Sam Bankman-Fried’s failed crypto trading firm Alameda Research appears to be consolidating crypto assets into a single wallet.

The firm has steadily accumulated $93,353,985 worth of Ethereum-based altcoins into just one address in recent days, according to the on-chain analytics company Nansen.

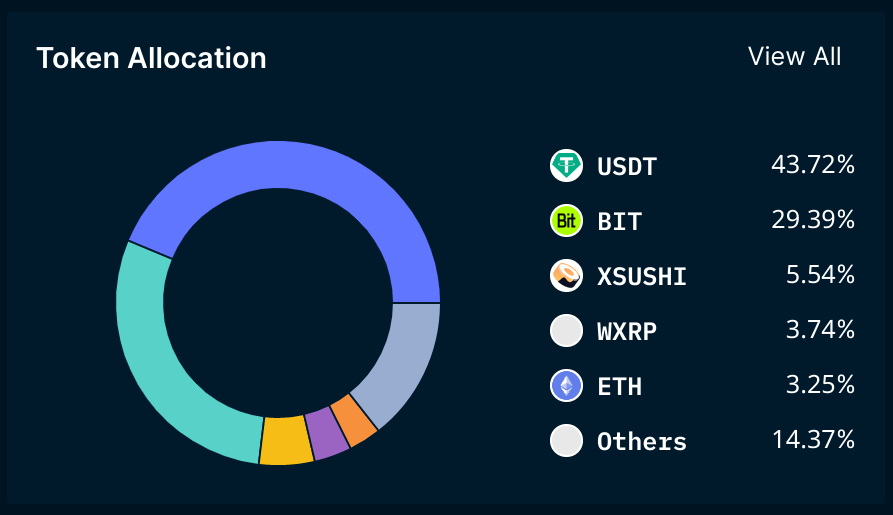

The bulk of the altcoins are denominated in the US dollar-pegged stablecoin Tether (USDT), which amounts to 43% of the portfolio.

The second-largest altcoin allocation is BitDAO (BIT). The decentralized autonomous organization (DAO), which is backed by Bybit, Pantera and billionaire Peter Thiel, represents a 29% chunk of the wallet in question.

The wallet also includes several additional assets in smaller amounts, including Ethereum (ETH) itself, which is 3% of the wallet.

Analysts at Nansen say the coins are likely being consolidated as bankruptcy procedures for Bankman-Fried’s defunct crypto empire FTX begin.

Bankman-Fried, who is accused of mishandling and spending customer funds, declared bankruptcy at FTX, FTX.US, Alameda Research and other FTX affiliates ten days ago.

John J. Ray III, who oversaw the liquidation of the scandalous American energy company Enron, is now managing the fallout from FTX as the company’s new CEO.

In his initial filing on the company’s affairs, Ray said he has never seen a corporate enterprise as mismanaged as FTX.

“Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here.”

The amount of customer money lost by FTX, Alameda Research and its subsidiaries varies wildly, and at least $1 billion worth of investor’s funds is believed to have vanished.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/robertedit949/Natalia Siiatovskaia