New data from market intelligence firm Santiment reveals that Ethereum (ETH) whales have accumulated $4.5 billion worth of ETH in over a month.

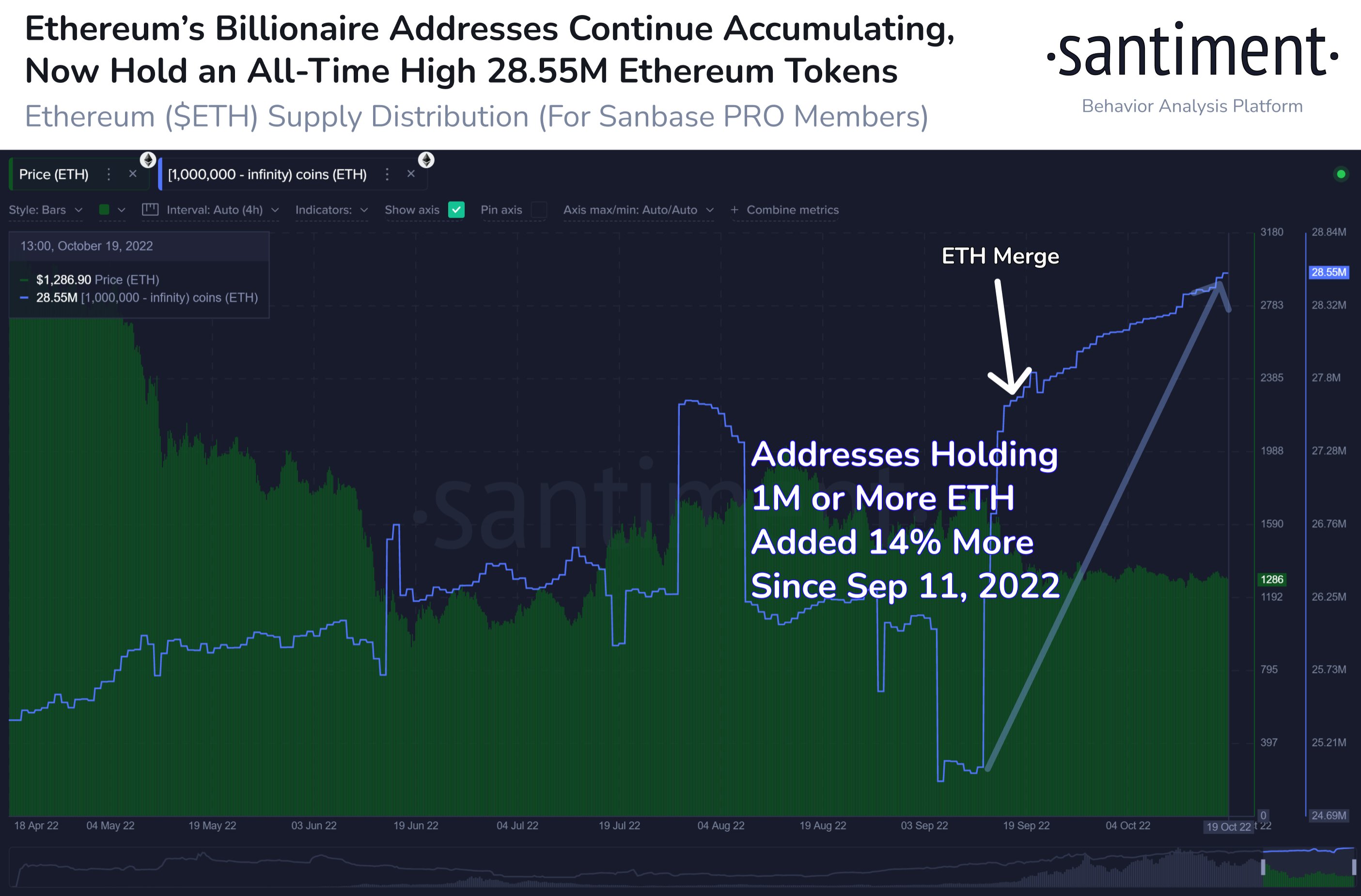

The crypto analytics platform tells its 147,000 Twitter subscribers that deep-pocketed ETH investors have been gobbling up the second largest crypto asset by market cap by the millions since September 11th.

“Since September 11th, Ethereum billionaire whale addresses holding 1 million or more ETH have collectively added 3.5 million more coins. This has increased their cumulative bags by 14%. There are currently 132 such addresses in existence.”

