Decentralized finance (DeFi) crypto hacks are already on the rise this month, according to the blockchain analysis firm Chainalysis.

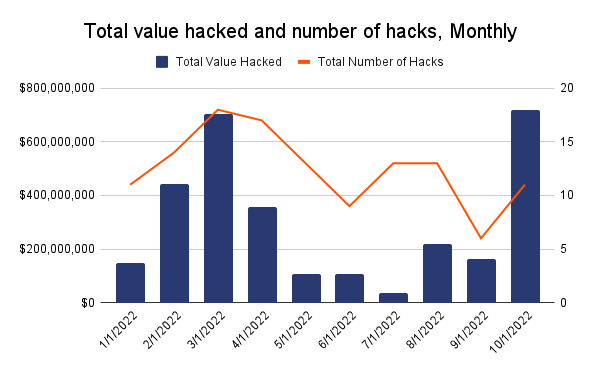

Chainalysis notes that October has been the most prolific month for hackers so far this year, with $718 million worth of assets stolen across 11 different attacks aimed at DeFi protocols.

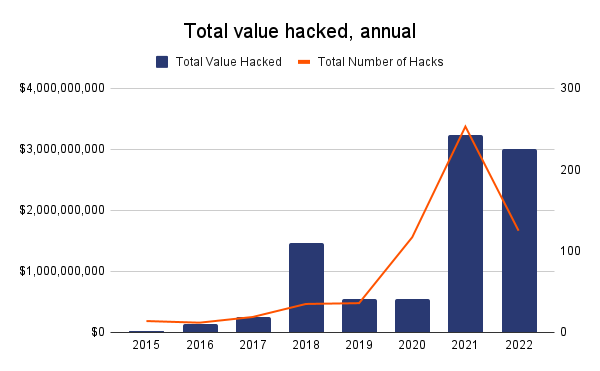

Chainalysis says the current total monetary value of hacks is likely to make 2022 surpass 2021 as the biggest year for crypto hacking ever.

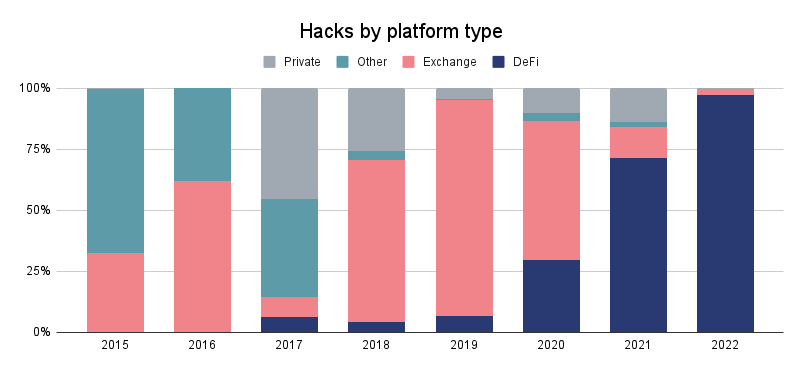

The firm also notes that crypto hacking targets have evolved over time.

“Back in 2019, most hacks targeted centralized exchanges, and prioritizing security went a long way. Now a vast majority of targets are DeFi protocols.

Cross-chain bridges remain a major target for hackers, with 3 bridges breached this month and nearly $600 million stolen, accounting for 82% of losses this month and 64% of losses all year.”

Just this week, a hacker exploited Mango Markets, a decentralized exchange (DEX) on the Solana (SOL) blockchain, taking off with crypto assets worth approximately $100 million.

The attacker manipulated the price of the DEX’s utility token, Mango (MNGO), and then borrowed the highest amount possible using the unrealized profit from a long position as collateral. The hacker then withdrew Bitcoin (BTC), SOL as well as the USDC and USDT stablecoins.

Follow us on X, Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Prince Zaleski/AtlasbyAtlas Studio