Popular quantitative analyst PlanB says he is buying Bitcoin (BTC) again and highlights data trends suggesting the king crypto may be gearing up for a surge.

PlanB tells his 1.8 million Twitter followers he is seizing the opportunity to purchase the leading crypto as he has done at other times after significant price declines.

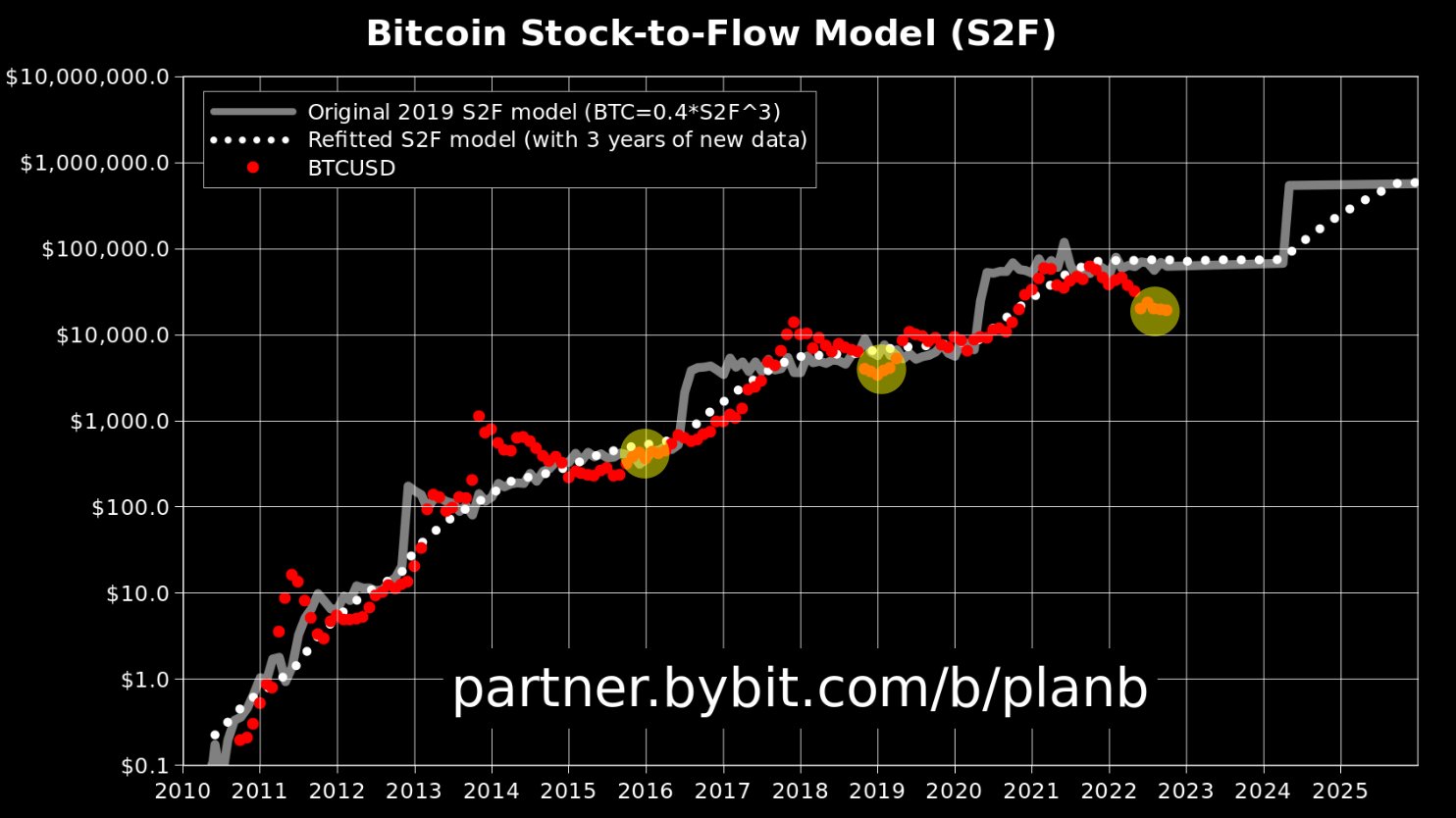

“My first Bitcoin investment was in 2015 at ~$400 (yellow circle). Most people said Bitcoin was dead. My second investment was in 2018 at ~$4000 when I published the S2F (stock-to-flow) model. Most people said Bitcoin was dead. My third investment is now at ~$20,000. Most people say Bitcoin is dead.”

