A leading digital assets manager is reporting that institutional investors have been buying up XRP for the last three consecutive weeks.

In its latest Digital Asset Fund Flows Weekly report, CoinShares says XRP’s boost in institutional flows suggests that investors think the U.S. Securities and Exchange Commission’s (SEC) lawsuit against Ripple Labs is looking weaker.

The SEC sued Ripple in late 2020 under allegations that the US-based payments firm issued XRP as an unregistered security.

In the past several weeks, numerous amicus briefs have piled up looking to prove the SEC otherwise, which some experts say is weakening the regulators case against Ripple.

Says CoinShares,

“XRP saw inflows for the third week totaling $1.1 million implying improving investor confidence as the SEC case against Ripple looks increasingly fragile.”

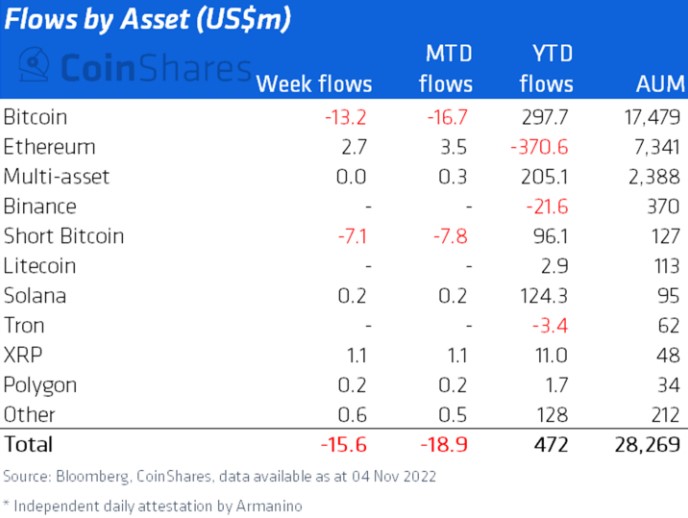

Overall, institutional crypto investment products saw outflows of over $15 million last week to start the month of November.

Bitcoin (BTC) investment vehicles faced the brunt of the outflows, losing $13 million last week.

“This follows a seven-week run of inflows and comes after the FOMC [Federal Open Market Committee] raised interest rates by a further 75 basis points.”

Regionally, CoinShares finds North American investors sold more last week than their European counterparts.

“The negative activity was focused on the Americas, with the US, Canada and Brazil seeing outflows of $21 million, $2.1 million and $1.8 million respectively. This was offset by inflows from Germany at $4 million and Switzerland at $6.8 million.”

Ethereum (ETH) investment products enjoyed $2.7 million in inflows last week while Solana (SOL) and Polygon (MATIC) took in $200,000 each.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured: Shutterstock/ValDan22/INelson