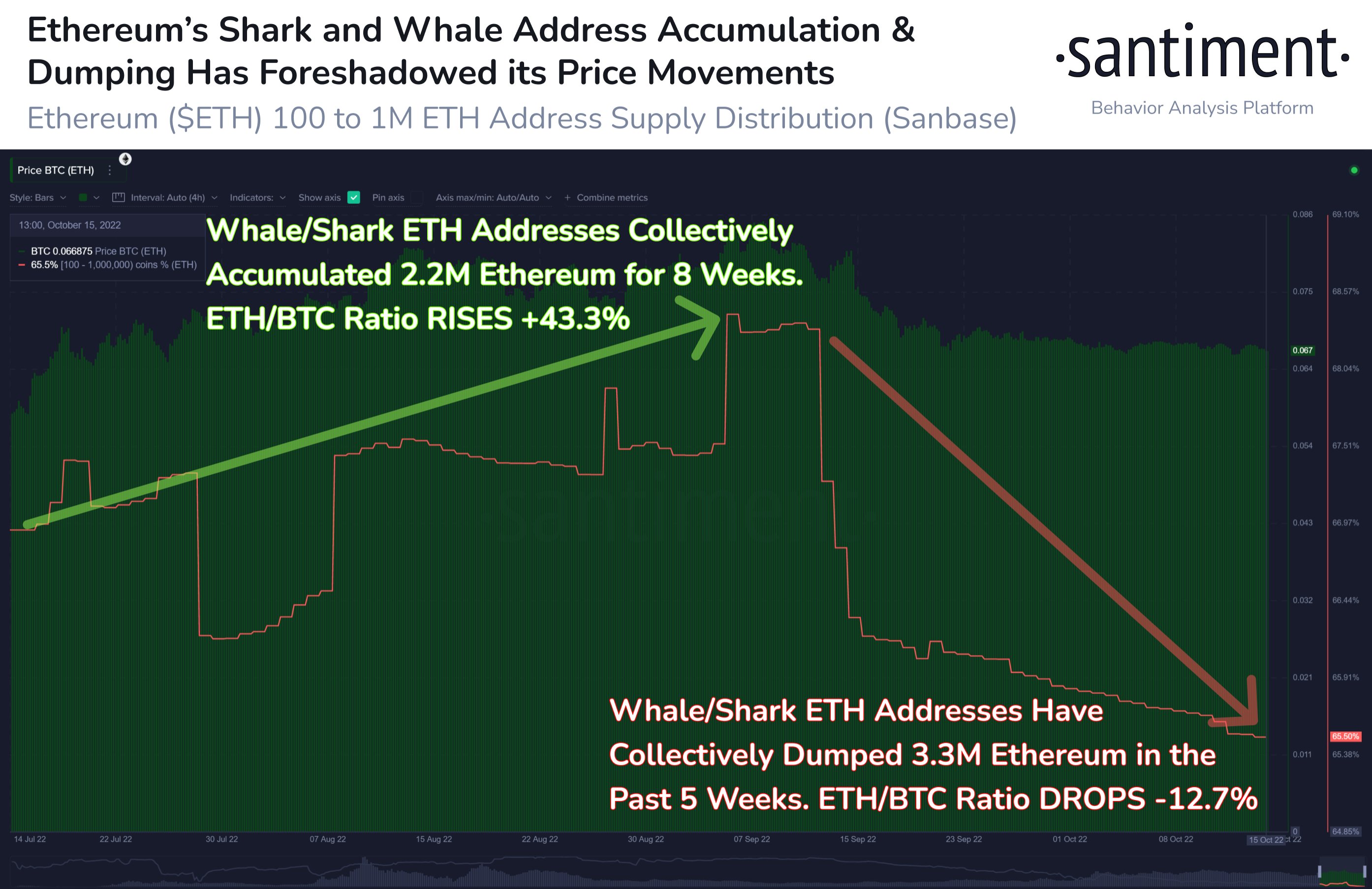

However, Santiment also finds that smaller ETH whales and ETH sharks have been selling the leading smart contract platform, drastically lowering their token counts. The data shows that the investors sold a combined $4.2 billion worth of ETH over the last five weeks.

The market intelligence firm also notes that the top altcoin’s price has fluctuated against the price of king crypto Bitcoin (BTC) due to the actions of this group of investors as the ETH/BTC ratio dropped 12.7% after 3.3 million tokens were sold.

“Ethereum’s shark and whale addresses (holding 100,000 to 1 million ETH) have dropped 3.3 million ETH in just the past five weeks. This equates to about $4.2 billion in dumped coins. The asset’s price vs. Bitcoin has ebbed and flowed based on [the] behavior of these key stakeholders.”

Ethereum, which has seen steady user growth since it merged from a proof-of-work consensus mechanism to a proof-of-stake one in mid-September, is changing hands for $1,294 at time of writing, a fractional gain on the day.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/WWWoronin/monkographic