Bloomberg Intelligence senior commodity strategist Mike McGlone says the crypto market crash recently reached extreme levels.

McGlone says Bitcoin (BTC) recently traded at the steepest discount since the computation of the flagship crypto asset’s 200-week moving average began.

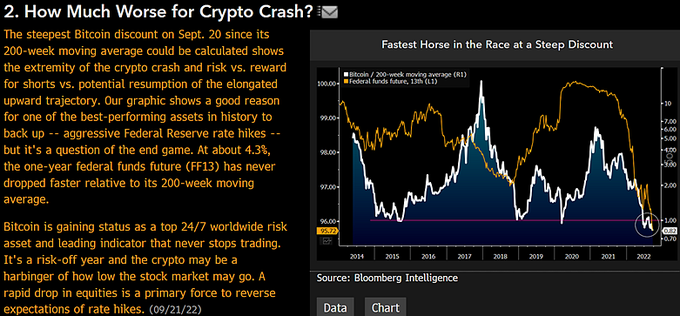

“The steepest Bitcoin discount on September 20 since its 200-week moving average could be calculated shows the extremity of the crypto crash and risk vs. reward for shorts vs. potential resumption of the elongated upward trajectory.”

According to the Bloomberg Intelligence strategist, the aggressive interest rate increases by the U.S. Federal Reserve offer a “good reason” for Bitcoin to reverse the downward spiral.

“Our graphic [below] shows a good reason for one of the best-performing assets in history to back – aggressive Federal Reserve rate hikes – but it’s a question of the end game. At about 4.3%, the one-year federal funds future (FF13) has never dropped faster relative to its 200-week moving average.”

The federal funds future is a derivative based on short-term interest rates as set by the Federal Reserve. Investors use the derivative to bet or hedge against the fluctuations in the short-term interest rate.

On the crypto market correlation with stocks, McGlone says that Bitcoin and other crypto assets could determine the stock market bottom.

“Bitcoin is gaining status as a top 24/7 worldwide risk asset and leading indicator that never stops trading. It’s a risk-off year and the crypto may be a harbinger of how low the stock market may go. A rapid drop in equities is a primary force to reverse expectations of rate hikes.”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Zaleman