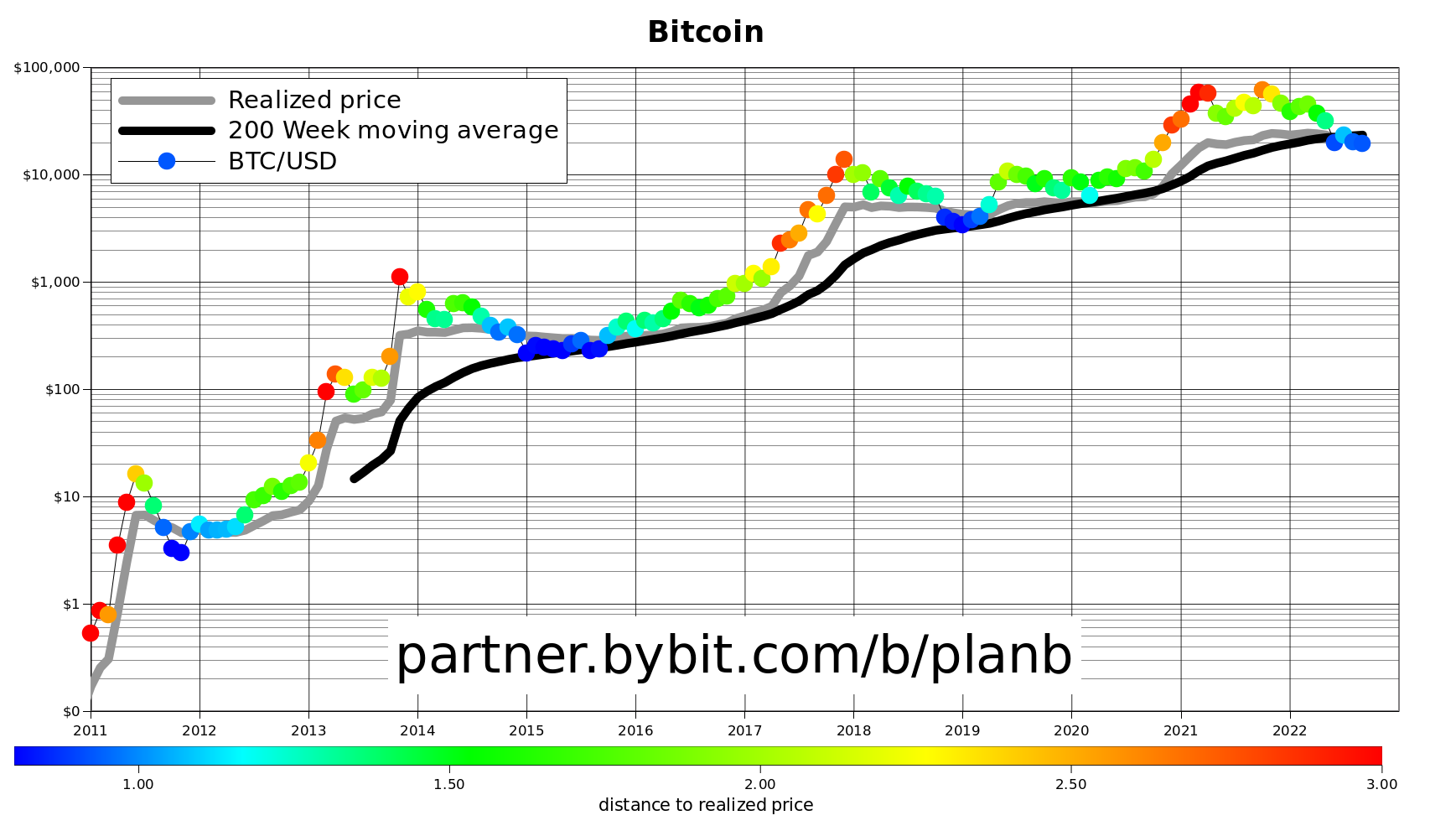

PlanB, who developed the stock-to-flow price model for BTC, says that for the first time in over ten years, Bitcoin is currently trading below its 200-week moving average and its realized price.

Analysts view realized price as a crucial support area for Bitcoin as the on-chain metric calculates the average value of all BTC at the price they were bought divided by the number of BTC in circulation.

