A new survey is revealing the price targets of executives in the crypto space for Bitcoin (BTC) following the high-profile implosion of FTX.

In new research, Web3 consulting firm BDC interviewed 53 C-level executives involved in various crypto projects including payments, decentralized finance (DeFi) and GameFi.

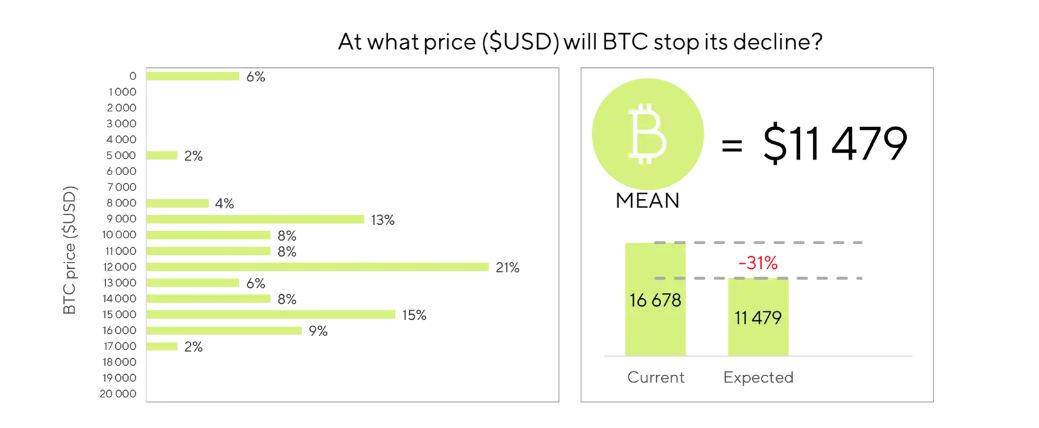

According to the survey, crypto executives believe that Bitcoin is likely headed into deeper bear territory. On average, the respondents think that BTC will stop its decline at $11,479, which is 27.89% lower than Bitcoin’s current price of $15,918.

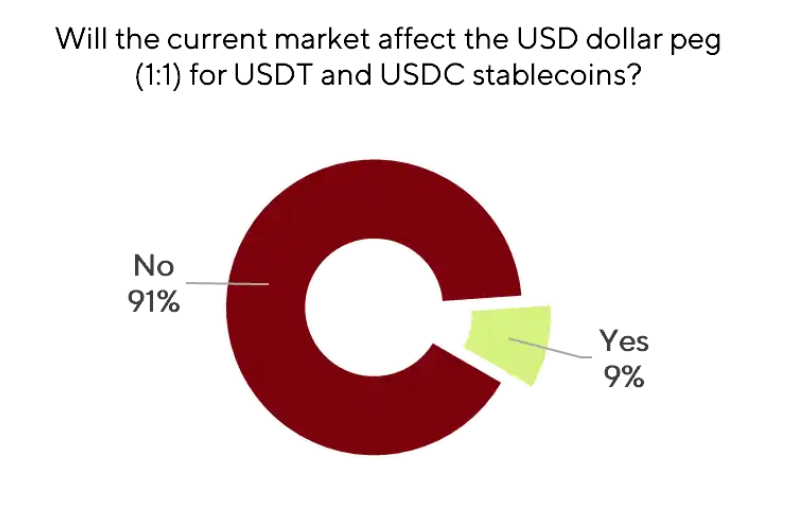

Looking at stablecoins, the survey shows that 91% of poll respondents believe that crypto assets such as Tether (USDT), USD Coin (USDC) and Binance USD (BUSD) will not lose their peg to the US dollar despite bearish market conditions.

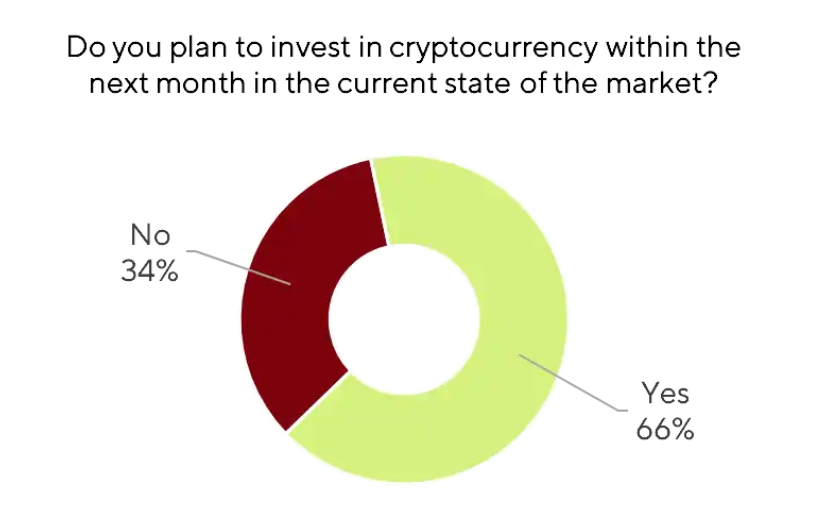

As for the personal investment tactics of C-level managers who participated in the poll, the survey revealed no one plans to trim their crypto holdings amid the bear winter.

According to the study, 66% of the respondents have plans to add to their crypto portfolio over the next month, while the remaining participants say they will not take any action. The survey highlights that not a single poll participant chose the option “No, I plan to reduce my current crypto portfolio” among the possible responses.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Shacil