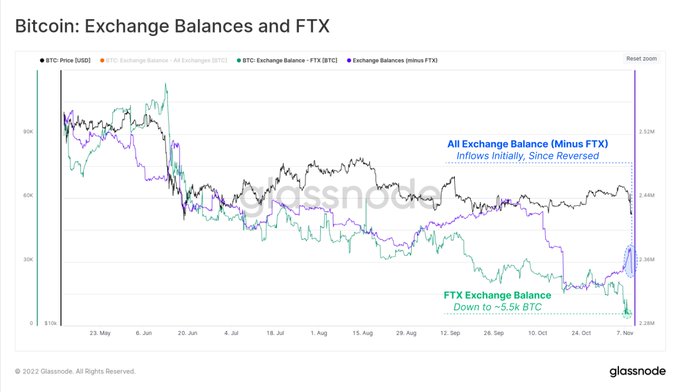

Blockchain metrics platform Glassnode says that FTX witnessed a massive Bitcoin (BTC) outflow amid news of liquidity challenges at the crypto exchange.

Glassnode says that approximately 14,500 Bitcoin left FTX at the height of the panic caused by information filtering out that the crypto exchange was on the cusp of insolvency.

“What we have seen is significant outflows from FTX, with the estimated balance declining by approximately 75% from 20,000 BTC to around 5,500 BTC.

Across all other exchanges, we saw inflows during the panic, however this has almost entirely reversed, leaving exchanges balances flat since Monday.”

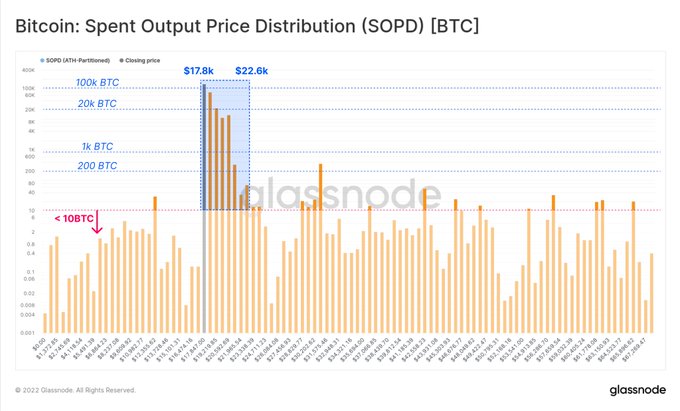

According to Glassnode, the outflows were attributed to recent buyers. The blockchain metrics firm says that “old hands” did not react significantly as Bitcoin hit a two-year low.

“If we look at the same metric over the last 24 hours, despite the price falling to $17,100, the vast majority of spent BTC was from within the current trading range.

It appears that most transactors yesterday were recent buyers.

We have not yet seen old hands react at any scale.”

Bitcoin is trading at $17,713 at time of writing, up by about 3% from the two-year low hit late Tuesday.

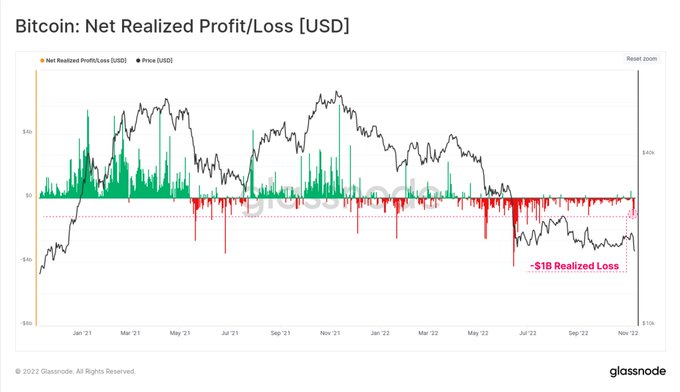

Glassnode says that the net Bitcoin losses incurred after the flagship crypto asset plummeted were about a quarter of what was wiped out after an earlier sell-off this year.

“On a net USD basis, this equates to just over $1 billion in Bitcoin net losses in a single day.

Whilst this is a significant sum, it is certainly not the largest, with the 14-June sell-off hitting over $4.2 billion in losses, the largest in this cycle.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Wirestock Creators/Sensvector