According to PlanB, BTC’s move below the two key indicators could present a once-in-a-decade opportunity for Bitcoin bulls.

“Bitcoin below 200-week moving average ($23,000) and realized price ($21,000). Structural break of a 10-year+ trend, or temporary macro-driven buying opportunity?”

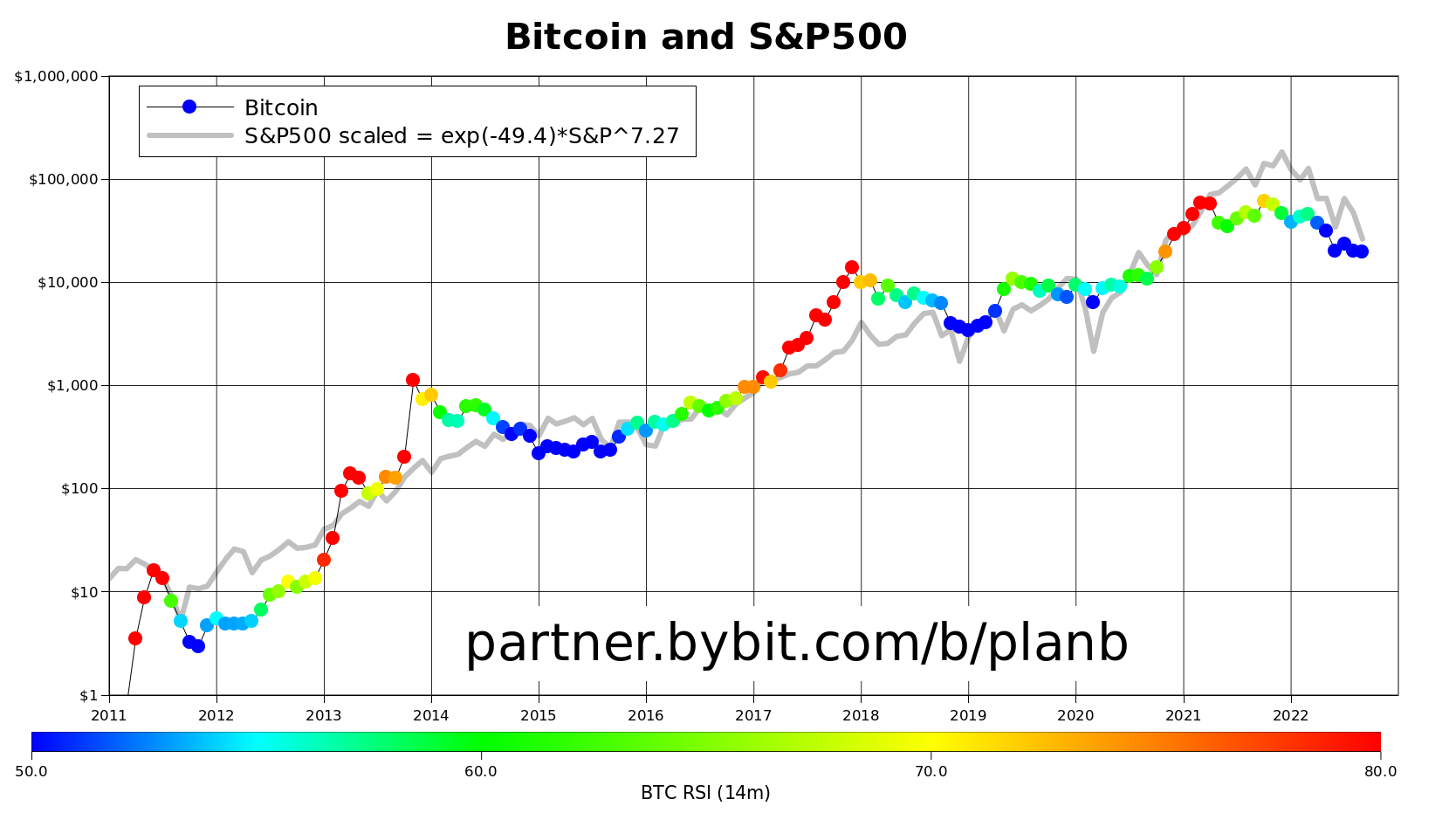

PlanB points to other indicators to make the case for a potential Bitcoin rally. According to the quant analyst, Bitcoin’s correlation with the S&P 500 suggests that BTC should be trading at higher price levels.

