LINK), with addresses holding between 10,000 to 1 million LINK increasing their supply held by more than 3% of the available coins in the past four months.

Additionally, whales are scooping up Amp (AMP), an Ethereum-based token used as collateral on Flexa Network transactions. Flexa is a DeFi payment processing system aiming to bring cryptocurrency payments to mainstream retail.

Addresses holding between 100,000 and 10 million AMP have increased their total supply of the crypto asset by more than 25% since the beginning of June.

Whale holdings of Litecoin (LTC), the fan engagement token Chiliz (CHZ) and enterprise solution OMG Network (OMG) are actively decreasing, according to Santiment.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Jaswe