Nearly a year after accurately forecasting this year’s meltdown in global markets, billionaire investor Chamath Palihapitiya says he’s positioned to capitalize on a major market rally.

In a new episode of the All-In Podcast, Palihapitiya says he’s bullish on the S&P 500 as he believes the stock market index has carved a short-term bottom.

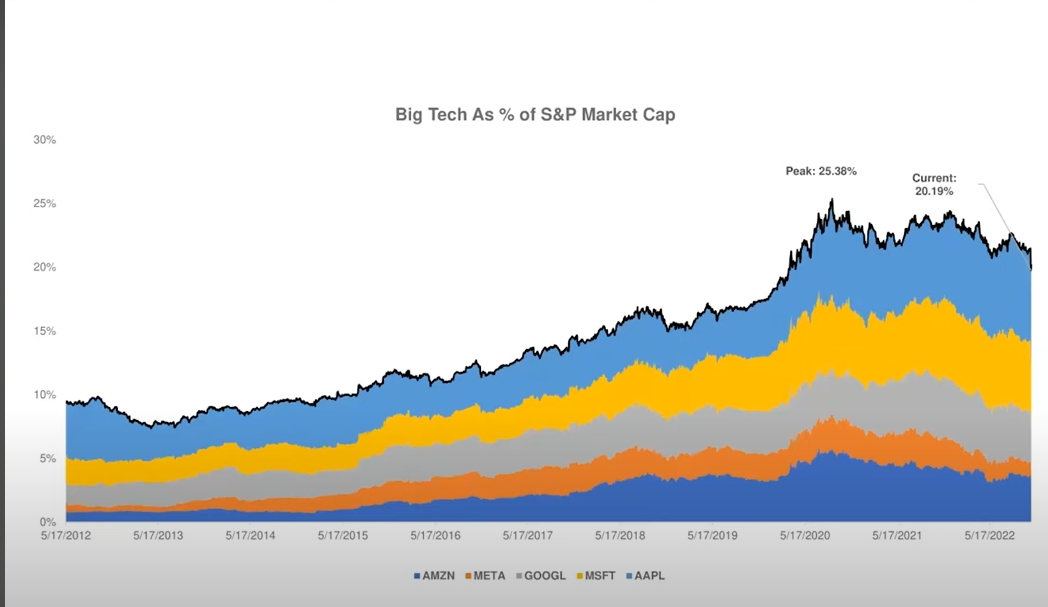

“What’s incredible on this chart is that when everybody talks about being long on the S&P 500, it was always really a proxy for being long Amazon, Facebook, Google and Apple. At the peak, in May of this year, $0.25 of every single dollar of the S&P 500 were these five companies.

We always said the market bottom will be when the ‘generals’ get shot… It looks like the generals have been shot. What’s incredible is this week every single one of those companies other than Apple really reported pretty crappy earnings. They got totally taken to the woodshed. The percentage of these companies as a percentage of the S&P [500] is now off by 500 basis points. It’s down to 20% yet the markets are ripping higher today…

I think this is the point where you have to start to get pretty constructive about where things are going because if this stuff could not bring the market down, it’s hard to see something other than an exogenous event, probably some Russia-Ukraine event, really having a negative impact. It seems pretty bullish for me.”

Crypto traders often keep a close eye on the S&P 500 as strength in the equities markets suggests that deep-pocketed investors are allocating to risk-on assets like stocks and digital assets.

Although Palihapitiya is bullish on the stock market, he predicts the rally will likely be unsustainable. He says that he agrees with the sentiments of fellow venture capitalist David Sacks who believes that the US will likely see a huge recession next year due to the impact of the Fed’s rapid interest rate hikes to the economy.

“I think the stock market is going up. Then it will go back down because what David said is right. But for the short term, this thing is going up. We’ve generally been positioned for it to go up and at some point, we will reverse and position for it to go back down, but it’s going up.”

I

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Natalia Siiatovskaia/jdrv_art