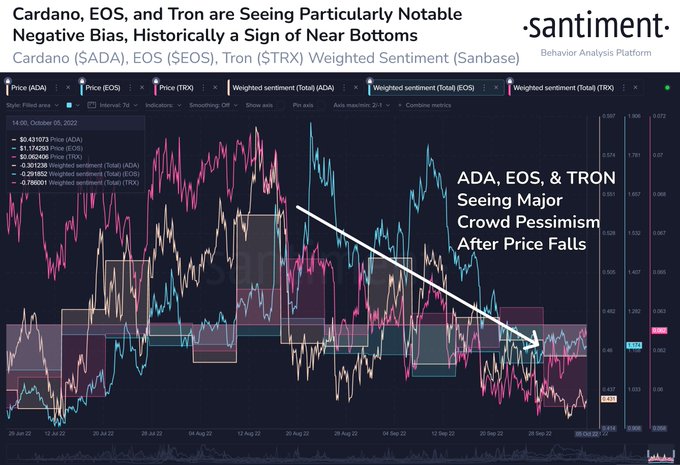

Crypto analytics platform Santiment is warning that three crypto assets are witnessing negative bias amid their poor price performance year-to-date.

Santiment says that traders are beginning to “turn on” smart contract-enabled blockchains Cardano (ADA), Tron (TRX) and EOS (EOS).

According to the crypto analytics platform, such negative bias is historically a sign that the bottom could be close.

“Cardano, EOS, and Tron are 3 once popular assets that have had trading crowds begin to turn on them. Price performance has been particularly rough for these three in 2022, and the capitulation may soon lead to price rebounds to reel them back in.”

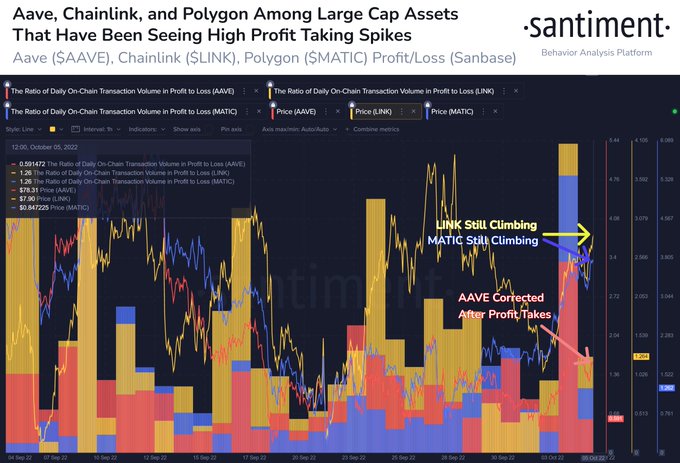

In contrast to the outlook for the above smart contract-enabled blockchains, Santiment says that decentralized blockchain oracle Chainlink (LINK), layer-2 scaling solution Polygon (MATIC) and decentralized finance (DeFi) platform Aave (AAVE) could have topped out for the short-term.

Santiment, however, says that if Bitcoin (BTC)’s key support level of $20,000 holds, Chainlink, Polygon and Aave could continue their upward trajectory.

“The early week price rises have led to high profit-taking levels for Chainlink, Polygon, and Aave. Typically, these can be some short-term top signals, but if accompanied by stability from Bitcoin staying over $20,000, there could be room for growth.”

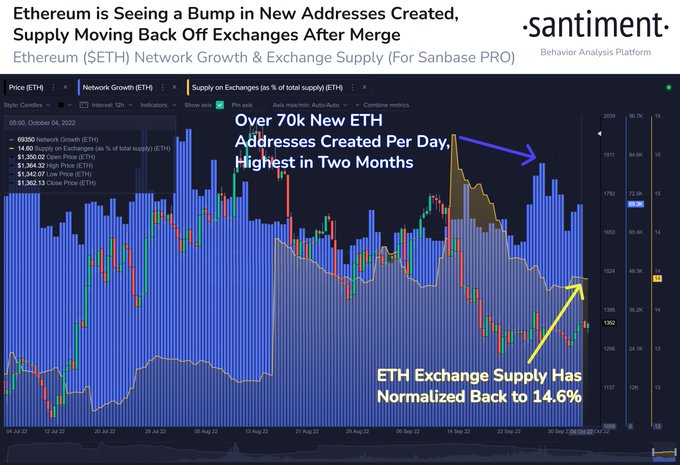

Turning to the second-largest crypto asset by market cap, Santiment says that the supply of Ethereum (ETH) on exchanges has declined to levels last seen before the height of the uncertainty that surrounded its transition to a proof of stake model.

“Ethereum’s amount of new addresses being created is hovering around 70,000 per day again, the highest seen since early August. And after quite a bit of uncertainty around the mid-September merge, the supply of ETH on exchanges has dropped back to 14.6%.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Tartila