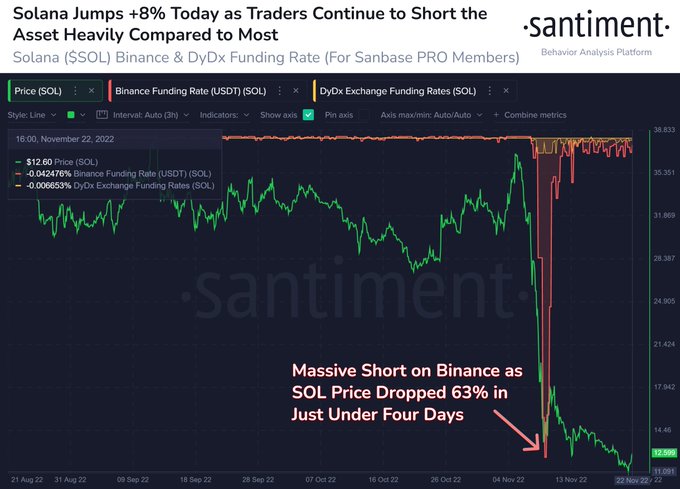

Crypto analytics platform Santiment says that the heavily bearish sentiment revolving around Solana (SOL) could push the price of the Ethereum (ETH) competitor up.

The market intelligence firm says that the fear, uncertainty and doubt (FUD) surrounding Solana could trigger the smart contract platform to rally until the heavily bearish sentiment reduces.

“There are not a lot of big Solana believers, even as its price bottomed out at $11.02 and rebounded to $12.70 over the past 15 hours. This FUD could cause more rebounding until traders slow down their nearly unanimous bets against SOL’s price.”

Solana is trading at $13.33 at time of writing.

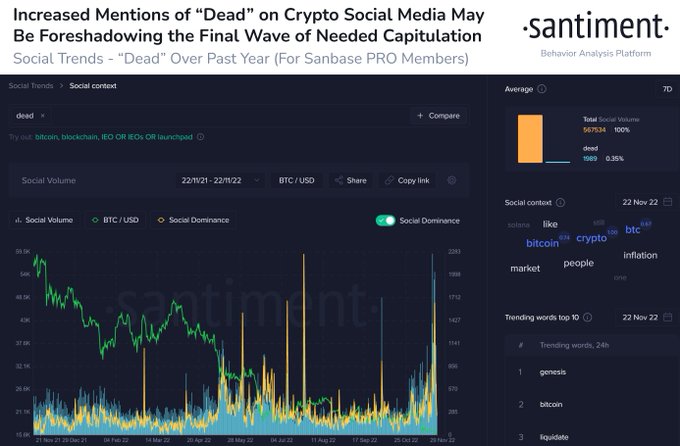

On the bearish sentiment across the wider crypto industry, Santiment says that capitulation events in the past have usually led to a rebound in prices.

“The word dead has been rapidly circulating around crypto platforms in November. As one of the more bearish sentiment words, this is a sign of traders giving up on markets rebounding. Ironically, this capitulation is historically when markets rebound.”

Santiment also notes the catalyst for BTC alternative Litecoin’s (LTC) 30% price rise during the past week was an accumulation spree by addresses holding between 1,000-100,000 LTC.

“Litecoin’s price surge may have shocked some of you, but the large address accumulation has been the key to watch. In the past two weeks, addresses holding 1,000 to 100,000 LTC accumulated $43.4 million in coins en route to the first price jump above $80 since May.”

LTC is trading at $78.71 at time of writing, up by around 24% over the past 24 hours and up by about 36% over the last seven days.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/ardanz