A widely followed crypto strategist is expressing bullish sentiment for Bitcoin (BTC) as the last quarter of the year begins.

The anonymous host of InvestAnswers tells his 444,000 YouTube subscribers in a new video that October is historically a bullish month for Bitcoin.

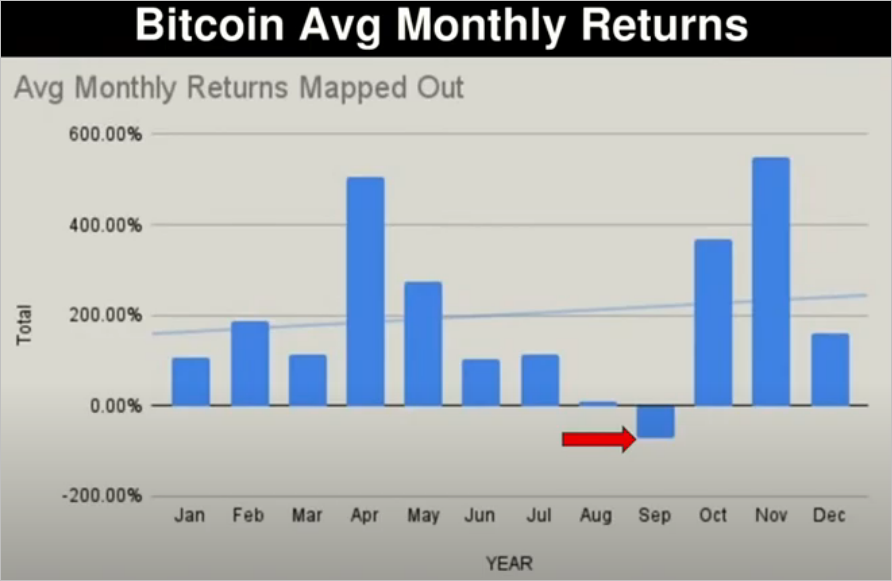

According to the host of InvestAnswers, Bitcoin could hit up to $26,000 over the next four weeks based on the average return for October. Bitcoin last recorded a price of over $26,000 in June while it last rose above $25,000 in August.

“If Bitcoin can hold in and around its level, it’ll be better than previously…

Looking forward to October, the average return for October is 28.42%, which would take the Bitcoin price up to about $25,000 – $26,000. So, we’ll see if it goes there.

Twenty-five thousand dollars is where we were not too long ago, and we could easily get back to that level.”

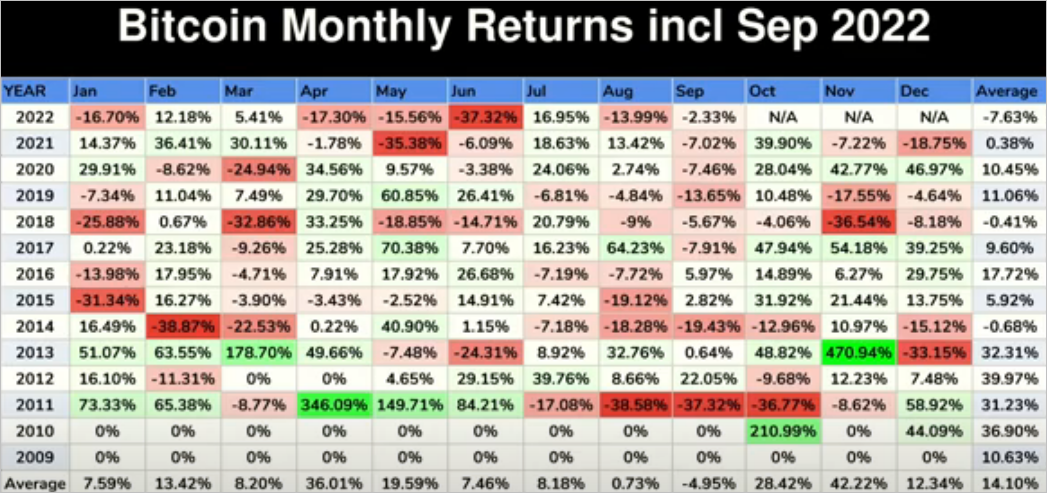

Compared to other months, the host of InvestAnswers says that October has typically offered the third-highest average monthly returns.

“Let’s look at how October benchmarks against other months in the history of Bitcoin…

Here you can see September is red. August is kind of like breakeven.

But October is the third-best month historically. And that’s why many people refer to it as Uptober.”

Bitcoin is trading at $19,411 at time of writing, flat on the day.

I

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Liu zishan