The U.S. Securities and Exchange Commission (SEC) is filing a motion to extend the amount of time it has to reply to the numerous amicus briefs supporting Ripple Labs.

The SEC sued Ripple Labs in late 2020 for allegedly issuing XRP as an unregistered security, and now numerous amicus briefs are looking to prove the SEC otherwise.

Earlier this week, crypto legal expert Jeremy Hogan said the amicus briefs filed are weakening the SEC’s case.

“One of the things you see when you look at these amicus briefs is that some parts are filling in the holes for Ripple and some parts are making new holes in the SEC’s argument.”

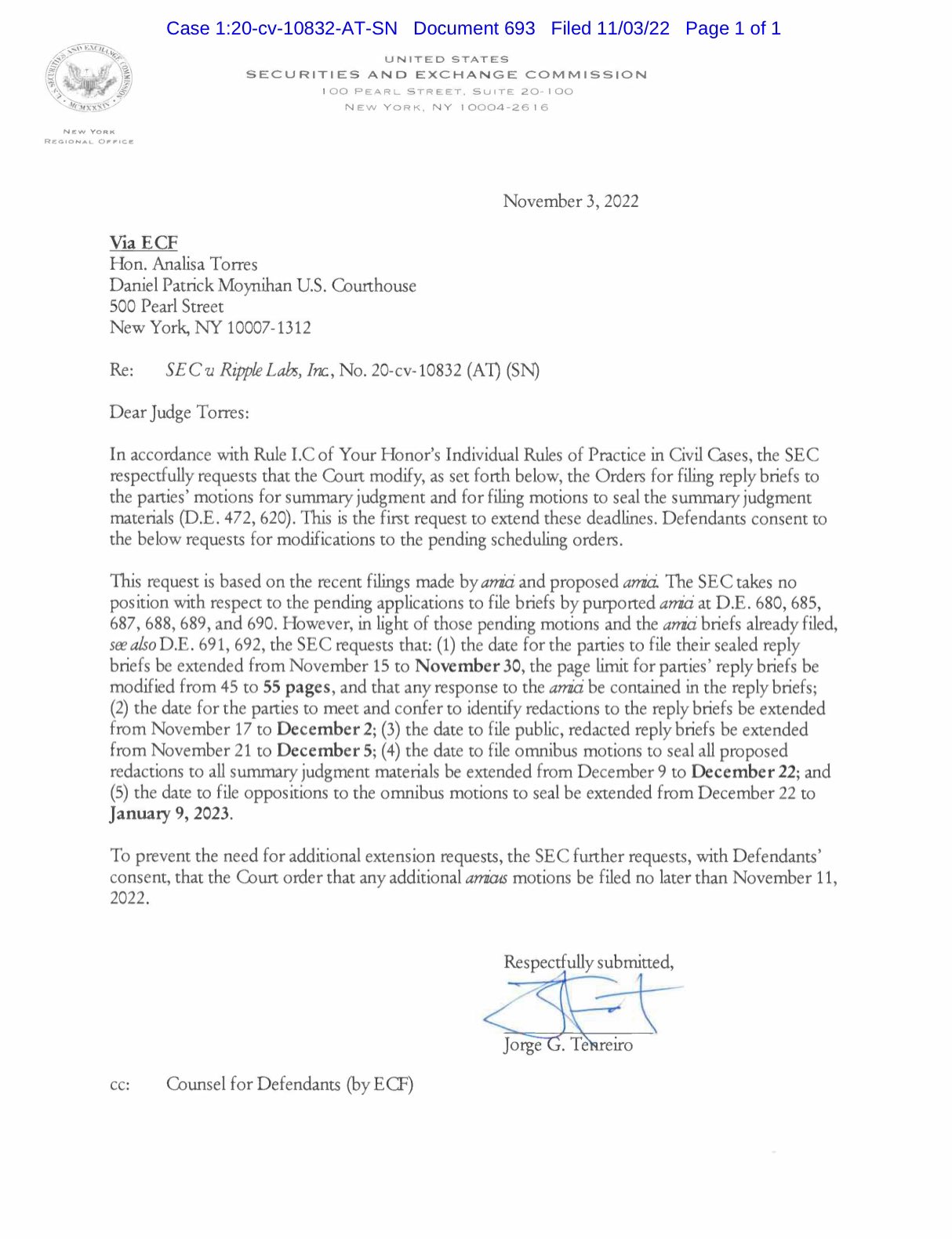

According to defense lawyer James K. Filan who has been closely following the case, the SEC has officially requested more time to respond to the briefs.

“SEC v. Ripple – The SEC has filed a Motion to Extend the Time to file all parties’ Reply Briefs until November 30, 2022 and asks the Court to Order that any additional Amicus Briefs be filed by November 11, 2022. Ripple consents. New dates in motion.”

Ripple’s general counsel Stuart Alderoty says the US regulator is showing their inability to learn, engage, and listen with the general public.

“A dozen independent voices – companies, developers, exchanges, public interest and trade associations, retail holders – all filing in SEC v Ripple to explain how dangerously wrong the SEC is.

The SEC’s response? We need more time, not to listen or engage, but to blindly bulldoze on.”

Several of the amicus briefs have been filed by high-profile voices in the crypto industry, including top US exchange Coinbase.

Last week, Coinbase sought to back up Ripple’s fair-notice defense, in which the firm argues the regulator failed to provide “fair notice” that it was violating any law.

Said Coinbase’s lawyers,

“Coinbase has formally petitioned the SEC to engage in rulemaking for the US digital asset industry so that market participants can have a better idea of what to expect in the future and avoid losses such as those that occurred in this matter. In the absence of a regulatory framework governing digital assets, Coinbase believes that parties like Ripple must be permitted to pursue fair notice defenses in matters where they are facing surprise enforcement actions like this one.”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/intueri