A popular on-chain analyst claims the current bear market hasn’t yet sent as many Bitcoin (BTC) underwater as previous bear markets.

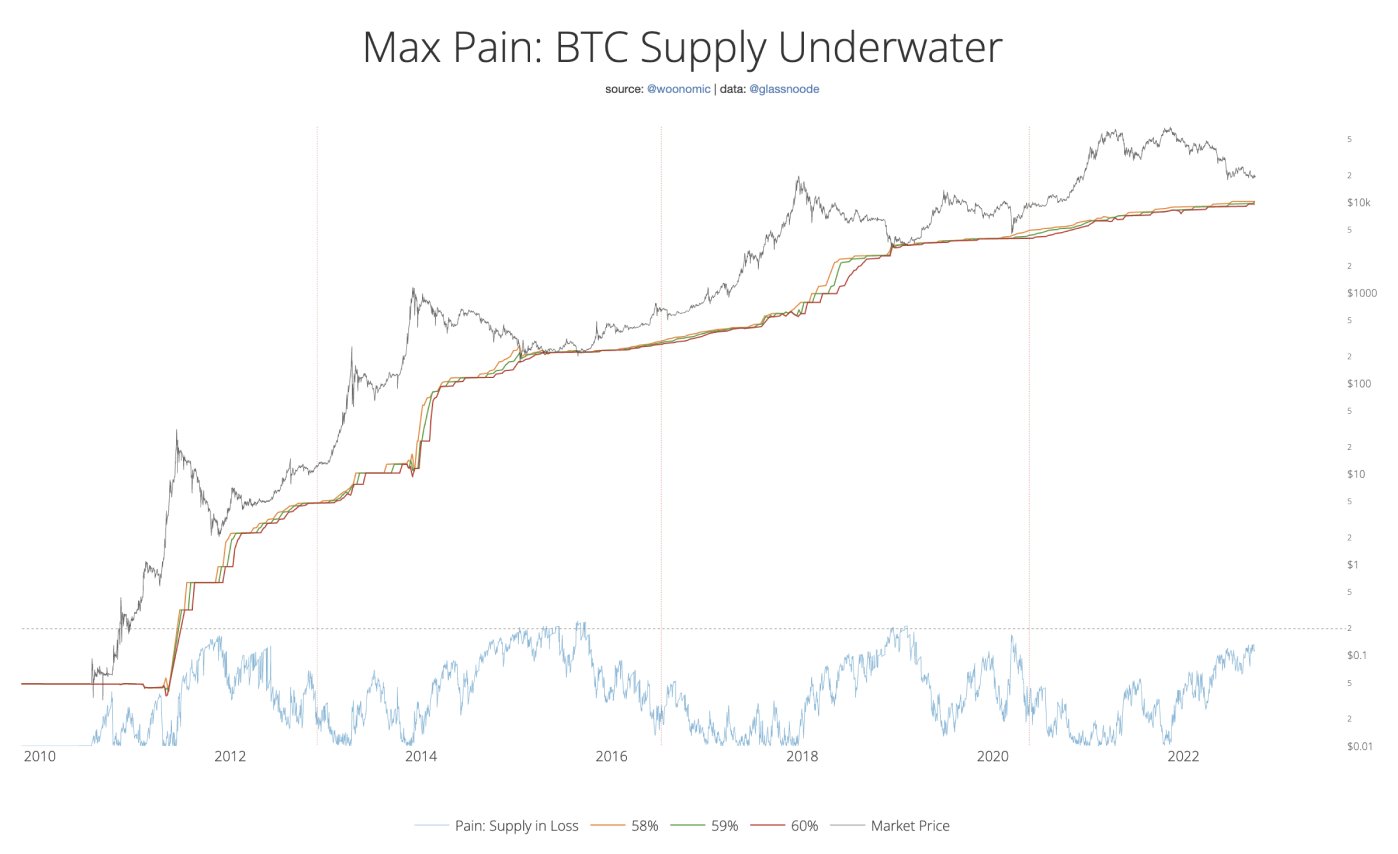

BTC analyst Willy Woo notes that showing how many coins are at a lower value compared to their purchase price is “one way of visualizing maximum pain.”

“Past cycles bottomed when approx. 60% of the coins traded below their purchase price. Will we hit this again? I don’t know. The structure of this current market this time around is very different.

Inside baseball… It used to be holders would dump their coins into the bear market. You see this in the red zones. In this cycle, we aren’t seeing any of the historic selling. It could be they are hedging on futures, and the holders this time around are hedge funds from 2020.”

Woo’s chart indicates that Bitcoin’s 60% underwater level is currently hovering around $10,000.

He’s not the only analyst to suggest BTC could dip another level lower: Nicholas Merten told his 513,000 YouTube subscribers this week that another leg of the bear market could send Bitcoin near the $13,000 level.

BTC is trading at $20,197 at time of writing. The top-ranked crypto asset by market cap is up nearly 3% in the past 24 hours and more than 5.6% in the past week.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Mia Stendal