“S&P 500 implied BTC price is $27,000.”

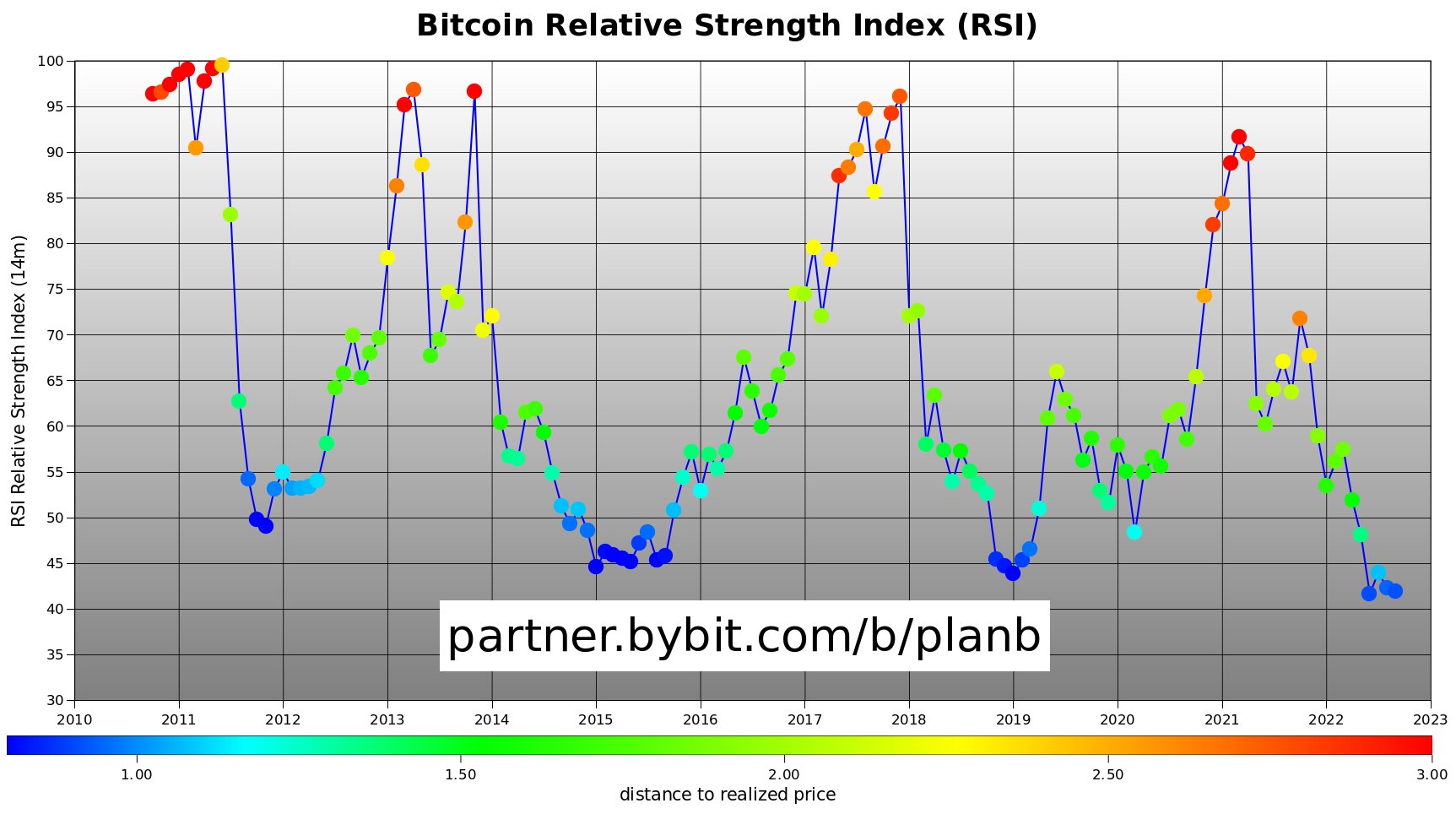

PlanB is also looking at Bitcoin’s momentum indicator, the RSI, which he notes is currently hovering at historic lows on the monthly timeframe.

“How long will Bitcoin monthly RSI (~42) stay low?”

At time of writing, Bitcoin is valued at $19,536, a slight increase on the day.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Zaleman